Real estate investment trusts (REITs) are set to see significant future growth, as they diversify into additional asset classes like industrial, data centres, hospitality, healthcare and education, experts said.

At early stages in India compared to other investment avenues, REITs are also set to benefit from the impending turn in the interest rate cycle.

"Today interest rates are at peak but likely to go down. It will have a positive impact on the REIT prices, which will eventually go up. REITs are partially a public market and partially stable income investments and thus the return expectations have to be calibrated (as compared to returns from the stock market)," Piyush Gupta, managing director of capital market and investment services at Colliers India, said.

Source: JLL

Source: JLLJayesh Faria, Director, Regional Head, Motilal Oswal Private Wealth, told Moneycontrol that beyond participation in commercial real estate offered through Mindspace, Embassy and Brookfield REITs, the Nexus REIT offers participation in shopping malls or the retail space thus increasing the scope for diversification.

CLSA Capital Partners said that the office real estate market is set to make a comeback in 2024 and it is positive for REITs.

"We expect office space absorption to grow 20 percent in 2024, and to reach the peak of 2019. We expect demand from global capability centres (GCCs) to make a comeback in 2024 and expect sustained demand from domestic companies," CLSA said in a report a week ago.

The recent amendment to the SEZ rules is anticipated to boost occupancy levels, particularly in Grade A Business Parks. Given the size of the Indian office market, there is considerable potential for the establishment of new REITs and the expansion of existing ones.

Last year the government issued a notification allowing floor-wise de-notification of SEZ spaces into non-SEZ use within information technology and IT-enabled services SEZ parks. This will further allow developers to unlock the SEZ spaces thus allowing more expansion.

A REIT is a hybrid fixed-income instrument offering a transparent, regulated, and diversified platform to earn regular income and potential capital appreciation over a 3-4 year period.

Even with their current challenges, diversifying one's investment portfolio beyond conventional stocks and bonds through REITs provides a sustainable long-term investment option with a return of at least 10-12 percent annually, they said.

Faria said today retail and high-net individuals (HNIs) can participate in commercial real estate through REITs, which is otherwise inaccessible to retail investors due to large minimum ticket sizes.

Gupta of Colliers India said typically a REIT investment today will return 12-13 percent annually if held for 3-5 years. "Out of the total return, about 6-7 percent is secure and the rest will depend on rental escalation and increase in capital values or prices of REIT in the public market – which will increase due to positive sentiment of the overall office segment and the potential decrease in interest rates."

Is it the right time to invest in a REIT?Experts say the investment decision will depend on individual interest and risk tolerance.

Although REITs are listed on the exchange there is relatively low liquidity with average daily trading volumes of Rs 8-16 crore over the last six months (that varies across REITs). Faria said the interim volatility in the price of REITs is much higher than traditional fixed-income instruments. Hence, the minimum investment horizon should be at least three years.

Growth since last yearLata Pillai, Senior Managing Director & Head of Capital Markets at JLL India, said since the pandemic India's listed office REITs have consistently demonstrated a strong track record of dividend payments and regular distribution.

"Today, the growth potential of REITs in India extends beyond commercial office assets, to other asset classes such as industrial warehousing and retail malls. Overall, these developments highlight the vast opportunities for investors in India's evolving REIT landscape," she added.

Since last year the Indian REITs have shown a constant track record in dividend payouts. However, according to Colliers India, the global headwinds at the beginning of CY2023 had led to a volatile global financial market.

Gupta said, "The majority of occupiers in the Indian commercial sector is from the US market, thus we did see a negative sentiment early this year. However, since mid-last-year, we see investors coming back to the market. As we speak to the global investors, we project that over the next 2-3 quarters a lot of capital will flow into the Indian real estate sector, and the REIT segment will be the first call for evaluation."

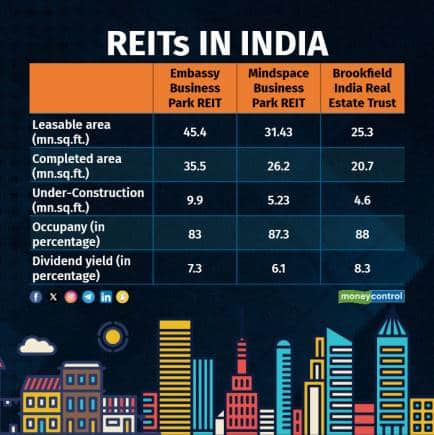

Current Indian REITs and its portfolioAccording to JLL Capital Markets research, Embassy Business Park REIT has an occupancy of 83 percent. It is spread 75 percent in Bengaluru, 9 percent in Pune, 10 percent in Mumbai and 6 percent in NCR. About 35.5 million sq ft (msf) has been completed and 9.9 msf is under construction.

Mindspace Business Park REIT has 87.3 percent occupancy and is spread 17 percent in Pune, 40 percent in Mumbai, 40 percent in Hyderabad, and 3 percent in Chennai. It completed 26.2 msf of development and 5.23 msf is under construction.

Brookfield India Real Estate Trust has 88 percent of occupancy. It is spread 15 percent in Mumbai, 69 percent in NCR, and 16 percent in Kolkata. It completed 20.7 msf of development and 4.6 msf is under construction.

Consistent dividend curve, rental growthExperts say the dividend payout has been consistent over the last year, despite the global headwinds and volatile market.

Gupta added that over the last year, all the Indian REITs have shown consistent distribution and cash flow with a 6-7 percent cash yield. "Dividend is unlikely to change drastically over the next year. Normally, it will change when there is a change in capex (capital expenditure) cash flow, and today office spaces have stable rental income. REITs are operating at optimal occupancy, thus unlikely we will see major changes in dividend yield."

Currently, the REIT occupancy, according to JLL Research, is 86 percent, 100 bps higher than Grade A office space in 2023.

According to data from ANAROCK India, Mindspace Business Parks REIT has an annual dividend yield of 5.83 percent, Brookfield India Real Estate Trust REIT has 7.04 percent, and Embassy Office Parks REIT has a yield of 6.15 percent.

On average, REITs in India provide yields within the 5.1-5.5 percent range. These yields have the potential to increase based on the rental renewal rates of tenants (re-leasing), Prashant Thakur, Regional Director & Head – Research, ANAROCK Group told Moneycontrol.

Which REITs have returned the most last year?REITs have three segments within their regular payouts: dividend, interest, and debt repayment, with the dividend component varying across REITs.

According to Motilal Oswal, the REIT prices have been flat to negative on a year-on-year basis, with Embassy REIT being the best performer, (one-year absolute returns at 3.7 percent). Mindspace REIT has the highest dividend component in its total yield followed by Embassy REIT, it added.

What to look out for while investing in a REIT?While investing in a REIT may depend on personal choices and risk tolerance, experts pointed out several key pointers to look at while investing in a REIT.

The first one is the quality of the assets and the scope for diversification. "REITs having diversified assets in multiple markets (across cities) will be a lesser-risk option for the investors. For example, if due to any reason, any of the sectors in the market is affected, it will not affect the entire portfolio," Gupta said.

Additionally, one should look at the tenant profile in a particular REIT – the industry they belong to and the markets they dominate. The quality of the tenant portfolio is equally important to be able to judge the risk level of the investment.

Lastly, the sponsor is an important factor, as the kind of new assets the REIT plans to bring inside the REIT depends on the sponsor. Experts said that REITs as an asset have to grow and new acquisitions should add more value. Thus, one should look at the ability of the sponsor to grow the REIT portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.