The countdown to the due date for filing income tax returns for the financial year 2022-23 (assessment year 2023-24) has begun.

You will have to file your returns by July 31 or be prepared to cough up a late-filing fee of Rs 5,000 and complete the process by December 31.

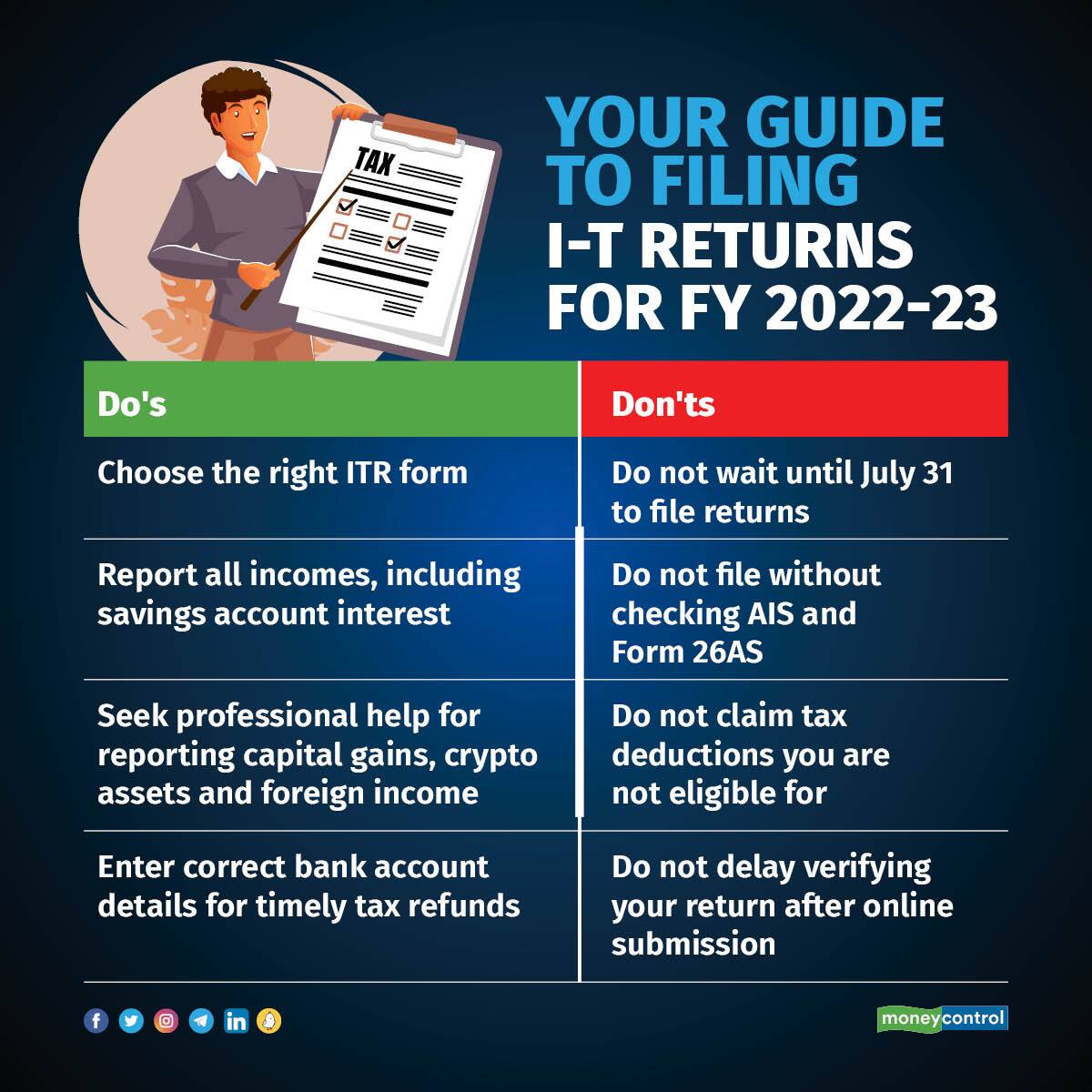

Now, that’s the first ‘don’t’ in the list of do’s and don’ts for filing income tax returns.

Also read: ITR filing mistakes: Common errors to avoid while filing income tax return for FY 2022-23

Do not claim fake deductions to secure tax refund

The salaried class has been at the receiving end of the income tax department’s surveillance this year. Many have received notices asking for documentary proof for deductions claimed.

