The need to purchase health insurance is well-accepted by millennials. But have you considered what happens if your expenses during hospitalisation exceeds your insurance cover? Rising medical cost could burn a huge hole in your finances. It is high time to look beyond health insurance cover bought by you or provided by your employer.

Have you considered creating a separate healthcare fund? Pankaj Mathpal, Founder and Managing Director of Optima Money Managers, a financial planning firm based in Mumbai, feels creation of healthcare fund should be a part of everyone's financial plan. "Buy a health insurance plan for yourself and your family. But create a separate healthcare fund by saving regularly to pay for expenses that are not covered by your health insurer.”

Why do you need healthcare fund?

Many think that buying a health insurance policy is all it takes. It is not the case. It is just the beginning of the long journey. It is fraught with many exclusions and does not cover all your needs. Explaining the need for a healthcare fund, Vishal Dhawan, Founder and Chief Financial Planner at Plan Ahead Wealth Advisors, said, “Health insurance policies do come with exclusions. Insurer won’t pay claims in case of excluded conditions. There are also situations wherein cashless treatment is not possible. In such a situation you have to pay for the treatment and then claim it. That makes a strong case for creation of healthcare fund.”

Moreover, a pre-existing condition is not covered by health insurance for almost four years from the date of purchase of the policy. A situation could occur wherein an individual is admitted to a non-network hospital in an emergency and the patient has to pay his bill first and then claim it later. In the case of retirees, who will pay for two nurses employed for 12 hours a day each as the individual is not in a position to take care of oneself due to deterioration of health on account of old age?

Questions do arise. Think of more such situations and one may wonder where the money would come from. Health insurance policies have their own limitations and you have to fund such needs out of pocket. That makes establishing a healthcare fund an essential part of your financial plan.

There are also specific situations where you have to create a war chest. “In case of families comprising of a special child and old individuals, a healthcare fund must be created as a part of the contingency fund,” Ramalingam K, Founder and Director of Holistic Investment Planners, said.

There are some insurance policies available in the market that allow you to pay for expenses not related to hospitalisation. However, such plans come with their own set of exclusions and limitations. In some cases, the premium charged is on the higher side while in others the objectives for which the money can be used are limited. Most financial planners advise creation of a pure health insurance plan and a savings fund meant for healthcare needs over the course of a policy.

If you have bought into the idea of creation of a healthcare fund, then there are two questions that follow. First, how much money should one set aside to tide over healthcare-related expenses? And second, how to create that fund.

There is no correct answer to the question: What is the right amount to be set aside for a healthcare fund? The sum will oscillate depending upon the quality of healthcare one needs. The costs will defer in case of a metro city and a Tier II town. Costs pertaining to trained resources are also high. For example a trained nurse will charge anywhere between Rs 1,000 to Rs 1,200 for a day shift at patient’s home. If you have to buy a small equipment or rent it, the costs keep adding. Inflation in healthcare must also be considered.

According to Ramalingam, taking into account today's costs, one may set aside around Rs 10 lakh in the retirement corpus towards a healthcare fund. "When you are employed you can dip into your contingency fund to tide over your healthcare expenses in addition to your health insurance,” he added. When you are young, the expenses towards healthcare may not be high. However, as you age, the expenses start rising. One should keep this aspect in mind while preparing for it.

Dhawan feels a contingency fund should take care of three to 12 months of one's expenses. "This can be tapped to provide for healthcare contingencies. Use short-term bond funds with low duration for this purpose. One could opt for the SIP route for investing in such a fund. Investing in bank fixed deposits can also be considered if you are in the lower tax slab.” It is also important to review your contingency fund every year.

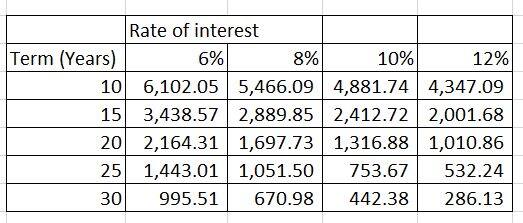

For an old age healthcare fund, one can take a bit of a long-term approach if starting of early. Invest in balanced funds and equity funds to help your money grow. But do not forget to shift your money gradually into bond funds when you approach retirement. In the accumulation phase, one can afford to keep it in risk-bearing investment options that reward handsomely. But once you approach the distribution phase – old age, take shelter in bond funds. The table below illustrates how much one should be saving to reach the Rs 10 lakh goal.

For example, if you intend to accumulate Rs 10 lakh over 10 years and the rate of return is 6% per year, you should be saving Rs 6,102 per month.

Though you may start with a number in mind today, the needs and income levels change over a period of time and so does medical inflation. Do account for it as you keep saving. Healthcare fund thus won’t be a task for you if you are disciplined with your saving.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!