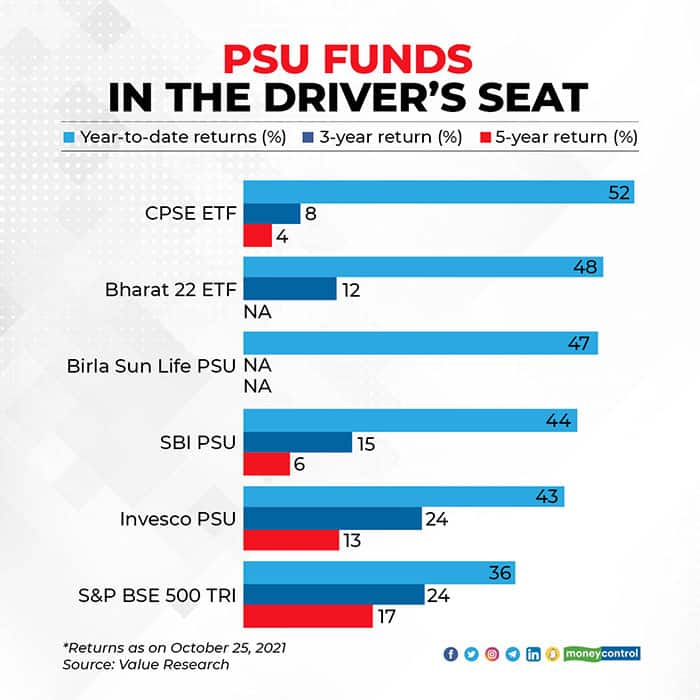

Public sector undertakings (PSUs) and old economy stocks have made a strong comeback in 2021. Mutual fund schemes that invest in them have given strong returns, too. The category on an average return has given 45 percent returns so far this year. According to Value Research data, it is among the best returns in the equity fund categories. Is this performance sustainable?

Attractive valuationsWhen equity markets bounced back after the March 2020 crash, PSU funds did not gain much. In fact, the S&P BSE PSU Index ended 16.9 percent lower in CY20. Why is 2021 so special then?

“PSUs have seen improvement in cash flows, have declared dividends even in stressed periods, and the payouts should improve as the economy picks up,” says Binod Modi, Head-Strategy at Reliance Securities.

Fund managers say this has created a situation where PSUs are still attractively valued, despite the run-up in the markets. “With overall stock markets getting overheated, there are very few pockets left for value investing and PSUs are among these set of companies,” says Mahesh Patil, chief investment officer, Aditya Birla Sun Life Mutual Fund, which runs Aditya Birla Sun Life PSU Equity Fund.

Patil adds that the recovery in the economy has also raised expectations of improved growth from PSU companies. “PSUs are generally not high-growth businesses, but sectors such as oil & gas, utilities, sectors where PSU companies operate, are now seeing better growth prospects on the back of economic recovery,” he says.

Stocks of PSU banks have also done well due to reduction in the size of non-performing loans (NPAs).

Switch from ETFs to strategic sales Earlier, the government used exchange traded funds (ETFs) – Bharat 22 ETF and CPSE ETF – to divest its stake in PSU companies. These regular stake sales through ETFs disturbed the demand-supply balance of the PSU stocks.

“Through the ETFs, there was heavy supply of PSU shares in the stock markets,” says Modi of Reliance Securities.

Also read: EPFO’s poor returns from equities: Blame it on the choice of ETFs

The offer-for sale (OFS) route has also weighed on the PSU stocks as it meant more supply of government-held shares in the stock markets.

This made it difficult for long-term investors to place their bets on PSU stocks. As OFS prices were offered at a discount, investors would participate with the aim of purchasing the stock at the discounted price and selling it at market price for quick gains. This added to the supply pressure on the stock. Additional discount was given to retail investors to attract them.

The government is now keen on selling its stake through strategic disinvestment and much less keen on using ETFs for the purpose.

“The strategic disinvestment route would help the government to realise better value for its holdings, and also help in enhancing the value of the PSU companies,” Patil says.

What should investors do? Such theme-based funds can be avoided for long-term financial goals, as these can go through periods of high volatility.

“PSU funds are not well-diversified, as they only invest in PSU companies, which have presence in a limited set of sectors. A diversified equity fund can give investors exposure to a wider set of sectors and growth-oriented companies,” says Rushabh Desai, a Mumbai-based MF distributor.

“While PSUs look attractive on valuations, it is important to enter as well as exit at the right time in theme-based funds, but this might not be possible for all investors,” says Kirtan Shah, co-founder and chief executive officer of SRE Wealth.

Savvy investors with the understanding of different sectors may make some tactical allocation to these funds with a short-term view.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.