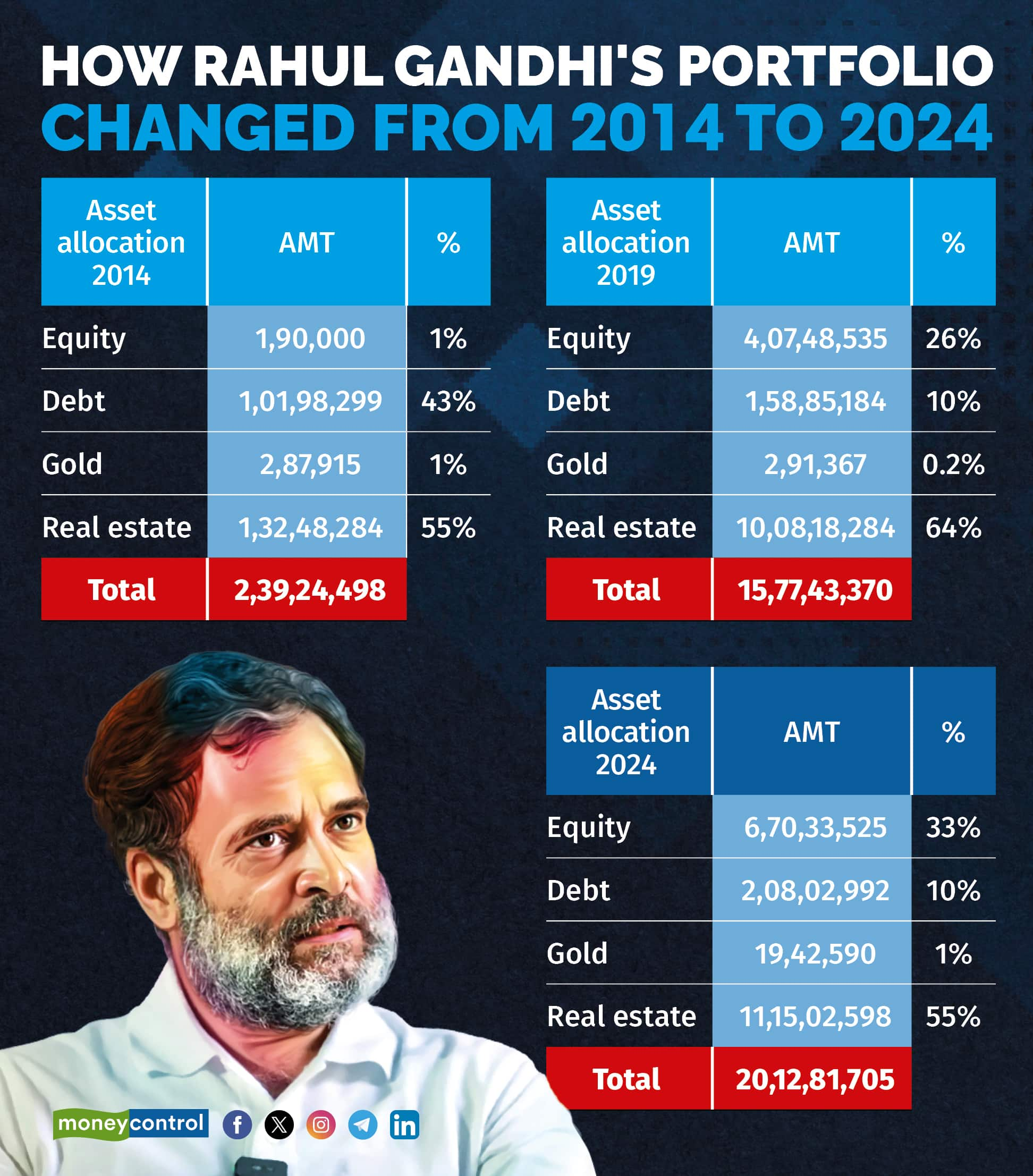

An analysis of Rahul Gandhi’s current portfolio, as per the affidavit he filed when filing his nomination for his constituency Wayanad, in Kerala, shows that his portfolio appears diversified and across asset classes.

