Having completed more than seven years at ICICI Prudential Asset Management Co Ltd, India’s second-largest fund house with assets worth nearly Rs 5 trillion or Rs 5 lakh crore, Anish Tawakley, Deputy Chief Investment Officer (CIO) - Equity, and Head of Research, has a common sense approach to fund management. “I am not necessarily looking to hit a six on every ball, but I am very concerned that I should not be clean bowled,” he says, describing his management style.

Tawakley believes it’s better to be in the second quartile consistently which will deliver good returns over the long term, compared to being obsessed with trying to be in the top quartile.

He is of the opinion that given market valuations in the neutral zone and the likelihood of healthy earnings growth going forward, one should expect moderate to reasonable returns from the markets.

Tawakley manages assets worth Rs 48,205 crore under five mutual fund (MF) schemes, including business cycle, focused equity, and manufacturing funds. Notably, the biggest fund, which he has been managing for the past five years, ICICI Pru Bluechip Fund (Rs 35,877 crore), has completed 15 years this month.

In an interview with Moneycontrol, Tawakley discussed his investment strategy, sectors where he is finding value, key risks the Indian economy faces and whether he would look to add loss-making start-ups to his newly-launched innovation fund. Edited excerpts:

Also read | Small-cap mutual funds love these sectors for higher returns

Let us address the elephant in the room. Is anything cheap in today’s markets? Are you finding any value pockets left out there?

I don't think there are pockets where valuations are extremely cheap.

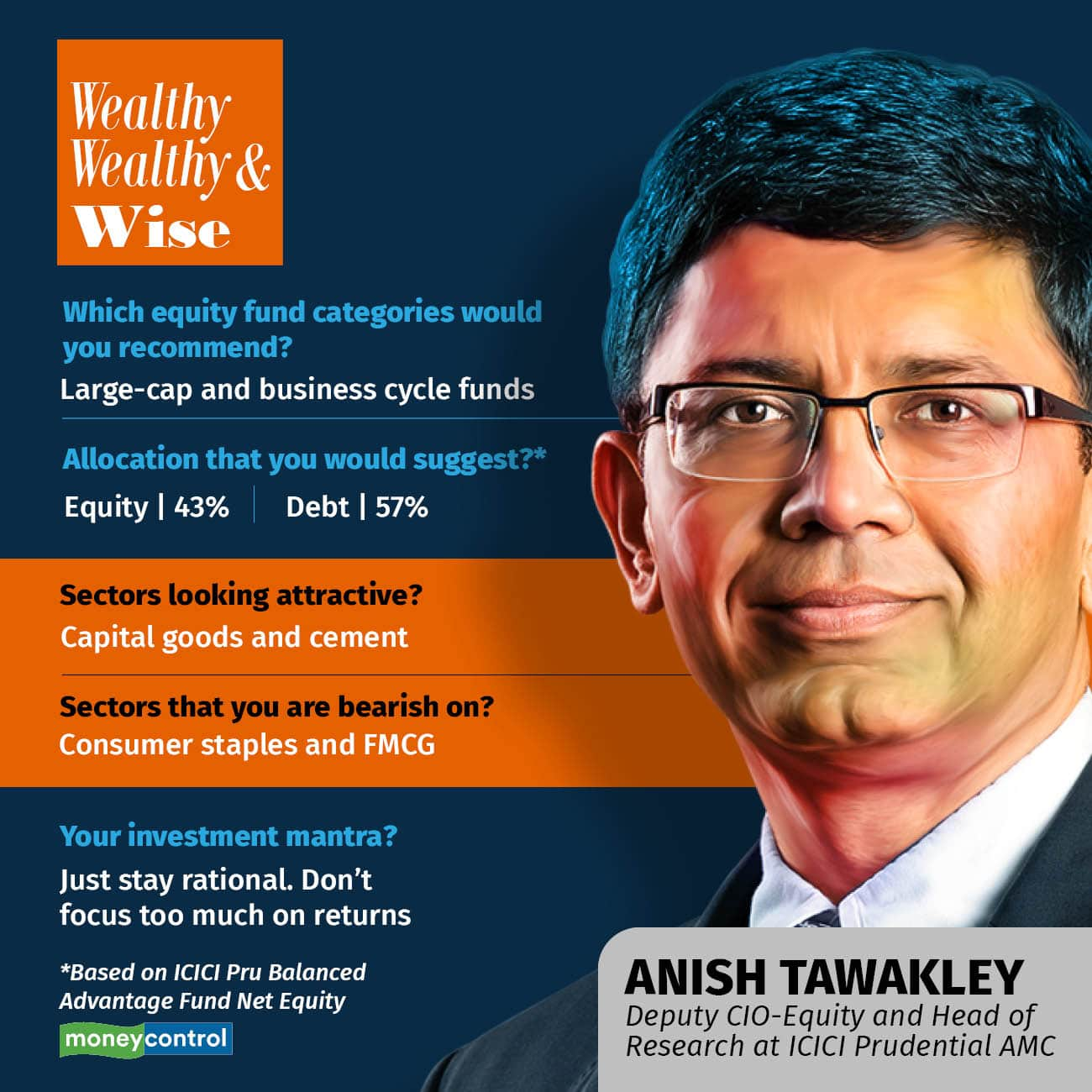

If the economy does well, then we can expect positive earnings surprises and domestic cyclical sectors, such as capital goods and cement to do well. Further, if volume growth is healthy, some of the financials, are likely to do well.

