It’s 5 pm on a cool spring evening and the ladies of the house are busy tidying it up before the guests — friends, relatives, and acquaintances — arrive.

Soon, elegantly dressed women start trooping in and take their seats in the living room. On cue, steaming cups of tea, coffee, and snacks make their appearance, along with board games.

The stage is set for an evening of banter and fun that ensues when a group of women meet; except that in this case, it's more than just fun and games. This gathering means business as well, since it's also about money.

Such kitty parties-cum-savings schemes are popular among women for their social as well as monetary benefits.

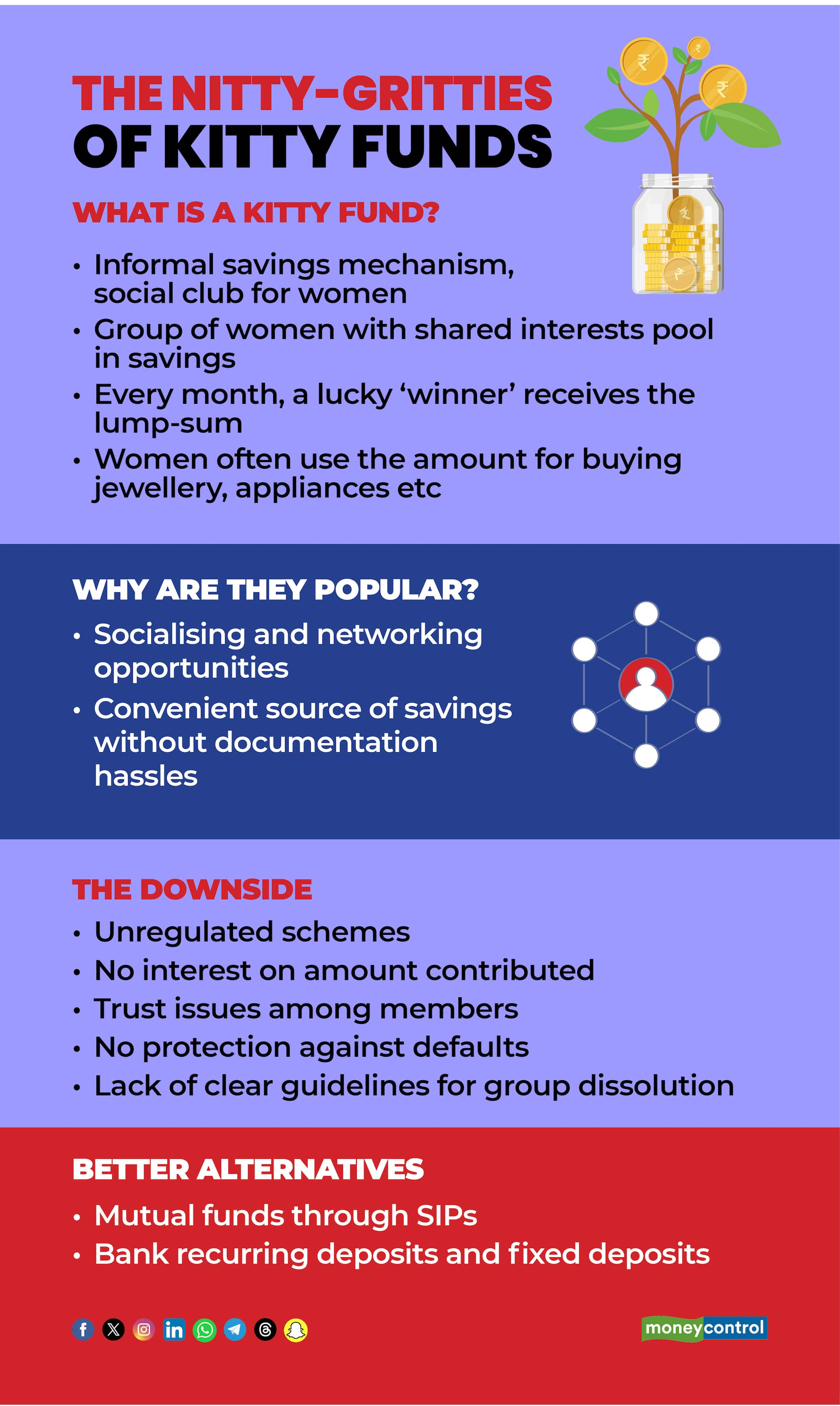

Here, women with shared interests collectively pool a fixed amount each month and vote (using chits) for who will host the next party. The money is then given to her at the next gathering. This continues till all members receive their share of the monies.