However, it is worth noting that his allocation to equities in 2014, the year in which the Congress-led United Progressive Alliance (UPA) lost the Lok Sabha elections to the Narendra Modi-led National Democratic Alliance (NDA), was zero.

While the diversification may have been based on the recommendations of the Congress leader’s investment advisor, the rise in equity market in the last 10 years during which Modi has been in power appears to have given confidence to Gandhi to invest more money in equity markets.

From nil to 30 percent

Gandhi’s 2014 affidavit shows that he had no investments in listed equity shares or even in equity mutual funds (MF). He did have a small allocation (100 shares worth Rs 1,900 each) to a company called Young Indian. Gandhi is a director on Young Indian, a company that owns the National Herald newspaper among other assets, including real estate. Aside from Gandhi, other Congressmen are director of the company like Sonia Gandhi and Mallikarjuna Kharge. Gandhi still owns 1,900 shares - which is valued at the same Rs 1.90 lakh - of Young Indian, as per his 2024 affidavit.

Young Indian’s ownership of a company called Associated Journals Ltd (AJL), which owns National Herald and real estate near Delhi’s ITO, has been the subject of prolonged legal proceedings between the Gandhis and agencies, notably ED and the IT department.

Rahul Gandhi's asset allocation - 2014-24

Rahul Gandhi's asset allocation - 2014-24

However, by May 2019, Gandhi’s portfolio had matured. His equity investments had gone up to Rs 4.07 crore. That was 26 percent of his overall portfolio, which was valued at Rs 15.77 crore then. As per his latest filing (March 2024), his equity investments had gone up to Rs 6.70 crore. This translates to 33 percent of his portfolio.

To be sure, it is not possible to calculate the precise returns that his equity portfolio has made over the years because the affidavits don’t mention when he bought and sold shares and mutual funds. Also the rise in his equity portfolio is modest between 2019 and 2024 (Rs 2.62 crore).

An equity portfolio goes up due to a combination of a rise in share prices (in case you buy shares directly) or net asset values (mutual funds) and by making incremental investments.

But it is clear that between 2014 and 2024, Gandhi has invested and allocated more in equities.

“As time has gone by, Gandhi’s confidence has grown. And this shows in his portfolio; he has allocated more to equities over time. He also appears to have confidence in the Indian economy,” says Srikanth Bhagavat, managing director of Hexagon Capital Advisors.

Rising equity markets have certainly helped Gandhi. Over the last 10 years (between January 1, 2014 till date), the S&P BSE Sensex went up by 13 percent on a compounded basis. Mid-cap stocks (BSE Midcap index went up by 20 percent) and small-cap stocks (BSE Smallcap index went up by 21 percent) have also gone up.

