Leena Surve, now 43, is a single mother. The Mumbai resident separated from her partner when her son Shlok, now 18, was just eight months young. A seasoned professional with two decades of working experience as an executive assistant in a private firm, Leena has goals — and the financial plans to achieve them — in place.

“With the support of my family, I have come a long way and done a pretty decent job of raising a fine man,” says Surve. The start of her financial journey, however, was beset with challenges — she had to start investing for various goals from scratch post her separation. And she had just Rs 500 for monthly investments.

Today, Surve invests 25 percent of her earnings to fulfil various goals, including building a retirement corpus. Her instruments of choice for the retirement fund are the public provident fund (PPF), National Pension System (NPS) and diversified mutual fund schemes. Having taken the D-I-Y route, she takes these investment calls on the basis of her own research.

Invariably, in most cases, children’s education expenses tend to take precedence over others. Take Bengaluru-resident Priya Shah’s (name changed) case. After her husband passed away due to an ailment when her daughter was two, Shah, now 42, had to raise the child on her own.

Not surprisingly, her priority was her daughter’s education and she directed the majority of her savings towards building a corpus to fund it. “Most of my savings were allocated towards the education expenses of my daughter. I started saving for retirement just six years ago,” she told this writer. Shah is now investing 20 percent of her earnings on her retirement fund.

Like Surve and Shah, several single parents in the country have to take care of multiple financial and other responsibilities on their own. Often, retirement as a financial goal is ignored till one is closer to the age of superannuation, which is a mistake that comes back to haunt people, say financial planners.

Also Read: Financial lessons to learn from your mother

Instead, it is best to have a comprehensive financial plan in place, one that is aimed at achieving all your goals, without having to compromise, they add.

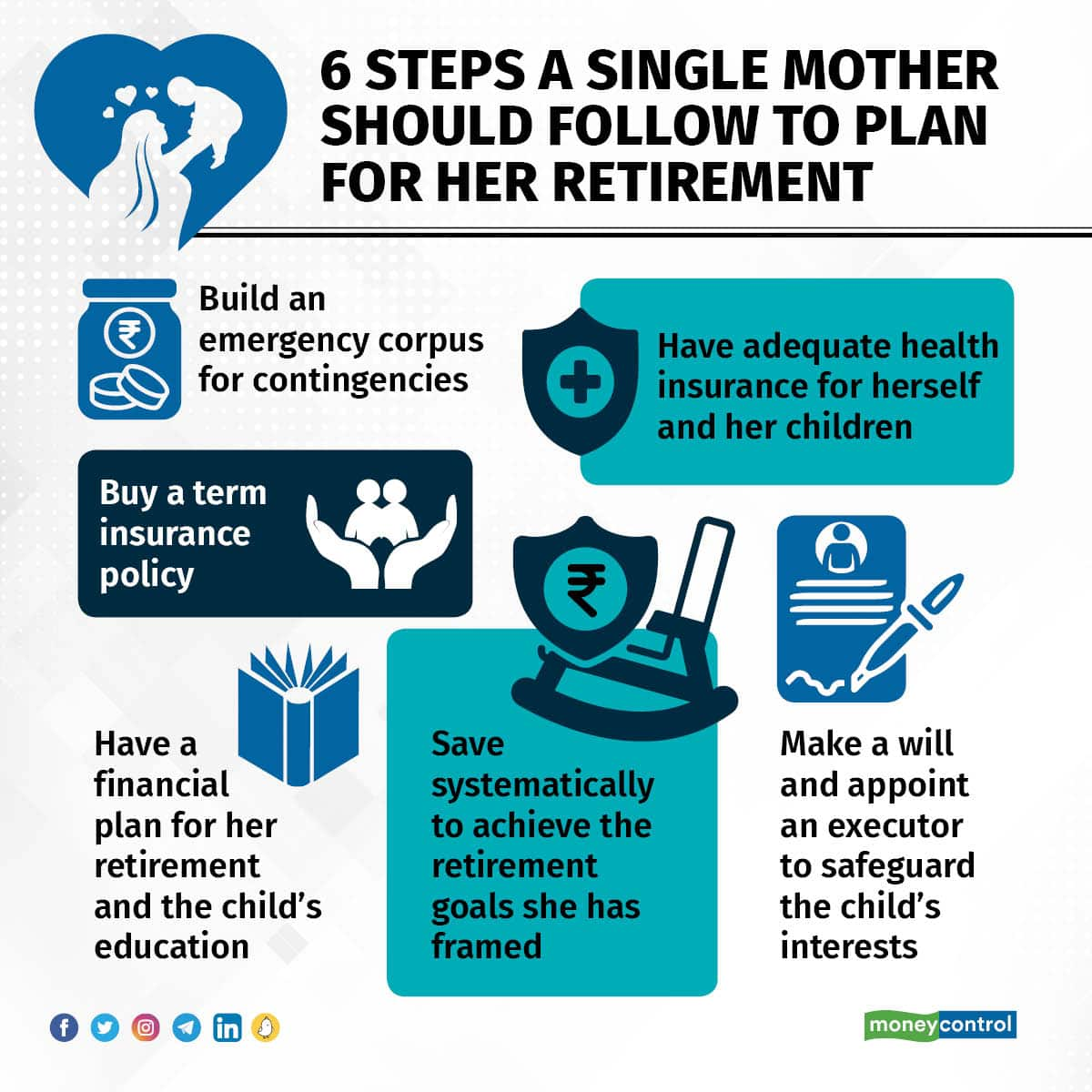

On occasion of Mother's Day, let’s look at the steps single mothers should take to plan for their key goals, including retirement.

