Conventional wisdom says that in order to achieve meaningful diversification, a portfolio of around 7-12 Mutual Funds (MF) is good enough. The flipside is that you may just find a lot of similar stocks across all your MF schemes.

A typical large cap or flexi cap fund is seen holding anywhere between 35 and 50 stocks, a mid-cap fund could have 60 or more stocks and it’s not uncommon to find 80-100 or more stocks in a small cap fund. That is diversification.

Now, so long as you invest in just one MF scheme, you get some diversification. A single fund manager makes changes and keeps an eye on the overall portfolio performance. Things start to get muddy when you add new funds to your existing list in the hope of getting a better portfolio performance. This may not work out as expected. Equity mutual fund schemes, especially in the large and flexi cap diversified category, have several overlaps in terms of individual stocks.

For example, HDFC Bank Ltd is a very popular holding across mutual fund schemes. We analysed the top 15 equity diversified mutual fund schemes (ranked by Assets Under Management, or AUM) and found this stock is present in 12 of the 15 portfolios. In 10 of those, it was among the top 5 holdings. Among the three where it is not present, one of the portfolios has Housing Development Finance Corporation Limited Ltd as the top holding; the two companies are in the middle of a merger.

The other common top holdings among these 15 funds were ICICI Bank, Infosys, Reliance Industries, Kotak Mahindra Bank, Larsen & Toubro Ltd, ITC Ltd, State Bank of India and Bharti Airtel. If not in the top five, then you will surely find these names in the top 10 holdings (see table).

ICICI Bank Ltd and HDFC Bank Ltd together contribute to 12.5% of the total equity market capitalisation of these 15 funds. Unless the new scheme you choose has a differentiated portfolio, you are most likely just buying more of the same.What do these overlaps mean for you?

ICICI Bank Ltd and HDFC Bank Ltd together contribute to 12.5% of the total equity market capitalisation of these 15 funds. Unless the new scheme you choose has a differentiated portfolio, you are most likely just buying more of the same.What do these overlaps mean for you? Within the funds that we analysed, the top 10 shares which were common holdings amongst them, on an aggregate basis, contribute 34 percent of the total equity market capitalization of these funds. ICICI Bank Ltd and HDFC Bank Ltd together contribute 12.5 percent of the total equity market capitalisation of these 15 funds. Unless the new scheme you choose has a differentiated portfolio, you are most likely just buying more of the same.

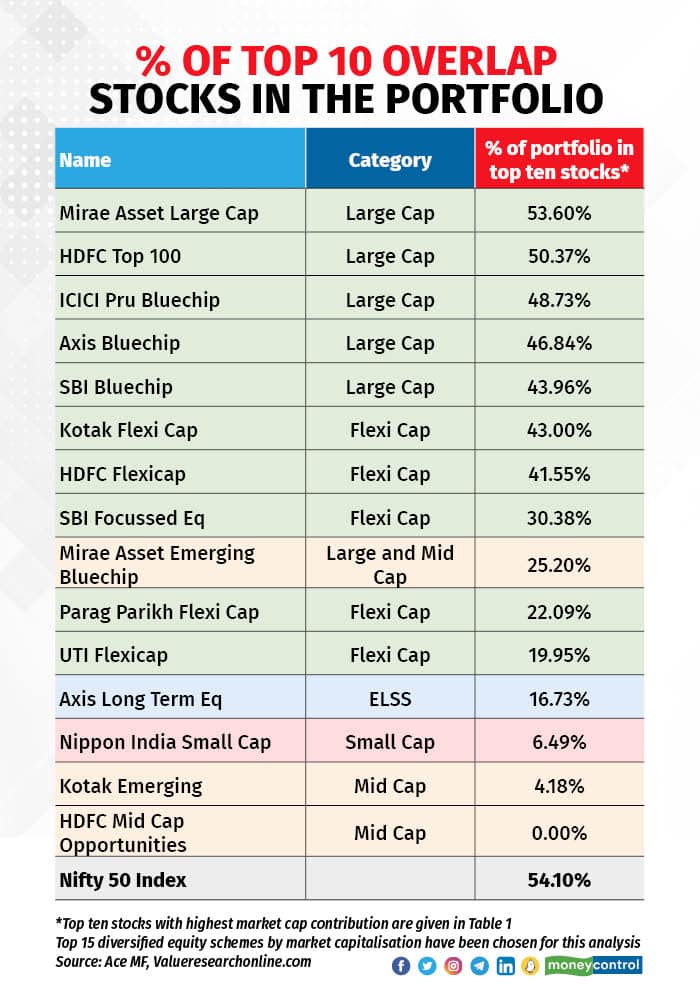

This overlap is apparent in large and flexi-cap funds and missing in mid and small cap funds.

