Small states and Union Territories (UTs), such as Manipur, Lakshadweep, Arunachal Pradesh and Tripura, are witnessing a big jump in investments in mutual funds even as the top 10 states in India, including Maharashtra, New Delhi, and Karnataka, continue to contribute nearly 90 percent to the overall mutual fund assets.

The total average assets under management (AAUM) of the Indian mutual fund industry grew by 30 percent to Rs 52.89 lakh crore at the end of last month from Rs 40.80 lakh crore in January 2023.

The country’s strong macroeconomic fundamentals and resilient earnings growth have been aiding positive market sentiments and encouraging more retail investors to invest in equities, primarily through the Systematic Investment Plan (SIP) route. A total of Rs 18,838 crore came into mutual funds through SIPs in January 2024.

Further, the participation of retail investors from smaller towns and cities has been steadily increasing, backed by rising financial literacy and access to financial products and services, thanks to the increasing reach and penetration of asset management companies (AMCs).

Top states rule

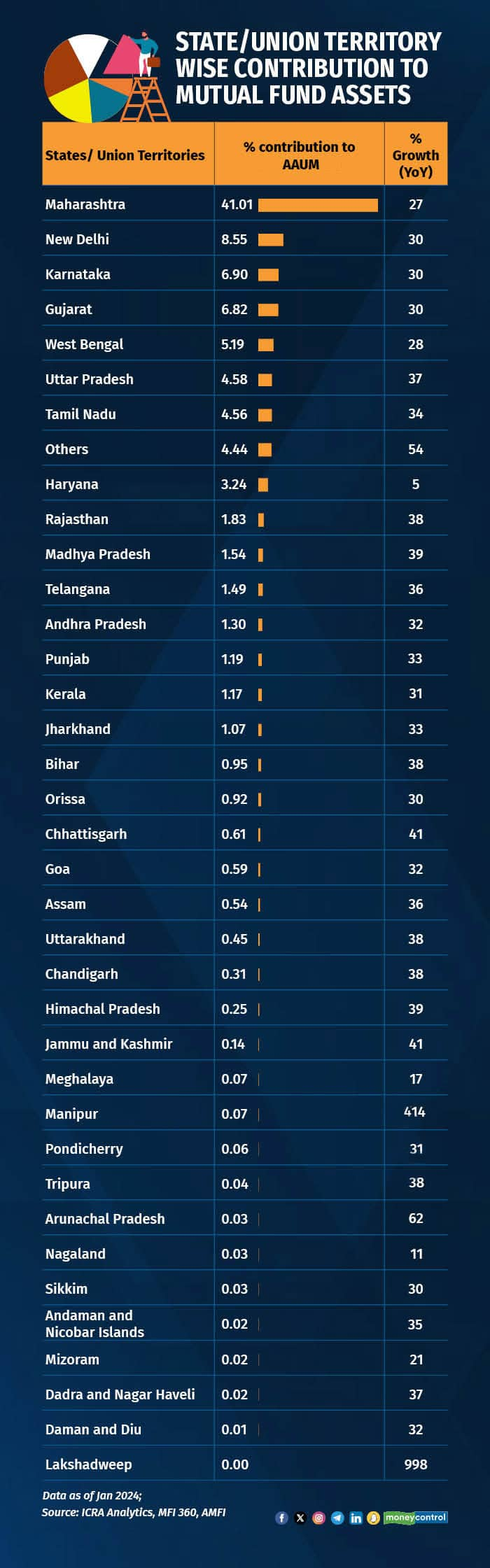

As per data compiled by ICRA Analytics, a wholly-owned subsidiary of ICRA Ltd, the top five states — Maharashtra, New Delhi, Karnataka, Gujarat, and West Bengal — saw a growth of around 27-30 percent in Average AUM (AAUM) in January 2024 on a year-on-year (YoY) basis.

Further, the top 10 states, including Tamil Nadu, Uttar Pradesh, Haryana, Rajasthan, and Madhya Pradesh, continued to enjoy 87 percent contribution to the total AAUM.

Maharashtra’s AAUM stood at Rs 21.69 lakh crore in January, up from Rs 17.14 lakh crore in January 2023, a growth of around 27 percent; New Delhi at Rs 4.52 lakh crore, Karnataka at Rs 3.65 lakh crore, and Gujarat at Rs 3.61 lakh crore. All these grew by 30 percent each YoY, while West Bengal, at Rs 2.74 lakh crore, grew by 28 percent, ICRA Analytics said.

Small states betting big

Interestingly, investments into mutual funds from the smaller states (beyond the top 10) and UTs have been witnessing a steady surge.

