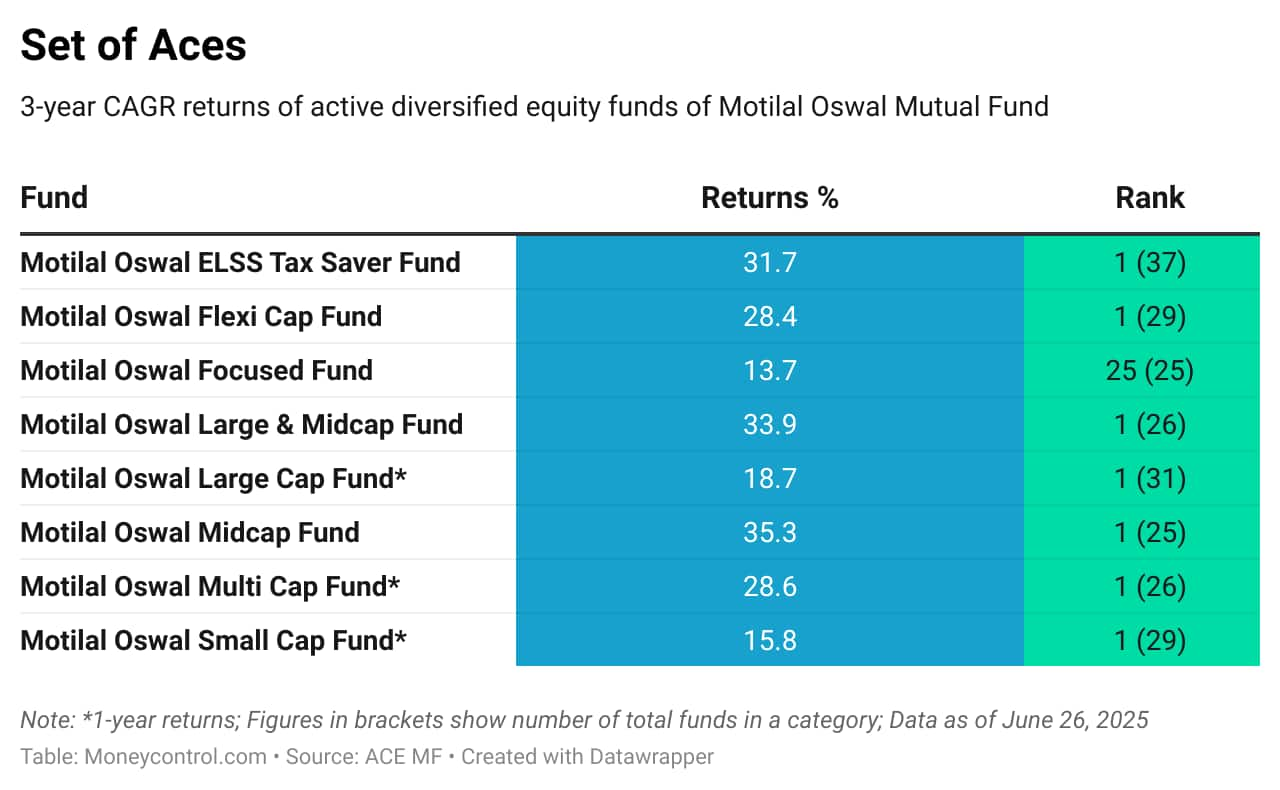

Motilal Oswal Mutual Fund, the 19th largest asset management company (AMC) by assets under management, is currently leading the returns chart as most of its diversified active equity funds are top performers on a three-year basis.

More than a year ago, Prateek Agrawal was elevated as the managing director and chief executive officer at the fund house. Agrawal’s first priority was to define and articulate the fund house’s core identity—of identifying high-quality businesses with sustained earnings growth potential.

“Our funds may be ideal for investors who understand the nature of differentiated strategies and are willing to stay the course through short-term volatility for long-term investment goals,” says Agrawal.