Such parties aren't just an indulgence of affluent ladies. Cutting across socioeconomic strata, many women — homemakers, white-collar employees, and even those employed as domestic help — see value in these groups.

Often driven by homemakers, these groups require one to contribute a fixed sum every month, and levy nominal penalties on members who default on contributions or attendance.

Kitty schemes

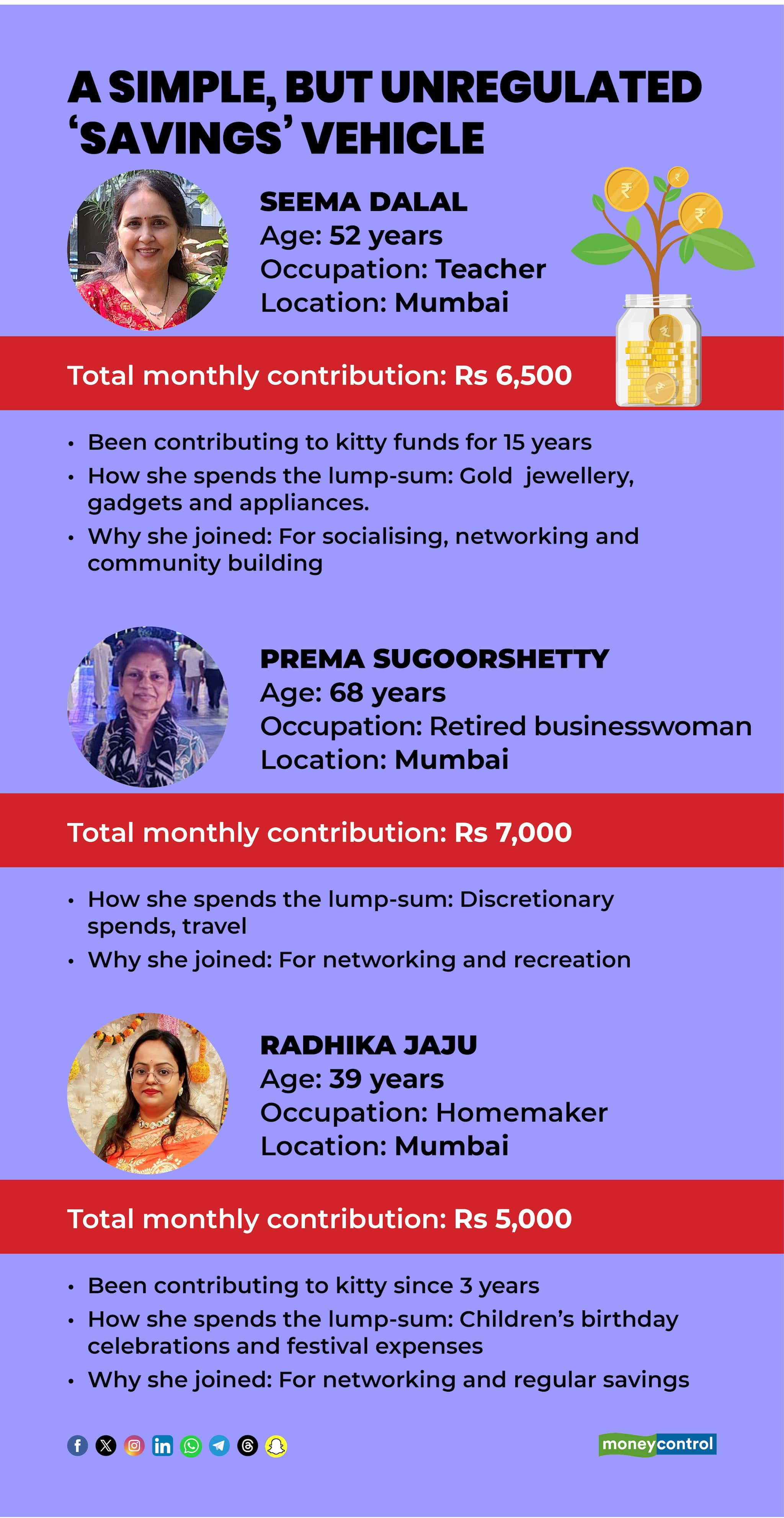

Seema Dalal, a 52-year-old teacher from Mumbai, has been active in kitty groups for 15 years. She’s a part of two such groups at present, contributing Rs 4,000 and Rs 2,500 per month. “These clubs give me an opportunity to network and socialise with women in my housing society,” says Dalal.