Where we have concerns around consumer staples and FMCG, where we believe margins are still too high. Metals are another pocket that could be under pressure given that Chinese growth may not be as metal-intensive as it has been in the past. So, commodity prices, in general, are likely to be under pressure.

Unsecured personal lending is another pocket that could see some stress going forward, as the space has grown too big too quickly.

Will the earnings season meet our expectations or would it disappoint?

Earnings season has been broadly in line with expectations. Growth has been healthy in general across most of the companies. There has been some pressure on margins, which was not entirely unexpected because margins had been quite strong. In periods when growth was slow, companies had been very disciplined about margins. But with growth coming back, they're being a bit more aggressive and competition is higher.

Coming to outlook, you get returns from two sources: from multiple expansions or earnings growth. Our view is that multiples are not cheap, but they're not too expensive either, which means that we wouldn't expect returns from multiple expansions. What we need to see is good earnings growth, and that will happen if the economy does well.

Our view of the economy is that it's in good shape, so, healthy earnings growth is likely going forward, and that should mean moderate to reasonable returns in the markets.

A concentrated or diversified portfolio in these markets: What’s your pick?

We always see value in some diversification. The point is even when we diversify, we still need to be right, because diversification alone doesn't deliver value.

At this point, we wouldn't go for diversification across the market. We believe, at this point, there is merit in being skewed towards domestic cyclicals. And within this space, there is value in diversifying once the sectors are chosen on top-down basis. So, you can take a sector skew, but post that we believe there is value in diversification.

You recently launched ICICI Innovation Fund. Would you look to add loss-making new-age start-up companies into this scheme?

Per se, it's not that we don't like temporarily loss-making companies. Here, the question is not about current losses, but whether the current strategy will lead them to eventually make profits. Eventually, the company has to make profits.

Also read | Are your equity funds investing in the same stocks?

There is a consensus view that these companies need to scale up to become profitable, which I do not completely agree with. Some of these companies might have to shrink to become profitable because they have expanded too quickly and are serving segments of the market that are unviable. So, the question now is how do they reduce the losses? Do they have to scale up or shrink? Given this difference of opinion on what it takes to become profitable, we are cautious on new-age companies.

With respect to the innovation fund, we are looking for companies that will be market share gainers with good financials over the next two to three years. And we will deploy funds as and when we get opportunities in that time frame.

ICICI Prudential Bluechip Fund has completed 15 years this May. How do you look to manage it to ensure that it outperforms the benchmark?

I have managed this fund for five years now. There are two things that are fundamental to my approach when it comes to managing this fund. One, spend time understanding the risks in the company. So, avoiding big mistakes is a major part of my investment strategy.

I am not necessarily looking to hit a six on every ball, but I am very concerned that I should not be clean-bowled.

The second thing is that even if you're consistently second quartile, over the long term you end up doing very well. It is not that I don't want to be first quartile, but the risk management approach is such that I'm happy being consistently second quartile because I know that it will deliver good returns over the longer period. We have to be mindful that in any one year, we don't have to hit the ball out of the park and be in the first quartile, because, then we end up being in the fourth quartile as well.

What are the biggest risks to the Indian economy and the markets at present?

One: oil price.

Oil prices right now are range-bound and not much of a concern, given that India has managed the supply well even during war times. (However), the price trajectory needs to be monitored.

Second: the need for fiscal discipline.

Over the last five years, when the economy was soft, we were of the view that government should step in and support spending, as private sector spending was weak. But as the economy gathers pace and private sector demand picks up, it is important that the government takes a counter-cyclical approach. Now is the time to cut the fiscal deficit and bring it under control. So, it is important that the fiscal remains disciplined. We think the budget is fine, and we should just stick to that.

Third: Unsecured credit.

We are a bit concerned about unsecured credit in the financial system and that has caused some turbulence.

Also read | 23% of salaried people aren’t prepared for financial emergencies: Survey

Given this, if one has Rs 10 lakh to spare, where should one invest it today?

You should have a longer-term time horizon if investing in equities. Second, the fund selection must depend on an individual’s investment objective. When it is irrationally pessimistic, we put more money into equities.

Within equities, we think large-cap and business cycle funds are a good place to be in, but people should choose their equity allocation basis their investment requirements.

Also read | Why insurance for surrogate mothers might be difficult to offer

What is your one big investment mantra?

My investment mantra is that markets are rational over the long term, but they're not rational at every point in time. If the market is irrational, you cannot outperform it and be rational at the same time. So, at some point, you need to be willing to sacrifice performance, and say, "Look, the market is in an irrational zone or this sector is an irrational zone, and I will take the pain of staying away from it because it's irrational.” So, between choosing to stay rational and delivering returns in an irrational market, one should choose rationality.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.