SIP isn't perfect; but it's the small investor's best bet

No matter what you have been told by those who sold you your mutual funds, SIP isn’t a risk-free strategy to invest in equities. But nevertheless, it’s a fairly good option when it comes to practical utility.

January 31, 2019 / 10:55 IST

Dev Ashish

In recent years, investing via Systematic Investment Plans (SIPs) has become very popular.

But SIP isn't a perfect strategy.

No matter what you have been told by those who sold you mutual funds, it isn't a risk-free strategy to invest in equities.

But nevertheless, it's a fairly good option when it comes to practical utility.

Markets don't go in a straight line. They move up, move down, move sideways and what not.

So if you invest a lump sum amount, and get your timing right, then you would enter the market at lower levels and have the option of exiting at higher levels.

Obviously, the return, in this case, would be maximized. This is the perfect strategy - Buy Low, Sell High. Simple.

But the problem with this perfect strategy is in its implementation. You can never be sure of whether you are really buying at a low or will the markets go down even lower.

Let’s take a small example to highlight this:

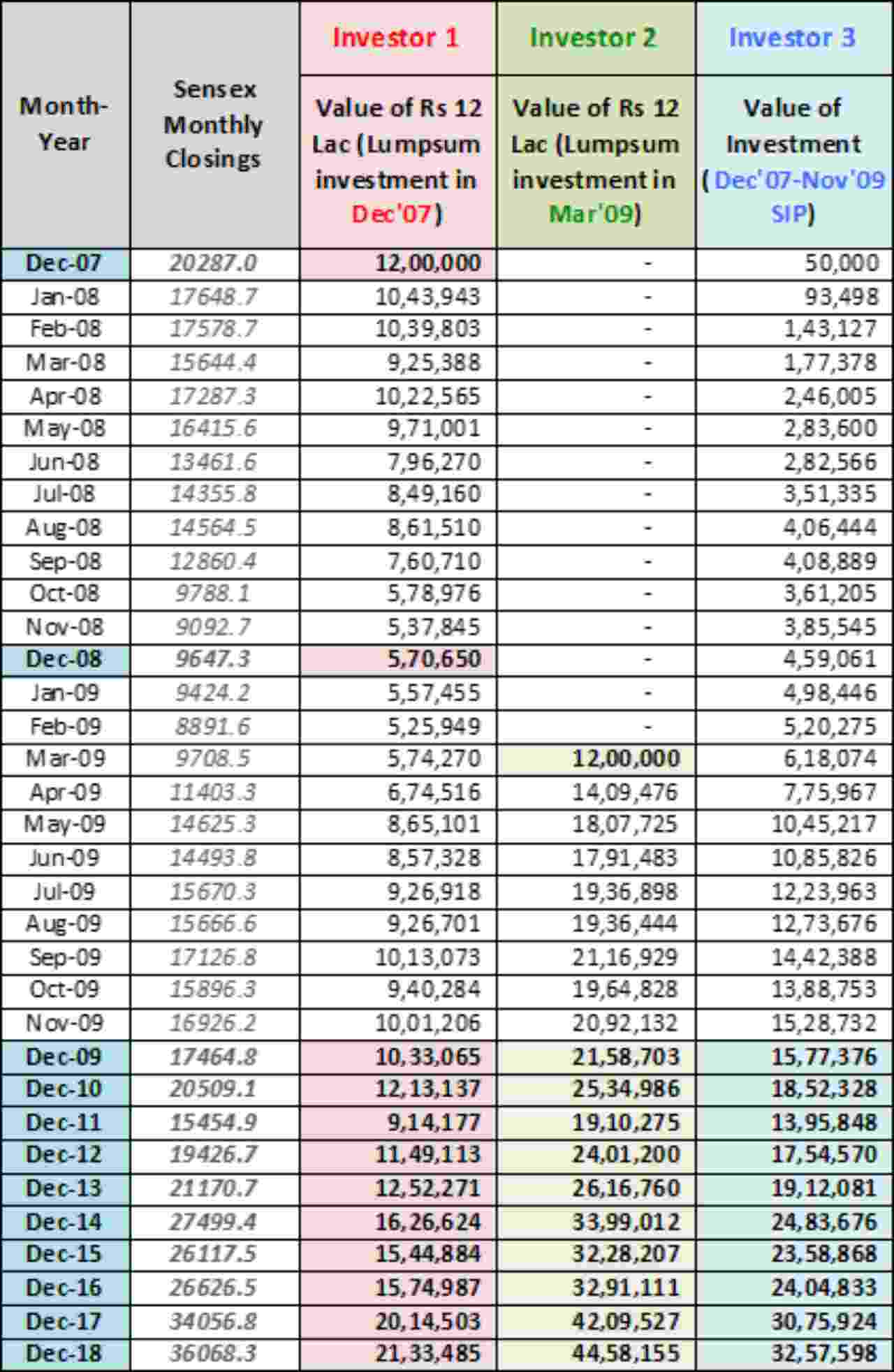

Suppose there are three different investors who wish to invest a total of Rs 12 lakh each:

- Investor 1 & 2: Can invest Rs 12 lakh lump sum (at different times)

- Investor 3: Can invest Rs 50,000 every month for 2 years ( Rs 12 lakh)

Now if someone were a perfect market timer, then they would have known that the bottom of the last real bear market (2008-09) would be set in March-2009.

So if this investor had invested Rs 12 lakh in one go in March-end 2009 in the Sensex, its value by December 2018 would have become Rs 44-45 lakh.

But this kind of return would have been available only if the investor had the ability to time the market perfectly.

Now compare this with the other investor who also wanted to invest Rs 12 lakh. But he got his timing almost ‘perfectly’ wrong and invested all the money in December 2007, i.e. near the peak of the bull market of 2003-2007.

The result?

The value of his investments by December 2018 would have been Rs 21-22 lakh. The difference between the perfect and imperfect market timing is clearly evident.

So buying low is fine if you want to make super returns. But how can you be sure whether you have the skill, the time and the knowledge (and wisdom) to perfectly know when the ‘low’ is.

And that is the problem with this theoretically perfect idea of Buy-Low-Sell-High.

If you are lucky and invest at the lows (and exit at the highs), your returns will be maximized. But if you aren’t lucky, then you will enter near the market peaks and witness the fall thereafter.

To avoid such situations, the concept of investment phasing had been devised. You call it the SIP. And it does reduce the risk of perfectly mistiming by spreading out the investments over a period of time.

