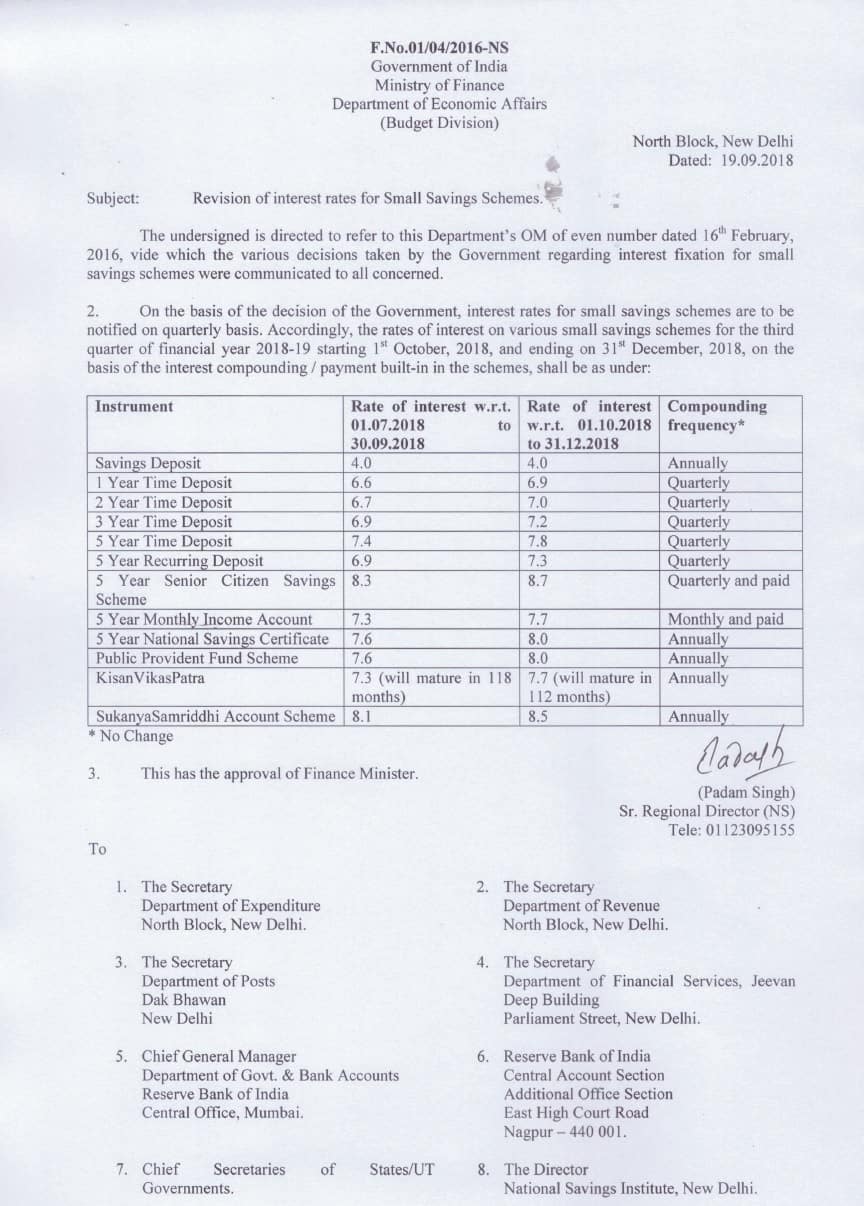

The government has decided to raise interest rates of small savings schemes such as National Savings Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), among others by 30-40 basis points for the October December quarter of the current financial year.

Interest rates for such schemes are revised on a quarterly basis and have been benchmarked to market interest rates since April 2016. Therefore, interest rates have been raised, in sync with hardening as g-sec or government securities yields.

The last revision in interest rates were made in January-March quarter of 2017-18, after which the finance ministry kept them unchanged for two quarters.

In quarter ended-March, the government had reduced interest rates on such schemes by 20 basis points.

The interest rate on PPF, Senior Citizen Savings Scheme, KVP, Sukanya Samriddhi Account Scheme and five-year NCS have been increased by 40 basis points, while that of one-year, two-year, three-year time deposit has been increased by 30 basis points.

Collection from small savings collections is crucial as it is one of the means for the government to finance its fiscal deficit. The government’s fiscal deficit has touched Rs 5.40 lakh crore for April-July or 86.5 percent of the budgeted target of the current financial year 2018-19.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.