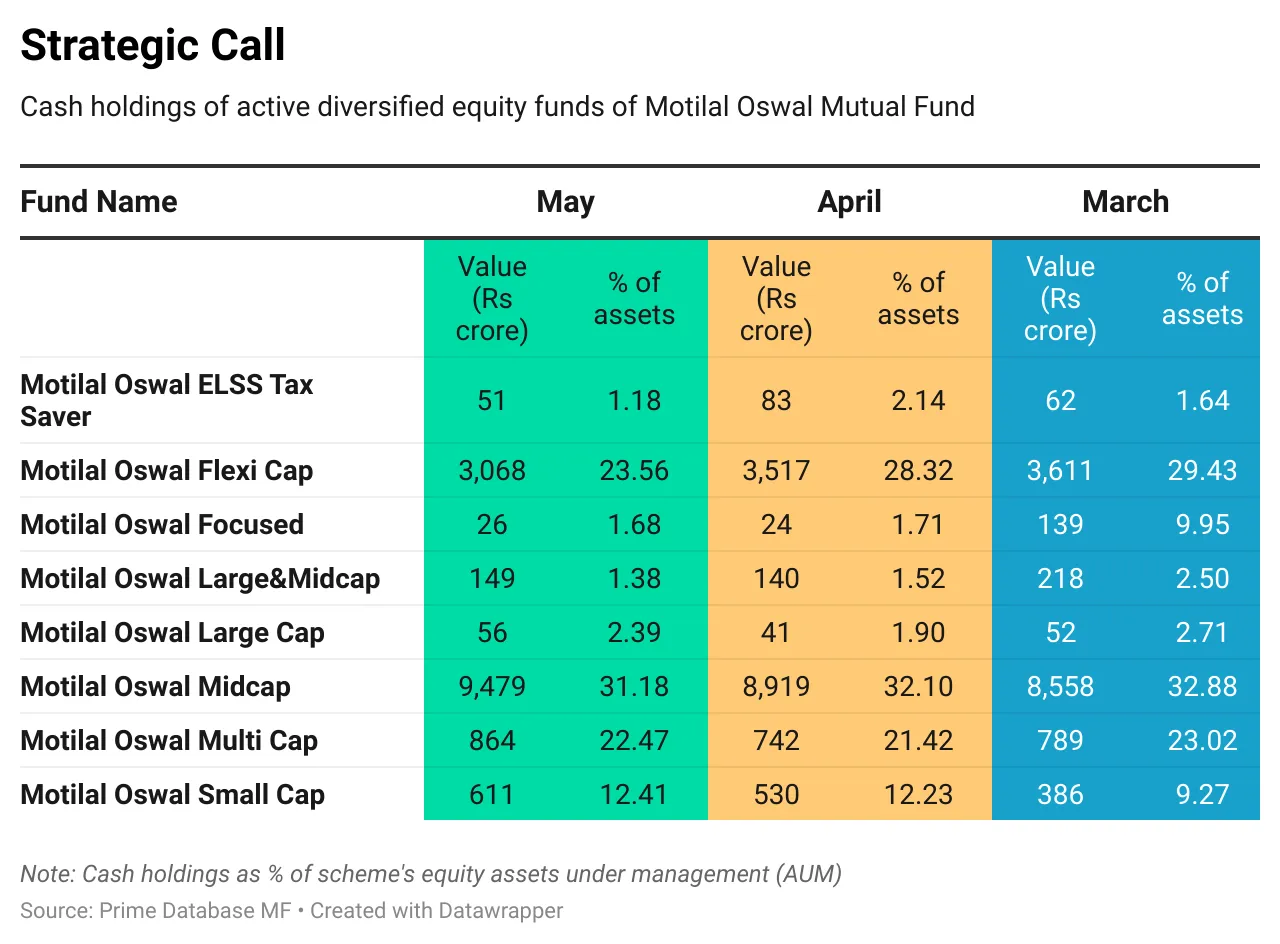

While many equity schemes of the fund house are chart toppers, some of its schemes have high cash allocation levels, but this has come down in the recent months.

Also read | Beyond tech giants: Three investment themes reshaping US markets

In an interview with Moneycontrol, Agrawal shared his views on what has made his funds tick in the last three years, Indian equities’ outlook, where he is deploying cash today and the changes he has brought in terms of management and investment style to the fund house. Edited excerpts:

Do you believe Indian equities are currently overvalued, fairly priced or is there still scope for growth?There are two broad schools of thought for generating market returns. One relies on identifying undervalued assets and buying something worth Rs 100 for Rs 50. That’s the classical value approach, which we typically don’t follow. At Motilal Oswal Mutual Fund, we follow the growth strategy.

Today, the market offers limited opportunities from a pure valuation comfort perspective, which can make it relatively challenging for value-oriented strategies to outperform. One only needs to examine the value indices, which have been largely stagnant.

Our focus remains on identifying companies with a clear trajectory of earnings growth well above the broader market and with the potential to maintain that over long periods.

We performed well when there was time for ‘value’, but now we believe that, on a relative basis, the environment is more suited to a growth style of investing.

The setting appears supportive of growth investing in a market environment characterised by stable interest rates, easing commodity prices and controlled inflation.

Motilal Oswal MF has posted strong performance over the past three years. What underpins this success?We continue to follow the growth style of investing, which is sustained growth in earnings. Our consistent emphasis on earnings-led growth has been central to our investment approach. The research team works cohesively to identify niche segments of the market, often underpenetrated or emerging themes, where we believe high structural growth potential exists. Our relatively nimble asset size gives us the flexibility to explore these pockets of opportunity that are not omnipresent. Index earnings typically move in line with nominal GDP. One needs to identify spaces with a structurally higher growth trajectory to seek differentiated outcomes.