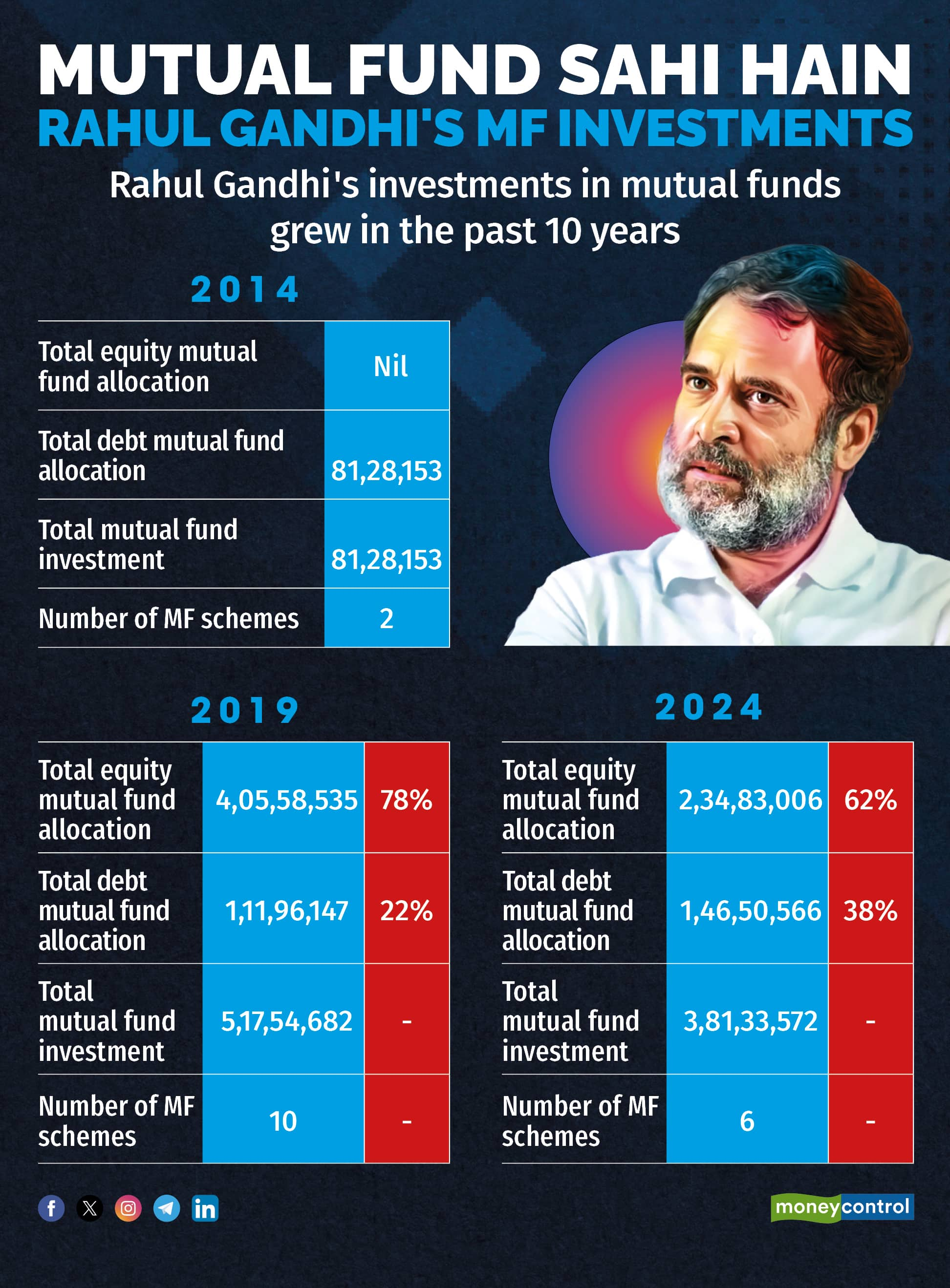

Mutual funds and direct equities

His confidence in Indian equities also show in the way he has shuffled the portfolio between 2019 and 2024.

Rahul Gandhi's mutual fund investments 2014-2024

Rahul Gandhi's mutual fund investments 2014-2024

In 2019, Gandhi was invested only in mutual funds, for his equity investments. He had invested in 10 mutual fund schemes, across large-cap, mid-cap and small-cap. By 2024, he had shifted some of that to direct equities. He still owns mutual funds, though they are now largely concentrated between HDFC Mutual Fund (India’s third-largest fund house with assts under management of Rs 6.19 trillion) and ICICI Prudential Mutual Fund (India’s second-largest fund house with assets under management of Rs 6.90 trillion). Parag Parikh Flexi Cap Fund is the only other fund house’s scheme in his portfolio, that constitutes 5 percent of his MF allocation.

Rahul Gandhi's asset allocation: Not enough gold

While Gandhi appears to have taken advantage of the massive equity rally that Indian stocks markets have had over the past 10 years, he has missed out on the gold rally. His allocation to gold, as per his 2024 affidavit is woefully low at just 1 percent. This translates to Rs 19 lakh, split between physical gold jewelry valued at Rs 4.20 lakh and Sovereign Gold Bonds with Rs 15 lakh. “Even though the SGB is a new and good addition to his portfolio, which shows financialisation of his savings, just 1 percent gold allocation (of his overall portfolio) is way too low. He has missed out on the entire gold rally,” says Viral Bhatt, founder of Money Mantra.

Gold has given a return of 9 percent between 2014 and 2024 - the 10 years of Modi’s government. However, much of this has come in the last five years, when gold prices went up by 15 percent since December 2018 till date.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!