The ongoing Ukraine-Russia conflict has laid bare the uncertainties even in regions considered peaceful. Many Indian students and other travellers were stranded as tensions escalated in a matter of few days, leaving them with little time to prepare for an evacuation. Moreover, their travel insurance policies’ terms and conditions meant that their treatment due to injuries or evacuation in such a situation wasn’t covered either. War and war-like situations are permanent exclusions under general insurance policies. This exclusion is also applicable to regular health insurance policies’ premium variants that offer global coverage.

Also read: Will banks give relief to Ukraine-returned students?

The cost of warSo, if you are covered under such health policies and have to undergo treatment for a serious ailment abroad, your treatment expenses will be paid for, but not in case of war. COVID-19 treatment, however, will be covered. Note that these policies are distinct from overseas travel insurance policies, which cover only emergency treatment abroad, besides other travel-related exigencies abroad. Unlike travel insurance policies, these are regular, domestic health policies that also pay for select critical illnesses if the need for treatment outside India arises.

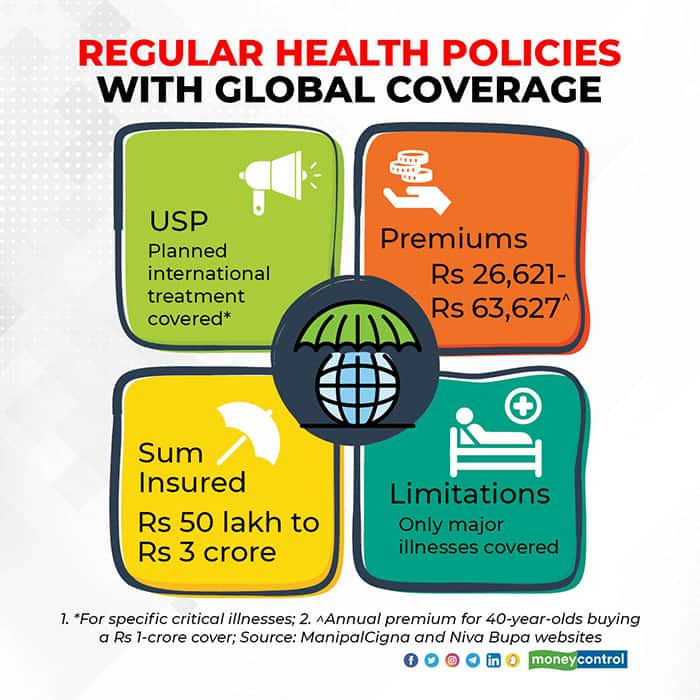

Insurers say such premium plans – typically with high sums insured of between Rs 50 lakh to Rs 3 crore – have gained in popularity in recent years primarily among the HNI segment. “Industrialists, doctors, senior management professionals and celebrities find value in this product. We have a fairly large customer base, but the overall size is still small. And, the average ticket size is larger,” says Bhabatosh Mishra, Director, Products, Underwriting and Claims, Niva Bupa Health Insurance.

However, even these products have war as an exclusion. “It’s not just war-like situation in Ukraine but almost a declared war. So, injuries sustained due the prevailing situation are not covered under these products,” says Mishra.

On the other hand, hospitalisation due to a pandemic or natural calamities will be covered. “Around ten years ago, insurers were reluctant to cover such catastrophes due to lack of reinsurance support. Over the years, they have started covering these events too. In case of COVID-19, the Insurance Regulatory and Development Authority of India (IRDAI) mandated that treatment expense be covered,” he adds. In simple words, if you travel to a foreign country armed with such a health insurance with global coverage, and you contract Covid-19 around the same time, your hospitalisation expenses will be covered.

However, the additional feature – global coverage – comes at an extra cost. For example, a 40-year-old choosing a Rs 1 crore sum insured will have to pay Rs 14,213 as annual premium if she were to buy an India-only plan. If she opts for global coverage, her premiums will shoot up to Rs 26,621.

Also listen: Has COVID-19 changed the insurance sector forever?

Planned overseas treatment under normal situations coveredYour plain-vanilla health cover - without global coverage - cannot come to your aid financially should the need to go abroad for advanced treatment arise. This is where the high-value policies with global coverage can be useful. “Considering the foreign currency values and the cost of healthcare facilities (specially in developed nations), international coverage can help mitigate considerable personal financial outflow in the event of hospitalisation abroad,” says Nayan Ananda Goswami, Head, Group Business and Retail Sales & Service at SANA Insurance Brokers.

Priya Deshmukh-Gilbile, Chief Operating Officer, Manipal Cigna Health Insurance says that many people today are looking to undergo treatment at renowned hospitals abroad. “This can be a financial burden unless you have a comprehensive health insurance plan that provides extensive coverage with access to quality healthcare,” she says. “We also pay for medical evacuation or repatriation from the destination country and diagnosis in India is not mandatory.” You can choose between plans that do not pay for treatment in USA and Canada and the ones that do. Such products also pay for modern treatment techniques like robotic or cyber knife procedures.

Note the restrictionsWhile the global coverage feature does offer comfort, it comes with its set of limits and exclusions.

Like other health covers, the insurer will pay for actual treatment expenses and not for evaluation, unless diagnostic tests are linked to hospitalisation, in which case they will be covered under pre-hospitalisation expenses.

Before signing up for one, you need to check the number and range of illnesses listed under this feature – insurers will not pay for all treatment procedures. For instance, Niva Bupa’s Health Premia variant covers critical illnesses including cancer, myocardial infraction, organ transplant, coronary angioplasty and stroke. Major illnesses covered under ManipalCigna’s Lifetime Health include cancer treatment, stroke, heart valve replacement, aorta graft surgery.

While choosing a product, ensure that you focus on the wordings rather than the number of conditions covered. Policy clauses that contain broader definitions of ailments will work out to be better than plans where higher number of conditions are covered albeit with narrower definitions. Also, check if your policy makes it mandatory for your condition to be diagnosed in India. Ideally, diagnosis in other countries, too, should be acceptable.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.