The assets under management of the Indian mutual fund industry rose above Rs 50 trillion (Rs 50 lakh crore) in December thanks to the continuous inflows and rally in Indian equity markets, according to data released by the Association of Mutual Funds of India (AMFI), the industry trade body for mutual funds.

Data showed that total assets under management (AUM) under the open-ended schemes stood at Rs 50.80 trillion in December against Rs 48.78 trillion in November 2023.

Also read | Mutual fund industry assets top Rs 50 trillion landmark: what helped achieve this number?

The rise in assets of the mutual fund industry has come on the back of rally in equity markets. BSE Sensex rose 7.53 percent in December, while NSE Nifty gained 7.93 percent during the month.

Meanwhile, inflows via systematic investment plans (SIPs) also rose to Rs 17,610 crore in December against Rs 17,073 crore in the previous month, underscoring confidence of retail investors.

Venkat Chalasani, Chief Executive of AMFI, said, " While the mutual fund (MF) industry took almost 50 years to build the first Rs 10 trillion of AUM, the last Rs 10 trillion, from Rs 40 trillion to Rs 50 trillion was amassed in just over a year. The entire mutual fund industry in India including the AMCs and the Regulator have put in focused efforts to reach investors across the country with support from the MF distributors."

Strong equity flows

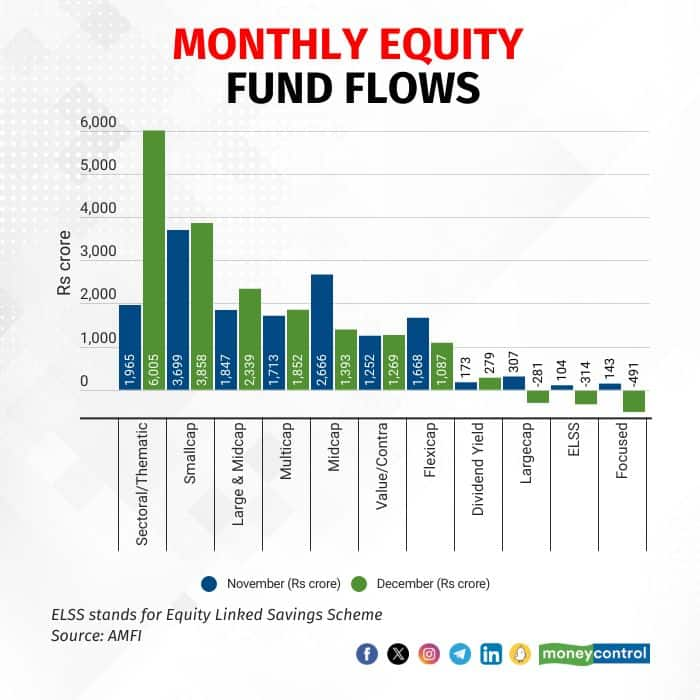

In December, net inflows into open-ended equity mutual funds gained 9 percent to Rs 16,997 crore against Rs 15,536 crore in November.

During the month, smallcap funds saw net investments of Rs 3,858 crore, while midcap fund inflows slumped 48 percent in December. Largecap funds logged net outflows of Rs 281 crore.

Also read | Find the best asset allocation mix that will maximise your returns

In November, smallcap funds had seen net inflows of Rs 3,699 crore, midcap funds had seen net investments of Rs 2,666 crore, while largecap funds saw buying of Rs 307 crore.

"Compared to the previous four months (August to November), there has been a significant dip in flows of the midcap category. This could partially be attributed to investors considering booking profits in this category given the sharp run-up it has witnessed recently. While the small-cap category too saw a fair bit of redemptions during the month, the quantum of purchases was significantly higher," said Melvyn Santarita, Analyst – Manager Research, Morningstar Investment Research India.

