In this article, we will illustrate the opportunities available in global markets and how you can use your understanding of Indian companies to learn more about related global companies.

Since most people think about large technology companies when the idea of investing in global or US markets is brought up, we will talk about a different sector – footwear.

Keep in mind that to illustrate how to go about understanding and analysing global companies, that too in relation to Indian companies, we are forced to discuss specific names. Treat this article as a theoretical exercise in understanding comparative equity analysis.

Comparison with a global peer

Suppose you like one of the most popular footwear companies in India, Bata.

Bata is a leader in the Indian footwear industry, which is around $3 billion in size. The industry is growing at around 11-12 per cent annually. Bata is a manufacturer and retailer of footwear with more than 1400 stores across India.

For comparison purposes, let us pick a company from the global markets that you might be familiar with, since it has launched products in India as well – Skechers.

The global footwear industry’s size is more than $200 billion annually. Skechers is one of the leading manufacturers and retailers of the global footwear industry. Skechers has a presence in more than 3000 locations worldwide.

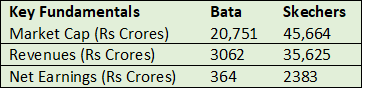

Let us consider the market capitalization—the value a buyer would have to pay for acquiring the whole company, in addition to assuming the debt—of both the companies.

The market cap of Bata is Rs 20,751 crore, while Skechers’ market capitalization is $6.4 billion, which translates to Rs 45,664 crore.

Let us quickly compare two other relevant numbers – revenues and earnings. Bata’s revenues are Rs 3,062 crore, while Skechers reported ~$4.993 billion, i.e. Rs 35,625 crores. Bata reported earnings of Rs 364 crore, while for Skechers the figure is $334 million, i.e., Rs 2383 crore.

From the above data, we can see that Skechers is a much larger company compared to Bata. In terms of sales, it is more than 10 times larger than Bata. Given that it has operations in the US and elsewhere globally, including in India and rest of Asia, it does not come as a surprise. Earnings of Skechers are more than six times those of Bata’s. However, Skechers’ market cap is just twice that of Bata’s.

Let us summarize the data in a table.

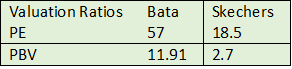

The above data indicates that Skechers is probably cheaper than Bata on a relative valuation basis. To ascertain this, let us look at some of the valuation ratios.

On a relative basis, Skechers does look cheaper than Bata. In fact, Bata is more than 3 times more expensive compared to Skechers on a PE (price to earnings)-multiple basis. On a PBV (price to book value)-multiple basis, Bata is over four times more expensive than Skechers.

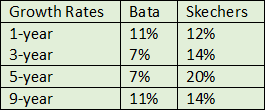

Could the different growth rates be the reason? Let us look at the growth rates.

Global companies too can grow faster

The data clearly shows that the growth rates of Skechers are higher than Bata’s. This demolishes the typical idea that Indian companies grow faster than global developed market firms.

In short, for a typical favourite Indian firm that an investor would like to buy, it is possible that there is a company available in the developed markets which has similar or much larger scale, wider geographic scope, higher growth rates and is available at cheaper valuation multiples compared to the Indian peer.

Therefore, before buying the shares of your favourite Indian company, compare it with developed market companies, especially US firms. Of course, the above is just an illustrative quick analysis. The analysis required to conclude on a buy, sell or hold must be much more extensive, including a detailed understanding of the potential risks involved and whether they compensate for the returns. However, we cannot jump to the typical conclusion that the Indian company is relatively safer and that a global one is more risky. The view from the US markets is that Indian markets are riskier. For Indians though, foreign markets are riskier because of currency risks and weaker understanding of foreign markets. We are trying to reduce the “weaker understanding” part and build more familiarity with foreign companies and markets.

Disclaimer: Our mentioning the name of any Indian or global company should not be construed as a recommendation to buy, sell, hold or carry out any other action related to those companies. Also, keep in mind that we might have those companies in our or client portfolio(s) already, or might be about to add those or might be selling those or might not have them at all. Further, there is a time lag between when we write the article and when you see the published article. Our suggestion is that you completely ignore the names as far as your actual investment decisions are concerned and carry out your own analysis, or rely on your advisor, before buying any stock.

(The writer is CEO & Chief Investment Strategist OmniScience Capital)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!