Also read: MC30 | New champions - schemes that made a fresh entry into the best MF list in 2023Harsha Upadhyaya, chief investment officer - equity, Kotak Mahindra Asset Management Company Ltd, says: “Stock overlaps are natural because, within the large cap universe, there are only 100 stocks to pick from whereas, in the small-cap space, everything below top 250 stocks is available. Market capitalization is not the first consideration for stock selection, we filter out stocks from a wider universe and then decide weights based on category and liquidity requirements.”

Before the Securities and Exchange Board of India (SEBI) came out with defined categorization for mutual fund schemes, there was greater leeway for differentiation in portfolio construction. Post that, for example, large-cap funds necessarily have to hold 80 percent in large-cap stocks where the universe itself is limited to 100 stocks.

If you look at the broad underlying benchmark indices, S&P BSE Sensex and Nifty 50, you will find that the stocks which are the highest market cap contributors in the top equity funds are also among the top stocks in these indices.

Table 1 shows the top ten stocks that have the highest market cap contribution to the 15 largest equity-diversified active funds. Other stocks like ITC, Tata Consultancy Services and Kotak Mahindra, which don’t show up in the top ten, follow close behind and are also big contributors to the benchmark Nifty 50.

Also read: MC30 review – 90% of schemes outperform peers in 2022Is it a simple case of trying to be close to the benchmark in order to protect yourself from going against the tide?Upadhyaya says: “We don’t seek relative differentiation with respect to the benchmark for the sake of it. In the case of flexi-cap portfolios, stock choices are considered keeping in mind portfolio liquidity too.”

Portfolio overlaps are seen mostly in large and flexi cap funds. Mid and small cap funds show less overlaps.

Portfolio overlaps are seen mostly in large and flexi cap funds. Mid and small cap funds show less overlaps.Impact on performance relative to the benchmark cannot be ignored. According to the findings of the SPIVA report published by S&P Dow Jones, which, compares the returns of S&P Indices versus active funds, within the large-cap category while in the 10-year return period around 33 percent of active funds beat the returns from S&P BSE 100 Index, the score has fallen to just 12 percent active managers who beat the index returns in 2022. Mid and small-cap funds fare better against the earmarked S&P BSE 400 Midsmallcap Index, with 45 percent active funds outperforming in 2022 and 50 percent beating the benchmark over a 10-year period.

What you should do?Diversifying across categories rather than within one category can help. Table 2 shows how mid and small-cap funds among the top 15, don’t have this issue of stock overlap, which signifies differentiated portfolios. Given the kind of performance slowdown in the large-cap category relative to the underlying benchmark, that’s one space where you can cut costs and stay with passive funds which mirror the index portfolio.

Says Rushabh Desai, founder of Rupee with Rushabh Investment Services: “Diversify across different styles and strategies, that way the overlapping stocks will have a lower impact in the long term if the fund portfolio sticks to the original style. Plus, one should diversify across asset managers; if you are picking, say, four actively managed, diversified equity funds, pick from four different fund managers and asset management companies.”

Adding more diversification through mid and small-cap categories will add unique exposures to your portfolio, but the risk of volatile returns and risk of returns not matching long-term expectations is also higher. Measure your own ability to absorb this risk before adding too many such funds.

In short, keep your equity mutual fund portfolio small and focus on diversification across categories rather than standalone funds. To be fair, it may be a bit much to compare portfolio overlaps across different categories in case you are a direct investor. But this homework is necessary to avoid duplication. Else, stick to a good financial advisor or a distributor who can do this homework for you.

Another tip to avoid overlaps in your portfolio. It is okay to expect duplications in large-cap funds, which is also why many experts prefer to have just one index fund (say a Nifty 50 index) and one Nifty Next 50 index to cover the 100 largest stocks by market capitalisation. But in case you wish to invest in a flexi-cap fund, just look at one statistic: how much has the fund invested in large, mid and small-cap stocks. If your flexi-cap fund invests too much in large-cap stocks, expect overlaps.

Dhuraivel Gunesekaran contributed to this story.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.