As Moneycontrol has pointed out earlier, some salaried tax-payers claim deductions – not part of the Forms-16 issued by their employers – while filing tax returns.

For instance, claiming the exemption for house rent allowance which is a part of pay packages even when they have not paid rent and are not eligible for the exemption under section 10.

Since no documentary evidence is to be attached while submitting I-T returns, some misuse this relaxation to secure tax refunds. However, this could result in I-T notices, as some salaried individuals realised recently. It’s best to be honest while filing your returns, instead of inviting trouble later.

Also read: Using AI and tech, Income-Tax department sends notices to tax evaders for fake donations

Multiple income sources? D-I-Y approach has its limitations

Hyderabad-based chartered accountant Nagachandra Reddy, Founder, Somu & Associates says he has come across such cases while filing returns this year. “Many tax-payers simply go by videos and reels on social media platforms explaining how tax returns should be filed. Some end up making mistakes that, in fact, result in additional tax outgo,” he says, citing the example of a tax-payer who treated the gains made on sale of stocks after holding them for less than one year as business income.

“It should have been treated as short-term capital gains that attract tax of 15 percent. Business income is taxed at slab rate and in this case, he was in the 30 percent tax slab,” says Reddy.

If you have dabbled in shares and cryptocurrencies, sold mutual fund units, own foreign assets or unlisted shares, you need to tread carefully with your returns. Non-disclosure can lead to tax notices and penalties. If you find the process to be complex, seek the help of tax professionals to see you through.

Also read: ITR filing: Claiming tax deductions without proofs can backfire, warn CAs

Ensure accurate reporting of interest income, capital gains

For salaried employees, Form-16 is the key document while filing returns. However, certain incomes do not reflect in Form-16. For instance, even assuming that they do not draw income from other sources, their savings account balance would earn interest, which is subject to tax (though savings account interest up to Rs 10,000 is allowed as deduction under section 80TTA). Likewise, capital gains that you may have made on sale of shares or mutual fund units won’t show up in your Form-16.

As a result, some may miss reporting such income, exposing themselves to the likelihood of an I-T notice. However, you cannot afford to make such mistakes now that you can easily refer to Annual Information Statement (AIS), which contains details of all such sources of income. Ensure that you go through AIS as also your bank statements and capital gain statements issued by mutual fund intermediaries, broking houses and declare these incomes to avoid tax notices later.

“With the introduction of Annual Information Statement (AIS), there is no question of missing reporting any income. We have seen individuals who would have probably skipped mentioning these income details, approaching us to file their returns after checking their AIS,” says Chetan Chandak, Director, TaxBirbal, a tax consultancy portal.

Choose the right ITR form

Your sources of income will also determine the ITR form you ought to use. So, a salaried individual with income from capital gains will have to use form ITR-2 to file the returns, besides sharing details in the capital gains (CG) schedule. Similar would be the case with a salaried tax-payer with income of over Rs 50 lakh, including rental income, unlisted shares, foreign income and assets and crypto transactions.

The simpler form ITR-1 is for salaried tax-payers who own one house property, and earn interest income and agricultural income of less than Rs 5,000. Their total income should be less than Rs 50 lakh. Filing returns through a wrong ITR form will render the ITR form ‘defective.’ You could receive tax notices to file revised returns and failure to respond in time will result in your returns being treated as invalid.

Do not ignore the I-T return verification process

If you think your ITR filing task is done for the year once you submit returns, you would be mistaken. There is one more step that you need to take to complete the process. For your return to be taken up for processing by the income tax department, you have to verify it within 30 days of filing. You can do this online through the I-T e-filing portal using your Aadhaar, pre-validated bank account, demat account and so on.

You can also download the ITR-V, or acknowledgement form, from the e-filing website and send it by post to the income tax department’s central processing centre in Bengaluru. However, it is best to choose e-verification through online modes as the process can be completed within minutes.

It is important to stick to the deadline - if you verify your return 30 days after filing it online, the date of verification will be treated as the date of filing returns. So if you verify the return after 30 days and the July 31 due date has passed by, it will be seen as return-filing post the due date, and you might have to fork out late-filing fees of Rs 5,000 (Rs 1,000 if income is less than Rs 5 lakh).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.