The civil aviation ministry has allowed full-fledged resumption of regular international flights from March 27, bringing cheer to the travel and travel insurance segments. “We hope we will get back to business as usual. The travel business has been almost dormant since the last two years,” says Subramanhyam Brahmajosyula, Head, Underwriting and Reinsurance, SBI General Insurance.

According to Amit Chhabra, Head, Health and Travel Insurance, Policybazaar.com, enquiries related to travel insurance on the portal have nearly doubled in the last three months compared to the same period last year.

Despite the enthusiasm, travellers are bound to be worried due to the recent COVID-19 surge in countries such as South Korea, China and parts of Europe. This apart, in a new, non-COVID development, you might not be able to get a travel insurance policy to cover your (unlikely) trips to Russia or Ukraine. “Travel to these countries may not be covered due to the ongoing conflict,” says Brahmajosyula.

Also read: Returned from Ukraine? Student travel insurance policy may be of limited help

Know what is covered under travel insurance

Soon after the pandemic hit Indian shores in 2020, the Insurance Regulatory and Development Authority of India (IRDAI) asked insurance companies to pay for COVID-19 claims. This included travel insurance and, therefore, your insurer will pay for your treatment should you test positive in your destination country. However, only hospitalisation expenses will be covered, which is the case with domestic health insurance policies, too. Post resumption of regular international flights, there will be status quo.

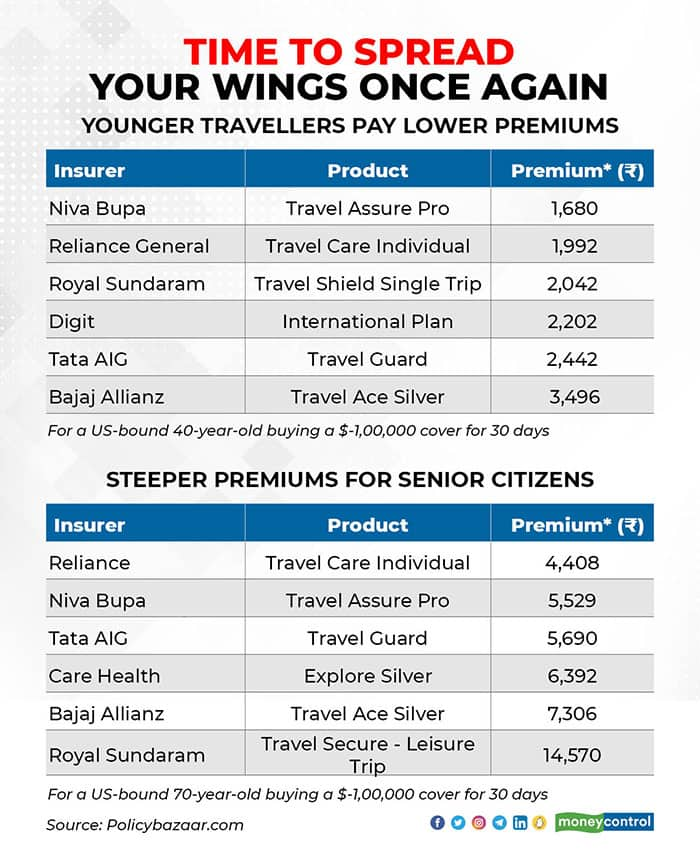

“Nothing specific will change. The products available remain the same and premiums, by and large, will hold. I do not see any imminent premium hike,” says Brahmajosyula. Since your regular health insurance policies, barring the ones that offer built-in global coverage, pay for healthcare expenses incurred only in India, you need travel insurance policies while travelling abroad. Several countries – for instance, the Schengen nations in Europe – make it mandatory to have such covers for visas to be processed.

Moreover, an increasing number of countries have now made it compulsory to buy insurance. “Pre-Covid, travel insurance was a mandatory requirement for travel to Schengen countries and an optional cover for other destinations. However, the new normal now sees additional countries like Thailand and UAE making travel insurance mandatory for travellers,” says Shiva Shanker Bazar, Head, Travel Insurance, Care Health Insurance.

Travel insurance policies not only reimburse any emergency medical treatment, but also cover trip cancellation, baggage loss, passport loss, missed connecting flights, evacuation and so on. Non-medical expenses such as these are not covered under regular health policies with global coverage. “Travel insurance policies pay for flight cancellation and delays, apart from health issues. Trip cancellations due to the traveller testing positive will also be covered — if the cancellation were to be caused by, say, a heart attack, it would be covered. The same is applicable to COVID-19 — it is treated as any other ailment,” says Chhabra.

While COVID-19 hospitalisation is covered, this may not be the case if you have to check into a hotel in case you test positive after you land or have to quarantine yourself in a hotel as part of your destination country’s mandatory COVID-19 isolation rules. Likewise, if you were to take treatment at your acquaintance’s house, for instance, it will not be paid for either.

“Some policies cover such expenses and some don’t. You have to check the features to be sure,” says Chhabra. Also, check the terms and conditions you need to fulfil to be eligible for the reimbursement, even if this aspect is covered. “Some insurance companies offer mandatory isolation at hotels (hotel quarantine cover) if the same is recommended by the treating doctor. In such cases, hotel accommodation cost up to the defined medical sum Insured is covered under the travel policy,” says Bazar of Care Health.

At your end, you need to ensure that you honestly disclose all your pre-existing ailments — planned treatment is not covered under travel insurance, but only under domestic health policies with global coverage. Some travel policies pay for emergency treatment of pre-existing illnesses. However, you need to declare such ailments at the time of buying the policy.

“Complete the proposal form carefully. Ensure that all health-related declarations are made so that there is no confusion at the time of claims,” says Chhabra. A failure to put out details of your health conditions could result in even unrelated claims being rejected. “Non-disclosure is treated as violation of contract. So, if you do not inform your insurer about your diabetes, for example, your claim might be for COVID-19 expenses, but could get rejected on the grounds of non-disclosure of diabetes,” says Chhabra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.