We follow a collaborative, research-intensive process where the entire investment team comes together to identify these narrow but promising growth corridors. Each fund manager is empowered to reflect these themes within their portfolios, ensuring exposure across mandates without diluting conviction. Names and the exposure level, they can choose. But the whole thought is that they are positioned in that space, and when growth starts, the portfolio should participate in that. Even in large-cap strategies, where 80 percent of the portfolio must come from the top 100 stocks, we actively seek growth-oriented leaders rather than hugging the index. This results in a high active share across our funds.

Also read | China funds give up to 53% returns in a year: Should you look to invest?

Importantly, we avoid sectors where we believe there is structural growth such as traditional banks, consumer staples, internal combustion engine vehicles and commodities like steel or oil refining. Our funds are not built to mirror the index but we aim to focus on themes where earnings growth potential, in our assessment, could be ahead of broader market trends.

Since November 2022, we have maintained the view that this is a favourable environment for active management. In past decades, this is when segments like software (in the 1990s) and private sector banks (in the early 2000s) delivered multi-year outperformance. Real estate did that briefly. Today, we see similar promise in sectors like renewable energy, electronics manufacturing, electric mobility, mutual fund platforms and next-gen tech. And if you look at our constructs, you will find most of these spaces are present in most of our portfolios.

What is different this time is the breadth and depth of opportunity. It is rare to see so many sectors simultaneously offering high growth potential that is likely to sustain across cycles. These themes are early in their maturity curves and materially underrepresented in indices, which, we believe, creates differentiated avenues for growth-oriented investing. We have positioned our portfolios to capture this shift decisively. While the past few years have been strong, we believe current conditions could mark the start of a longer-term trend, and our portfolios are positioned with that possibility in mind.

Given this strategy, do your funds tend to be more concentrated?While we manage focused, high-conviction portfolios, we do not pursue excessive concentration. In most of our funds, excluding a few specialist mandates, individual stock weights typically range between 2 percent and 5.5 percent, and wherever exposures are on the higher side, they are in highly liquid stocks. Our aim is to express strong investment ideas decisively, without compromising on risk management.

We also recognise our role within a client's broader portfolio. We don’t expect to be the sole fund in an investor’s basket. In reality, most investors hold multiple mutual funds, often 8 to 10 or more, resulting in exposure to a large number of stocks, including many that mirror the index. This leads to index-like returns despite paying for active management.

Also read | F&O taxation: What you need to know about turnover, losses, and ITR filing

With us, investors get exposure to a curated set of around 30 stocks, companies with high earnings growth potential, selected through deep fundamental research. If paired with a high-quality, value-style fund, which may hold another 50–60 differentiated names, the combined portfolio spans 80–90 stocks. In my opinion, that is sufficient diversification, with just the right amount of focus that supports differentiated outcomes. Ultimately, such a blend, growth and value, high conviction and risk spread, can create a robust, well-balanced portfolio.

We keep saying, we are consistently inconsistent. It will have to happen because we run funds with high tracking errors.

Our funds may be ideal for investors who understand the nature of differentiated strategies and are willing to stay the course through short-term volatility for long-term investment goals.

