Goal-based financial planning is an investment process that allows you to achieve goals across different stages of life. It is the process of defining different goals, quantifying them in value, and then having an investment plan to meet the goals.

For goal-based planning, goals should be specific, measurable, achievable, relevant, and time-based. This approach makes your goals and plans more rational, practical, and well thought out.

Goal-based planning can be either short-term (buying a phone, laptop, etc.), mid-term (2-5 years, example — down payment for a house, vacation, etc.), or long-term (>5 years, example — retirement, child’s education, etc.)

Steps for Goal-based planning

i. Defining a goal and setting the goal amount - You need to know what you are saving up for, what is today’s cost and what will be the future cost.

ii. Investment horizon – The investment horizon gives you a precise timeline to meet the goal.

iii. Risk appetite – It is an outcome of your horizon, income, expenses, dependents, and behaviour during a volatile market.

iv. Asset allocation – You have an asset allocation between equity, debt, and gold and within equity — large-, mid-, small-cap, or thematic, etc.

v. Investment selection – Once you have a portfolio allocation done, you pick the most fundamentally strong instrument from the available universe of the category.

vi. Rebalancing– Markets are bound to be volatile. Thus, while setting the goal, you need to periodically exit and re-allocate.

Now, let us see when you should exit your goal.

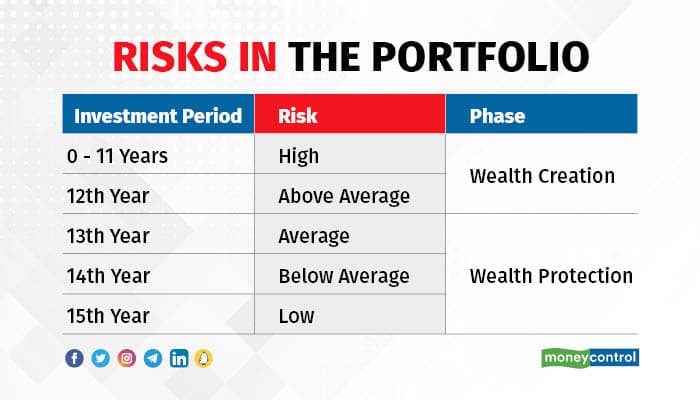

A goal-based investment plan is only successful when a proper exit strategy is created, which also means you rebalance. There are two main phases of an investment cycle in a goal-based approach. These are:

Wealth creation: This is the majority phase of the goal where the risk appetite is high, duration is long, and growth is high. You have high equity exposure.

Wealth protection: This is the final stage of your goal with the objective of protecting the corpus. Here, duration is short, growth is low, and the risk appetite is low.

For example, if your investment horizon is 15 years, you can take the first eleven years in the wealth creation stage and the last three years to preserve your savings and investments.

The below table shows how the risk in the portfolio has been reduced.

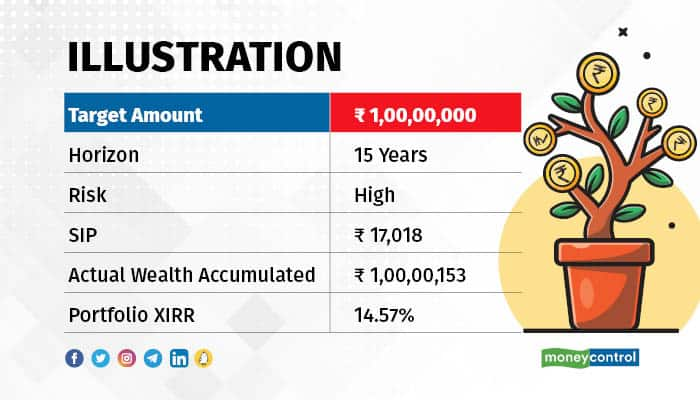

Let us see an example

While the table looks simple, your portfolio will grow in phases, with multiple exit strategies in place for different stages of the goal (see below).

Note: Period understudy is between Jan-07 – Dec’21. LHS is investment value and RHS is BSE Sensex Value.

Source: BSE Sensex

Having a defined exit strategy for different time periods allows you to re-assess and re-allocate your assets in an instrument that makes sense from your risk appetite point. If you look at March 2020, during the COVID-19 period, the market corrected by -29 percent from its peak of December 2019, whereas a periodic exit strategy led to single-digit correction in the portfolio.

When you do goal-based investing, the idea is to achieve the goal with optimised risk instead of running out of cash or outperforming your goal. The above portfolio has been rebalanced (profit booked periodically and asset allocation changed) only to reduce the risk when you are closer to your target. Towards the end, the capital should be preserved because, in goal-based planning, you have pre-defined events such as education, and retirement which cannot be delayed.

Conclusion

An investment plan should always have an exit strategy to avoid significant losses when you need to fulfil your investment goal or when you need that money. Also, it is always good to prepare as early as possible for any goal. You'll be able to take advantage of the dips and peaks in the market during significant market movements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.