Most of us think income tax is a once-a-year problem. File your return, pay whatever is left at the time of filing the Income Tax Return (ITR), and move on. But the government doesn’t like waiting. If your total tax liability for the year is more than Rs 10,000, you are expected to pay it in parts while the year is still running. That’s what we call advance tax. Basically, the taxman wants his money “as you earn,” not in one big cheque at the end.

For salaried people, employers usually take care of this through Tax Deducted at Source (TDS). But if you have taxable income such as capital gains from the sale of shares or mutual funds, you are liable to pay advance tax in instalments during the year. Similarly, if you are a freelancer or a consultant, the advance tax rule applies to you. Skip it, and you will have to cough up extra in the form of interest under Sections 234B and 234C.

Who is not required to pay advance tax? Senior citizens aged 60 years or more who do not have income from any business or profession are exempt. However, if they have business or professional income, they fall under the ambit of advance tax.

You might be tempted to say, I’ll just pay the tax at the end of the year and bear the interest. But here’s why that’s not smart. First, it’s an unnecessary leak from your pocket -- Why pay extra when you can avoid it? Second, it makes financial planning a nightmare. Instead of breaking your tax into manageable bites across the year, you’re staring at one giant, painful bill while filing ITR. And third, paying on time keeps you compliant. No red flags, no letters from the tax department, no stress.

How Advance Tax Works

Think of advance tax like your rent or EMI. You don’t wait till year-end to pay your landlord or bank, right? You split it across the year. The tax department works the same way. It has fixed four checkpoints for you to pay: June, September, December, and March.

What Happens If You Don’t Pay?

The short answer: interest. And the longer you delay, the more it hurts. That’s where Sections 234B and 234C come in.

“It is always suggested to assess your future income based on salary, rental, business, and other sources for the financial year and pay advance tax if the payable amount is more than Rs 10,000 (after excluding TDS). Pay advance tax in instalments each quarter, with the entire tax cleared by 15th March of the financial year,” says Deepak Kumar Jain, Founder and CEO of TaxManager.

Section 234B – Default in payment of advance tax

If you haven’t paid at least 90% of your total tax by the end of the financial year, you will be charged 1% interest every month on whatever’s unpaid, from April until the day you finally clear it.

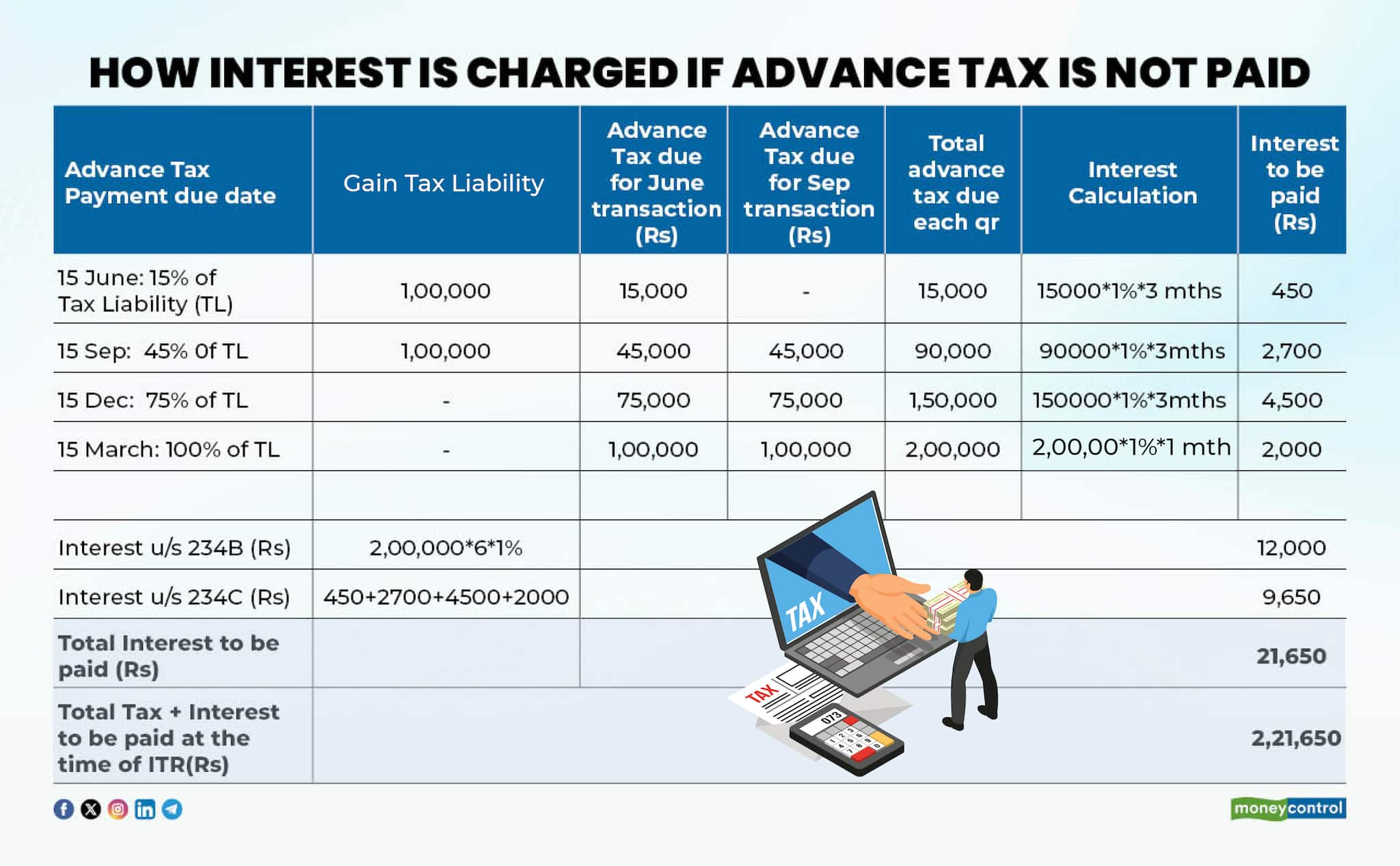

Section 234C – Interest on deferment of advance tax instalmentsSuppose your total capital gains tax liability is Rs 2 lakh — Rs 1 lakh in June and another Rs 1 lakh in September. If no advance tax is paid, each due date will have a shortfall, attracting interest:

Since less than 90% of the tax was paid by March 31, Section 234B interest also applies:

Rs 2,00,000 × 1% × 6 months (till September 15, 2025) = Rs 12,000

Overall interest: Rs 21,650

Final payable tax at ITR filing: Rs 2,21,650

Why Bother Paying on Time?

Advance tax isn’t an extra penalty or hidden charge; it’s simply the tax you owe, paid in instalments instead of a lump sum. The system is designed to keep the government’s cash flow steady and your payments manageable. Ignore it, and you don’t just face a year-end crunch; you also get slapped with interest under Sections 234B and 234C.

So the choice is yours. Pay as you earn, or pay extra later. If you are earning beyond your salary, whether through side hustles, property rent, or stock trading, this rule is especially for you. A little attention to advance tax today can save you both money and unnecessary drama when tax season rolls around. So if you haven't paid advance tax for FY25 yet, pay it at the time of filing your ITR. But for the next year, plan better by paying the due advance tax for FY26 by September 15, 2025.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.