Continuing our earlier example, imagine that unlike the previous two lumpsum investors, there is a third investor - who too wishes to invest Rs 12 lakh but not in one go.

Instead, he opts for Rs 50,000 monthly SIP for 24 months (total investment again being Rs 12 lakh = Rs 50,000 x 24).

He begins in Dec 2007 and continues investing till Nov 2009.

Any guesses what would be the portfolio value for this investor by Dec 2018?

The answer is Rs 32-33 lakh.

And what were the values for perfect and imperfect timers?

Rs 44-45 lakh and Rs 21-22 lakh respectively.

This is exactly why SIP is a practical approach for most common people.

They can neither time the market ups and downs perfectly nor bring in the large one-time investment amount.

So what’s left for them is to invest smaller amounts regularly- this way, all the investment doesn’t go into the market at just one market level. So the risk of being completely wrong is avoided to a large extent. Of course the opportunity of being perfectly right is also missed. But that is fair given everything that is on offer.

And here is a tabular depiction of all 3 investors we discussed above- with portfolio value at the end of each year in between. Spend some time on the table and you will understand the crux of the story:

To put it very simply, the actual value of SIP is not in mathematics but how it disciplines the investor. It is the simplest way of investing regularly without having to worry about whether it is the right time to invest or not.

Many feel that since SIP is far from perfect, it can be optimised further by making it start/stop, increase/reduce based on some factors like valuations, market falls, etc.

It is true that it can be done. A simple strategy like value averaging would ask the investor to increase SIP amount when markets are down and reduce SIP amount when markets are rising.

But varying the SIP instalments is theoretically easy, but putting it in practice is difficult for most investors (unless aided by smart tools). It sounds interesting but it does add a layer of complexity (trying to time the market from within SIP framework) whereas SIP itself was about simplifying investing without the need to time the markets. For most people, the simple SIP is better suited from a practical perspective.

To conclude, there is no perfect answer here. If you feel you can time the markets well and bring in large lump sum amounts when needed, then you can avoid going the regular investing route.

But if you are a common investor, who neither has the skill nor the time to study the markets (and understand its dynamics), then it’s best to stick with the middle path of investing regularly. SIP is the best bet for such investors even if it’s not the perfect strategy for sophisticated investors. So understand your limitations and choose an investment strategy accordingly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!