The popularity of Non-Fungible Tokens (NFTs) has received a further boost of sorts. Superstar Salman Khan announced last week that he would be bringing out his own collection of NFTs – Salman Khan Static NFTs. These would be sold on Bollycoin, a Bollywood-centric NFT platform.

Bollycoin would give an opportunity for investors to buy clips and stills, iconic dialogues, unseen footage, posters, and so on from their favourite stars and films.

In March 2021, Christie’s auctioned a work by digital artist Mike Winkelmann, known as Beeple, for more than $69.3 million. The famous Charlie Bit My Finger video on YouTube, which holds a record with more than 885 million views, sold for $760,999.

Hang on a second, what are we talking about here – pixelated cartoons and YouTube videos valued at millions of dollars? Maybe NFTs need a closer look.

Rise of the NFTs

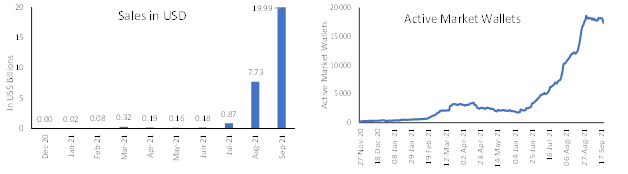

The value of the digital art market grew by 299 percent last year, according to the NFT 2020 Report, and that is just the tip of the iceberg. In the trailing one year, NFTs have shown extensive growth in the market. Sales numbers have increased by 125 percent. And the amount of money transactions have increased by 50000 percent as per nonfungible.com.

Source : https://nonfungible.com/ (data for sales extrapolated for last 10 days of September)

Does a steep rise indicate a bubble?

Many in the investment fraternity are drawing parallels to the Tulip bubble and/or tech bubble. While based on price moves, the interest in NFTs does rhyme with the history of Tulip or tech bubble, but there are many fundamental differences.

In the 1630s, Broken Tulips became famous among the rich (status symbol). The steep demand pushed up prices. In 1637, the market collapsed. It was driven by the fact that people had purchased bulbs on credit, hoping to repay their loans when they sold their bulbs for a profit. NFTs are also a status symbol – to some extent. But these are tokens or certificates of ownership of specific results of intellectual work. They help creative people make money on a product that has no physical manifestation.

Similarly, in the 1990s, there was a bullish trend in the US tech stock market. Without making a profit, without creating a coherent product, companies went IPOs. In late 2000, investors got scared and the stock market crashed within weeks. Investment capital began flowing in other directions. The bloated companies that never became profitable were shut down.

Now, the widespread interest in NFT art appears at first to be similar to investing in dotcoms. But that’s not true, as in this case, the real product comes first. Nobody buys a masterpiece that might be made in the future – only one that they can see and possess. And sky-high prices for an exclusive product are common in the world of art.

Rising popularity among millennials

Blockchain and diversification benefits are likely to keep NFTs on the investment radar of HNI & UNHI categories, especially in the alternative assets bucket. However, it is easily in the highest risk bucket and hence caution is advised. Investments are to be made only if you are an aesthete and have done your homework on the creator and scarcity of an NFT and how it will be part of the new evolving digital world. Trifecta of challenges in terms of regulation (taxation & legal framework), transaction cost and liquidity continue to keep NFT investments from taking off.

However, NFTs are here to stay and grow. A sure sign of their arrival is that the likes of Facebook and Microsoft are pouring billions for building this virtual reality universe and use NFTs as an avatar or block of metaverse. In India as well, many leading Bollywood celebrities have taken a plunge into it.

Millennials will the biggest drivers of this trend, especially because they are becoming major part of workforce. For the millennials, the real-world identities are largely set by factors such as birth, geography, culture, education and by interactions with other humans. In the digital world (e.g., MetaVerse), one can construct a new identity, which is free of geography and social ties (theoretically a more egalitarian setting), and potentially very different from the user’s real-world identity. A Millennial in normal life could be an introvert and socially secluded, but in the digital world he can make himself a fashion icon and an orator par excellence.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.