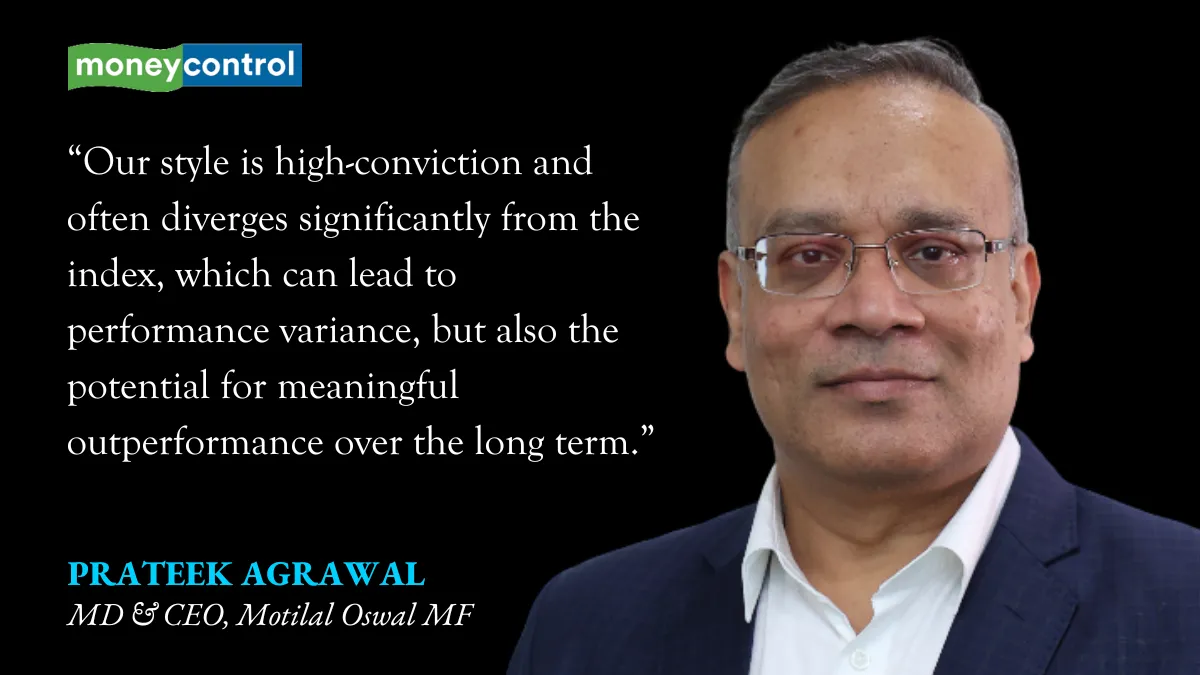

So should investors have a high risk appetite to invest in your funds?It’s less about risk appetite and more about alignment with investment philosophy. If one prefers benchmark-hugging, low tracking-error funds, our approach may differ. Our style is high-conviction and often diverges significantly from the index, which can lead to performance variance, but also the potential for meaningful outperformance over the long term.

There is still a need for a player like us in the market—focused, high-conviction portfolios that do things the old way. Names are added to the portfolio for their growth potential rather than simply hugging the index and maintaining low volatility. We believe this approach can complement broader investor portfolios by offering a differentiated, research-driven strategy that is structurally distinct from the benchmark.

Some of your funds are holding relatively high cash levels. How should investors interpret this?As a house, we do not favour holding excess cash. That said, practical considerations around trade execution, especially in large transactions, sometimes necessitate temporary cash positions. In the mutual fund industry, you can't sell and buy the same day.

The elevated cash levels observed earlier this year were more situational, largely driven by heightened volatility during the January–February period. Some managers increased the cash portion. As we speak, that is being deployed, as we think the situation has normalised.

Any notable sectors where you’ve increased allocation recently?We have already discussed several structural growth sectors earlier, many of which are represented in our portfolios. Investors will see these allocations reflected more visibly in the upcoming portfolio disclosures.

Rather than chasing short-term sector rotation, we focus on long-duration themes with strong earnings potential.

Consistency across all funds is not our goal, nor should it be for investors. In today’s environment, most investors hold multiple mutual funds. If all those funds aim for consistency, the aggregate result is often a diluted return profile closely tracking the index.

This approach, in our view, defeats the very purpose of investing in active strategies. At Motilal Oswal Mutual Fund, portfolios are designed to be high-conviction and structurally different from the benchmark. We maintain a high active share and tracking error, not by accident, but by design. This allows us to pursue differentiated outcomes, rather than replicate market returns.

Think of our strategy as more similar to performance-focused global hedge fund constructs—selective, research-driven and positioned far away from the index. We offer our investors a differentiated investment construct with the potential for long-term outperformance.

Since taking charge of Motilal Oswal Mutual Fund, what strategic shifts have you implemented?When I stepped into this role, the objective was not to disrupt but to build on a strong legacy with greater strategic clarity and sharper focus. The first priority was to define and articulate our core identity, to be known as investors in high-quality businesses with sustained earnings growth. That’s the space we understand well, where we believe long-term wealth can be created.

We improved our internal processes to ensure this growth-oriented philosophy is consistently reflected across all our portfolios. Our goal was to build a platform where each fund aligns with the same core principles, while allowing fund managers the flexibility to express high-conviction ideas.

We also took steps to enhance portfolio diversification, ensuring our allocations reflected both discipline and opportunity. Our portfolios remain conviction-led, but with a structure that enables them to participate more broadly in emerging growth themes.

A critical shift was reinforcing a collaborative, idea-sharing culture across the investment team. We encouraged cross-functional dialogue, knowing that meaningful insights often emerge when perspectives are challenged and refined in a constructive environment.

Also read | Flexicap, largecap, value funds cut cash in May; midcap, smallcap schemes stay cautious

We reaffirmed our commitment to growth investing, which is backed by research, driven by fundamentals and focused on long-term compounding. Our intent is clear: when investors think of growth-oriented equity investing, we aim for Motilal Oswal AMC to be a relevant partner for long-term investors seeking growth-oriented equity solutions.

Like any journey in equity markets, the path ahead may have its ups and downs. But if people understand what we are doing, I believe that over the long term, those who joins the journey will be happy to be with us through thick and thin.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.