Also read | Mirae India MF offers a new way to invest in smallcap funds. But is it worth it? A Moneycontrol Review

For instance, Pondicherry registered 31 percent growth in AAUM at Rs 3,193 crore in January; Tripura posted 38 percent growth at Rs 2,053 crore, while Sikkim saw 30 percent growth at Rs 1,780 crore. Manipur witnessed a whopping 414 percent surge in AAUM at Rs 3,726 crore, while Lakshadweep registered a 998 percent increase at Rs 169 crore.

The high percentage is because of the lower base.

Also read | Have a complaint against National Pension System? Here are 3 steps to resolving it

Ashwini Kumar, Head-Market Data, ICRA Analytics, said, “Mutual fund penetration has been steadily improving in smaller towns and cities, backed by increasing awareness among people, the growing interest among retail investors in investing in equities through the mutual fund route, and the opening up of branches of AMCs beyond the top 30 towns.”

Limited penetration

In terms of existing penetration, the per capita penetration in Maharashtra is highest at Rs 1,69,300, with its AAUM accounting for nearly 77 percent of the GDP. In comparison, it is lowest in Manipur at Rs 3,270, accounting for 3 percent of GDP.

As per estimates, mutual funds continue to form a modest slice of the total pie of household savings, as they contribute less than 10 percent to the total financial savings as of March 2022. Bank deposits continue to have a huge share, followed by life insurance.

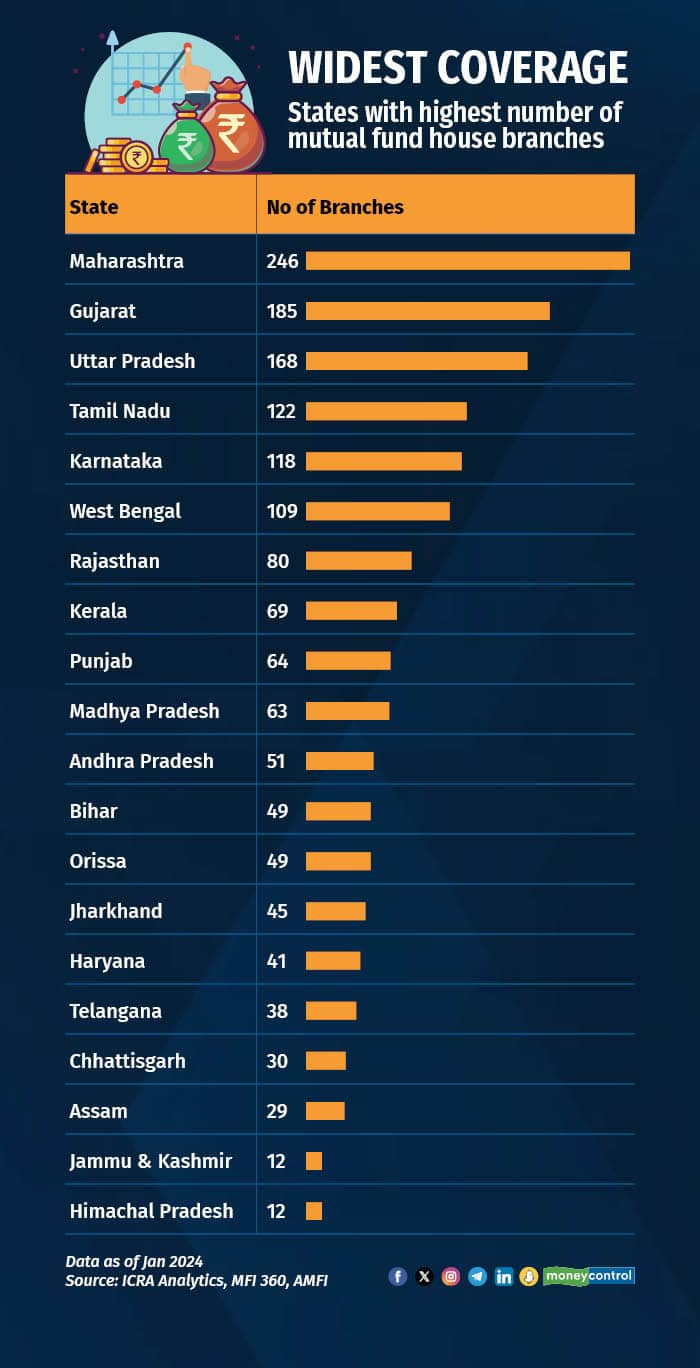

The ICRA Analytics highlighted the need to deepen the distribution channels across India, as areas such as Tripura, Meghalaya, Manipur, Nagaland, Arunachal Pradesh, and Andaman and Nicobar Islands had mutual fund branches in single digits each, while two states, Mizoram and Sikkim, didn’t have a single AMC branch.

On the other hand, the top 10 states, including Maharashtra, Gujarat, Uttar Pradesh, and Tamil Nadu, have 77 percent of AMC branches out of the 1,595 total branches in India. The bottom 10 states’ share in total AMC branches is just 2.50 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.