Also read: Money lessons woman finance leaders and their moms learnt from each other

Build a solid foundation

Instead of looking for a quick fix in the form of the best pension plan or the best retirement scheme, put in place an emergency fund, which should be equal to at least six months of your expenses. This should be adequate to tide over your daily expenses, loan EMIs and insurance premiums in case of loss of a job. Also purchase the right insurance covers.

Also Read: Mastering your finances: Financial lessons for Gen Z and Millennial Moms

A few single mothers this reporter spoke to did not have pure protection term insurance policies. Others were unable to afford one due to health complications. “Life insurance companies are quoting much higher premiums as I have been diagnosed with diabetes. The premiums are beyond my budget,” says Seema Deodhar (name changed), 40, the single mother of a seven-year-old boy. It is best to buy one as soon as possible as premiums increase with age and ailments.

“Single mothers should have a term insurance plan. It is critical to provide financial support to the family in case of any uncertainty, even death,” says Aniruddha Sen, Co-founder, Kenko Health. Buy one even if you have to pay higher premiums due to your ailments, after making necessary changes to your budget.

Purchasing adequate health insurance is also important, they must also look out for health financing that provides coverage not only in case of hospitalisation but also for out patient department (OPD) expenses, he adds. Other additional covers, if need be, can also be added.

Estimate the retirement corpus required

Once you have adequate insurance and emergency funds in place, start preparing for your other goals, including retirement.

Figure out how much money you will need when you retire, after factoring in inflation. “You can calculate the required retirement corpus by estimating future retirement expenses, determining the retirement age, estimating future income, determining the inflation rate, and consulting with a financial advisor,” says Amit Gupta, MD, SAG Infotech. By doing so, single moms can develop a realistic plan to save for their retirement needs.

You can use this retirement calculator.

Sometimes a spike in inflation may slow down progress towards your financial goals. But you can course-correct by changing your investment mix.

Leena Surve, 43, with her son, Shlok, 18. For her retirement, the single mom has been investing in PPF, NPS and diversified mutual fund schemes.

Leena Surve, 43, with her son, Shlok, 18. For her retirement, the single mom has been investing in PPF, NPS and diversified mutual fund schemes.

Follow a systematic investment strategy to build a retirement corpus

The earlier you start investing, the better it is, as this ensures the money has more time to compound.

“A single mother may need a smaller corpus as you are making retirement plans only for one person. But you have to remember that you are also doing it on a single income. This means you may have to reassess not just the size of your corpus but also how much you can invest, where you invest, and when you plan to retire,” says Adhil Shetty, CEO, Bankbazaar.com.

When it comes to retirement, Surve, the single mother of an 18-year-old, invests Rs 10,000 per month in NPS. She also prefers investing a lumpsum amount from her annual incentives in this scheme. This is besides regular investments in PPF and diversified mutual fund schemes. “I think in the next 15 years, I may have managed to collect a fairly decent amount by investing in these schemes for my retirement,” says Surve.

Never allow your risk-aversion to exclude or scale down equity investments in favour of ‘secure’ fixed income options, advise experts. Equity is an asset class that is ideal for long-term wealth creation, if you can stomach volatility in the short-term, they explain.

Also read: MC 30 top performing mutual fund schemes

Invest across equity, debt and gold systematically through mutual fund schemes with a good track record. “Diversification is key to reducing risk and maximising returns. You must consider investing in a mix of stocks, mutual funds, and fixed-income securities,” says Gupta.

Yet, if you do not wish to look beyond fixed income instruments, identify the most remunerative ones among the options at hand.

“If you are employed, consider voluntarily opting for a higher contribution to the EPF (VPF). This would mean a higher contribution from your salary towards your retirement fund, which can help build a substantial corpus over time,” says Gupta.

Also read: Caught between kids and parents, Gen S mums have six financial lessons to learn

Retirement funding should be done with well-regulated and time-tested products, say the experts. "Avoid getting into high-risk avenues such as cryptocurrency, small-cap stocks, or even speculative adventures such as options trading," says Vivek Bajaj, Co-founder StockEdge & Elearnmarkets. Once you decide on your asset allocation, ensure that you keep rebalancing it from time to time. As you move closer to the financial goal, keep increasing your allocation to relatively less risky assets such as debt.

Also, do not sacrifice your retirement goals for other goals. Do not withdraw money from your retirement corpus for your child’s education. “A single mother should maintain the financial discipline of consistently contributing to the retirement corpus and avoiding unplanned expenses on the child,” says Shailendra Dubey, Partner, PlanMyEstate Advisors LLP. Instead of dipping into her retirement corpus, she should take an education loan for the child and let the child pay back the loan once he or she starts earning, he adds.

A single mother’s life insurance and financial assets should be adequate enough to take care of the child’s education and other needs in case of early death. It is also important that they write a Will for smooth transfer of assets and appoint an executor.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.