Mumbai-resident Prema Sugoorshetty, 68, was part of four kitty clubs until a couple of years ago, and continues to be part of two. “The primary motivator is not money, though it does play a role in ensuring that participants turn up for monthly gatherings. We get to exchange ideas and be aware of the latest trends when we meet. It helps generate excitement for several days of the month,” she explains.

Sugoorshetty contributes Rs 7,000 every month in total to the two clubs. Another active participant, Radhika Jaju, a 39-year-old homemaker, has gradually increased her savings, and thus monthly contributions, from Rs 2,000 to Rs 5,000 in the last three years.

Those from economically weaker sections of society also find succour in such groups. Take, for instance, Kusum Shirke (name changed on request), a 35-year-old domestic help in Mumbai, who wants to save solely for her personal needs without her husband’s knowledge.

“I prefer handing over my money, painstakingly saved every month, to other women who are in the same boat. I maintain savings and fixed deposit (FD) accounts too, but my family members have access to the documents related to these. My group is made up of women I know. They will not divulge my contribution details to my family,” she says.

A section of women in the lower strata of society feel especially compelled to turn over their precious savings to their husbands or other male members of the family, who then often spend it as they wish.

Despite being viewed as a casual social activity, kitty parties serve as an informal financial support system for women, according to Dr Vikas Madhukar, Pro Vice-Chancellor at Amity University, Gurugram.

The comfort of community

Jaju and Dalal admit that contributing to the kitty doesn't earn them any interest income, yet they value its benefits. Jaju notes that the lump sum payout provides a convenient, tax-free source of funds for unexpected expenses.

Meanwhile, Sugoorshetty believes that while putting away money in an FD earns interest, it cannot foster this sense of belonging. “It cannot help us develop networks beyond our close relatives,” she says. Women also use these networks to promote small businesses — for instance, in food items or cosmetics — that they may have started.

“Banks and mutual funds (MFs) should encourage women participating in kitty parties to invest in FDs and MFs by offering customised investment products, and create financial awareness through workshops,” says Gurleen Kaur Tikku, Founder, Hareepatti, a financial advisory. Financial institutions can also lend a helping hand by providing financial literacy resources to women in multiple languages, which they can read and understand.

Also read | Indian women now prioritise retirement and travel, planning for kids’ weddings takes a back seat

But, beware

Since these are informal schemes, they are not regulated by the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI). It is a grey area that women must navigate carefully.

There have been instances where kitty groups were disbanded before all members received their share, leading to financial losses for some, said Nisary Mahesh, Founder and CEO, HerMoneyTalks.

There's always a risk that one or more members in a group may default. A key concern is the lack of clear guidelines for scenarios like group dissolution before all members have received their monies, and questions about refund rights.

To minimise risk, Tikku advises women to join closely-knit groups, establish transparent rules and guidelines for contributions and defaults, maintain accurate records, and keep group sizes small to limit exposure. For instance, Sugoorshetty says she has never come across any defaults in any of her kitty groups. "This is because I have always been part of groups that only admit friends, relatives, neighbours, or reliable acquaintances. I have never been anxious about the security of my contributions," she says.

However, kitty parties can also have their own financial pressures. “The need to present oneself well can result in overspending on clothing, accessories, and makeup, straining ones budget and hindering long-term financial objectives,” says Tikku. Another risk is taking on debt to contribute to the kitty, which can create a vicious cycle that's hard to escape, she adds.

Invest wisely

According to Mahesh, the social aspect of kitty parties often leads participants to view the lump sum payouts as "treat money" that's meant to be spent, and not as something that's for investment in formal financial products.

For instance, Dalal uses these funds for discretionary spending, such as buying gold jewellery or purchasing household gadgets. Jaju utilises the same for her children’s birthday celebrations and to cover festival expenses.

Mahesh suggests that instead of splurging, one can invest the money in mutual funds to earn higher returns, which can then be used to fund various goals, such as a dream vacation in the short-term, or medium-to long-term objectives like children's education.

Also read | Ladies Special: Smart investment strategies for every stage of life

Lack of returns

Since people typically contribute cash to the kitty, the funds lie idle, unlike a bank account or other investment.

Consider a kitty club with 12 women contributing Rs 3,000 each, resulting in a payout of Rs 36,000 per member over a 12-month period. This does not earn any interest, which means that members miss out on potential returns.

“Investing this amount in a mutual fund through the SIP (systematic investment plan) route could generate healthy returns over time, making it a more strategic financial move. Recognising opportunity costs and investment potential is crucial for making informed financial choices,” explains Mahesh.

If you must contribute to kitty clubs due to social obligations, ensure that the amount is minuscule part of your savings, and maintain a clear distinction between informal and formal savings, say financial experts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.