Banking complaints rose by 32.81 percent under the Reserve Bank's Integrated Ombudsman Scheme between April 1, 2023 and March 31, 2024. The Reserve Bank of India (RBI) received 9.34 lakh complaints through the offices of RBI Ombudsman and the Centralised Receipt and Processing Centre, according to the RBI’s latest annual report on Ombudsman Scheme.

The substantial rise in banking complaints could point to growing customer dissatisfaction with banking services but could also reflect increased awareness and utilisation of the ombudsman scheme, as more individuals seek resolution to their grievances. The report reveals that nearly 65 percent of complaints received in 2023-24 came through the online portal.

RBI sees surge in complaints

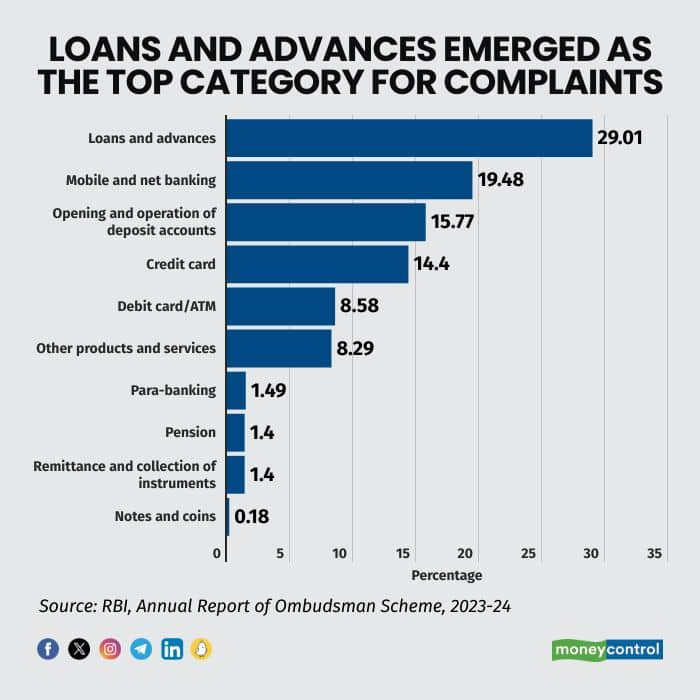

Loans and advances topped the list of complaints received by the RBI, with a staggering 85,281 grievances, accounting for 29.01 percent of the total complaints. This represents a significant 42.70 percent increase from the previous year, according to the RBI's annual report on the ombudsman scheme.

Further, according to the report, mobile and net banking complaints saw a significant surge of 32.61 percent (from the previous year) to 57,242, accounting for 19.48 percent of total complaints. Additionally, complaints related to opening and operating deposit accounts rose by 34.45 percent (from the previous year) to 46,358, making up 15.77 percent of total complaints. Furthermore, credit card complaints increased by 23.95 percent (from the previous year) to 42,329, representing 14.40 percent of total complaints.

The RBI has uncovered instances of unfair interest charging practices by lenders during its onsite examination of banks for the period ending March 31, 2024. Banks were found to be charging interest prematurely, from the date of loan sanction or loan agreement execution, rather than the actual disbursement date. Additionally, in cases where loans were disbursed via cheque, interest was charged from the cheque date, even if the customer received the cheque days later. Some banks were also charging interest for the entire month, even if the loan was disbursed or repaid mid-month. Furthermore, certain banks were collecting advance instalments but still charging interest on the full loan amount, highlighting a lack of transparency and fairness in their practices.

During the year, the customers lodged complaints regarding various credit card-related issues, including unauthorised transactions, fraudulent activity, and unsolicited card issuance. Additionally, customers expressed dissatisfaction with disputes involving merchants, as well as the non-receipt of rewards and promotional benefits.

RBI sees a jump in complaints from individuals, senior citizens

Individuals, including senior citizens, accounted for the largest share of complaints received by the Reserve Bank's ombudsman offices in both 2022-23 and 2023-24. Notably, the number of complaints from this group saw a significant increase of 24.09 percent - rising from 2.07 lakh in 2022-23 to 2.57 lakh in 2023-24.

Also read | Budget 2025: Time to revamp personal taxation, reward taxpayers

Complaints against banks and NBFCs dominate

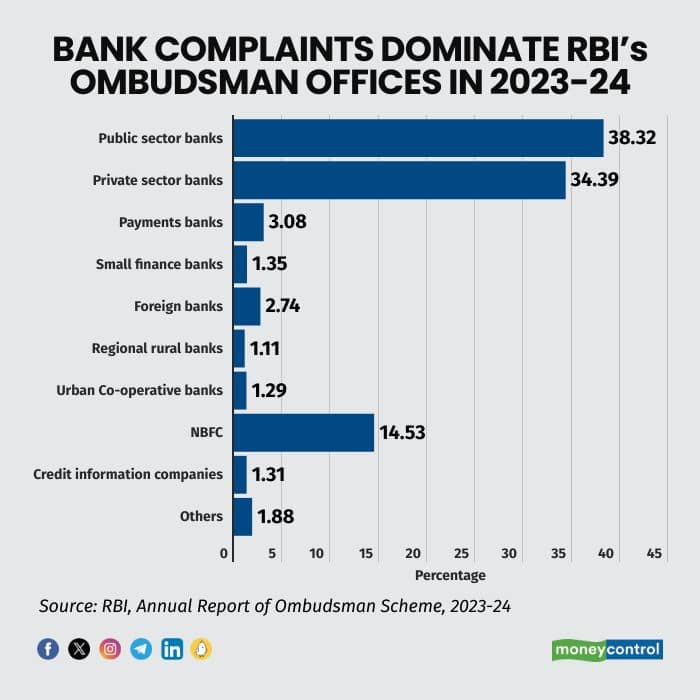

According to the report, complaints against banks dominated the grievances received by the Reserve Bank's Ombudsman Offices in 2023-24, accounting for 82.28 percent of the total complaints (2.42 lakh). Non-Banking Financial Companies (NBFCs) followed, with 42,699 complaints making up 14.53 percent of the total. Within the banking sector, public sector banks accounted for 38.32 percent of complaints, while private sector banks accounted for 34.39 percent.

Report shows high disposal rate

The Reserve Bank's Ombudsman Offices resolved 2.84 lakh complaints and reported a disposal rate of 95.10 percent. Of the total complaints resolved, 1.93 lakh were deemed maintainable, accounting for 67.83 percent of all disposed complaints. About 57.07 percent of these maintainable complaints (1.10 lakh) were settled through mutual agreement, while 40.78 percent (78,654) were rejected by the RBI Ombudsmen, and 2.14 percent (4,136) were withdrawn by the complainants, it reports.

Also read | How the next-gen of affluent families are managing their wealth

RBI's Ombudsman Scheme: Here's how to register your complaint

RBI’s integrated ombudsman scheme covers entities regulated by the central bank, including scheduled commercial banks, urban cooperative banks, non-banking financial companies (NBFCs) and non-scheduled primary co-operative banks with a deposit size of over Rs 50 crore.

You can file a complaint with the ombudsman in multiple ways. To file the complaint online, you can log on to the website https://cms.rbi.org.in. You can also register your complaint by sending an email to CRPC@rbi.org.in or by calling the contact centre on toll-free number 14448. You can also send your complaint physically by filling the form and sending it to the ‘Centralised Receipt and Processing Centre’ set up by RBI in Chandigarh.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.