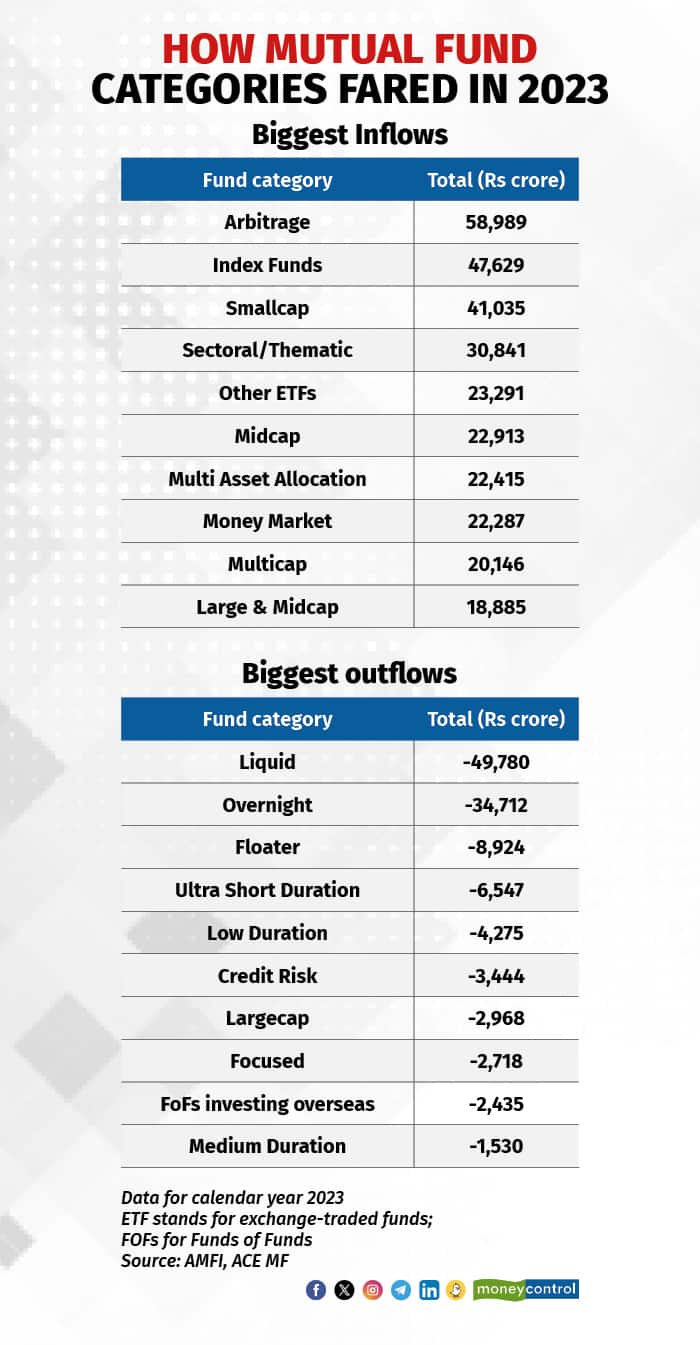

For the whole calendar year, smallcap funds saw net inflows of Rs 41,035 crore, while midcap funds saw net investments of Rs 22,913 crore. On the other hand, largecap funds witnessed net selling of Rs 2,968 crore.

Equity-oriented mutual funds had recorded a 22 percent decline in funds flow in November.

Also read | Why Axis Mutual Fund CEO B Gopkumar is confident of its turnaround by June 2024

Big outflows in debt

On the fixed-income, debt funds saw net outflows of Rs 75,560 crore last month against net outflows of Rs 4,707 crore in November.

From the debt-oriented schemes, liquid funds saw the highest net outflows at Rs 39,675 crore, trailed by low-duration funds at Rs 9,432 crore and money market funds at Rs 8,384 crore. Ultra-short duration and floater funds also had net outflows of Rs 6,000 crore each, followed by Rs 4,865 crore from overnight funds.

“Total inflows into the mutual fund industry fell by Rs 40,685 crore on the back of quarter-ending advance tax payments, regular redemptions from debt funds and higher valuations in equity space,” said Gopal Kavalireddi, Vice President of Research at FYERS.

Hybrid funds in demand

Hybrid schemes saw net flows of Rs 15.009 crore, mainly due to an inflow of Rs 10,645 crore into arbitrage funds.

"Many investors have started reallocating their funds between equity and debt in light of the Indian markets moving to all-time high levels. Multi-asset allocation funds had inflows of Rs 2,420 crore, followed by balanced advantage funds at Rs 1,369 crore," said Kavalireddi.

For the calendar year, the net flows for equity funds stood at Rs 1.61 trillion, with 39 percent or Rs 63,949 crore coming into mid and small-cap mutual funds. Sectoral or thematic funds were the next best category, garnering Rs. 30,841 crore for the year. Largecap and focused funds were the only two sectors with negative inflows of around 1.7 percent each.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!