It has been a tough ride for the Indian equity markets over the last three months. After the benchmark indices hit their all-time peaks in September 2024, they subsequently corrected. The heightened volatility is likely to continue due to the escalating geopolitical tensions, experts say.

Investors with a medium-risk profile, who are concerned about the current market volatility, can consider investing in large-cap funds.

These funds inherently tend to take exposure to businesses which have been around for longer durations and have undergone all kinds of business cycles, allowing them to absorb market and economic shocks better.

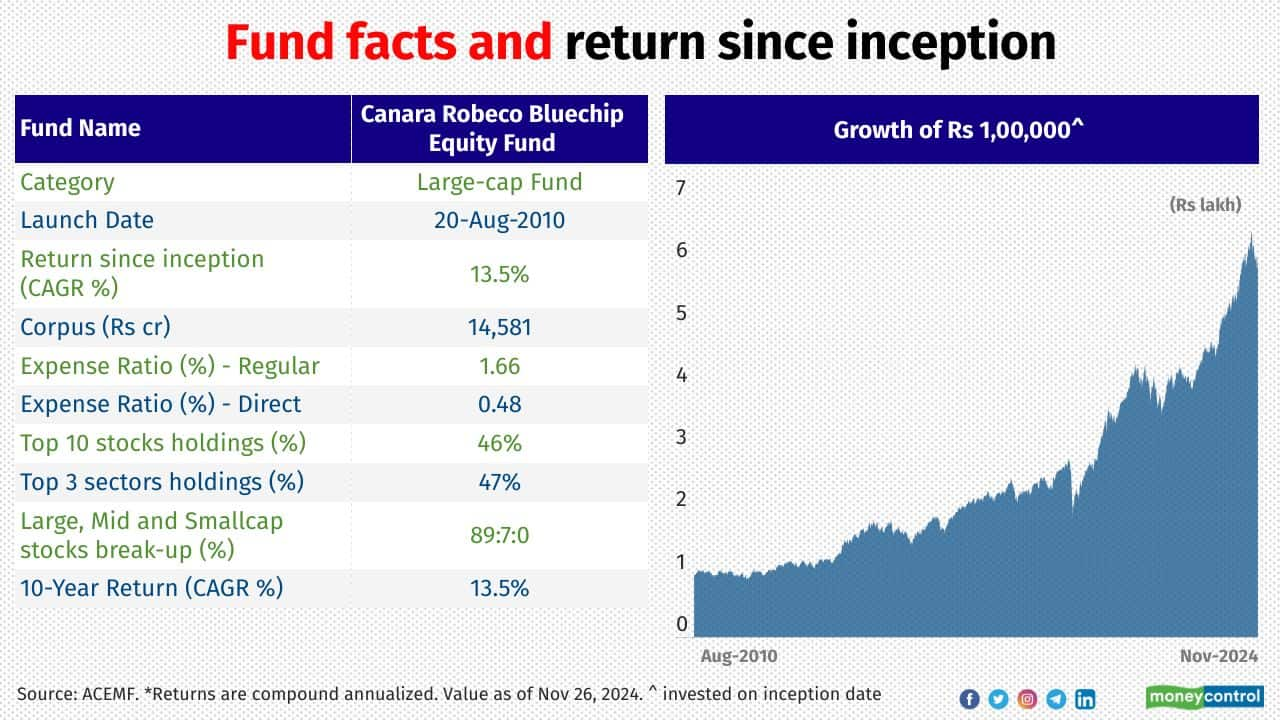

Canara Robeco Bluechip Equity Fund (CBEF) is one such fund under the large-cap fund category.

CBEF has delivered superior returns since its launch in August 2010. This scheme is part of MC30, Moneycontrol’s curated basket of 30 investment-worthy mutual fund (MF) schemes.

Though the scheme has delivered below-average returns in the short term, its long-term performance has been noteworthy. It has delivered a compounded annual growth rate (CAGR) of 13.5 percent since its launch. The scheme is managed by Shridatta Bhandwaldar and Vishal Mishra.

Well-established bluechip stocks provide stability

As mandated by the capital markets regulator, CBEF invests at least 80 percent in the top 100 listed companies, based on market capitalisation. They are well-established companies with a proven track record and stable earnings.

Shridatta Bhandwaldar, Head of Equities, Canara Robeco Mutual Fund, says: “Large-cap funds inherently tend to take exposure to businesses which have been around for longer durations and have undergone all kinds of business cycles, allowing them to absorb market and economic shocks better. Large-cap businesses through the cycles become institutionalised in terms of business and management structure and that adds to resilience.”

Large-cap funds are less volatile, compared to mid- and small-cap funds.

From a market perspective, they are relatively efficiently priced and well-researched and has lesser volatility, adds Bhandwaldar.

Improving outperformance of active equity funds

The period between 2018 and 2022 had been a rough one for active large-cap funds as they found it difficult to beat their benchmarks due to the narrowing down of the category’s investable universe and the choppy market conditions. However, things changed after 2022 as many active large-cap funds delivered better returns than their benchmarks.

According to ACEMF data, 17 out of 30 active large-cap funds beat their respective benchmarks in the one-year period that ended in November 26, 2024, thanks to the broad-based market rally.

A long-term performer

CBEF has delivered close to the average return of the category in the last three years, given its tilt towards growth and quality versus value.

The scheme had a relatively lower allocation to value stocks. Also, under-allocation to public sector undertakings (PSUs) and non-banking financial companies (NBFCs) that performed exceedingly well in 2023-24 lowered its relative performance.

However, the long-term performance of the scheme has been noteworthy. Performance, as measured by the five-year rolling returns calculated over the last 15 years, shows that CBEF delivered a CAGR of 13.5 percent while the Nifty 100 TRI (Total Returns Index) gave 12.9 percent. The large-cap category delivered 12.6 percent during the period.

High-quality, growth-oriented portfolio

Bhandwaldar places a lot of importance to promoter integrity.

Of the 100 stocks in the BSE 100 index, he invests more than two-thirds of the scheme’s corpus in companies he calls ‘compounders.’ These are companies with competitive business advantages and grow consistently across market cycles. They provide stability and protect the downsides well in corrections. But he keeps about one-third aside for what he calls alpha generators – companies that see a sharp jump in share prices when their value is unlocked.

The scheme has remained consistent with its investment approach over the last eight years, revolving around owning quality businesses, managements and balance sheets, without compromising on incremental earnings growth and capital efficiency over 1-3 years, adds.

Over a long period, the scheme's consistent investment approach has helped it deliver good risk-adjusted returns to investors. The sector bets that helped the scheme over the last one year include Auto, Industrials, Pharma, Hospitals, Aviation, Defence, Telecom and IT. What has not worked so well has been FMCG, NBFCs, and a few others, Bhandwaldar added.

It has invested about 88-90 percent of the portfolio in large-cap stocks. The top three sectors, as of October 31, 2024, were Financial, IT and Healthcare and the top five stocks were HDFC Bank, ICICI Bank, Infosys, Reliance Industries and Bharti Airtel.

CBEF can be part of the core portfolio of investors with a moderate risk appetite, with a time horizon of five years or more.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.