Despite concerns of overvaluation in the mid-cap space, mutual fund managers are generally bullish on this segment. As per ACE MF research application, mid-cap stocks account for Rs 8.7 trillion or 20 percent of the equity Assets Under Management (AUM) of the mutual fund industry, which is Rs 42.6 trillion. The total AUM of the overall MF industry stood at Rs 67 trillion as on August 31, 2024.

Mid-cap companies are often in the growth phase of their business cycle and tend to have higher growth potential compared to large-cap companies. Mid-cap stocks tend to be part of not only the portfolios of equity-oriented mutual fund schemes but also those of conservative schemes such as hybrid and retirement-focused ones.

Using five charts, we explain the trends in the mid-cap segment and how mutual fund managers allocated and benefited from those potential multibaggers.

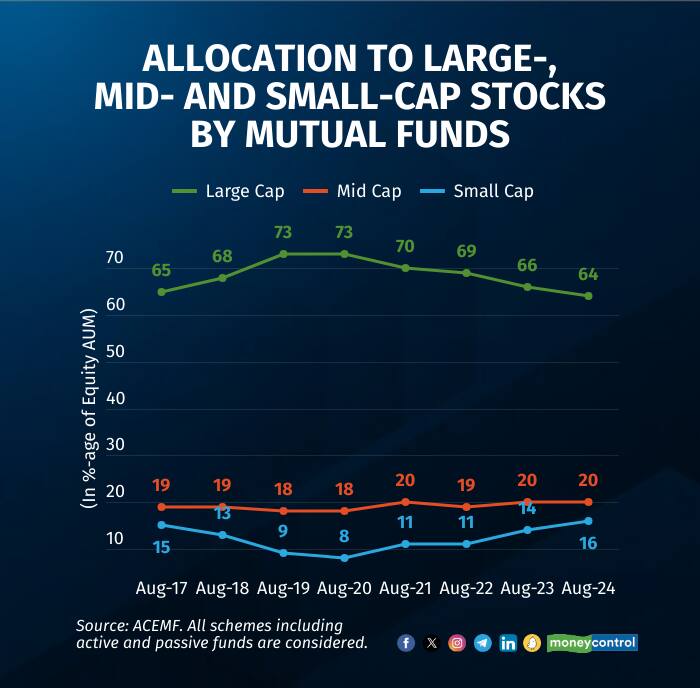

Allocation to mid-caps rises, gradually

Data compiled from 2018 (Since the AMFI classification on M-CAP came into force) shows that the share of mid-caps in the overall equity AUM of mutual funds hovered between 19 percent and 20 percent. Meanwhile, the share of small-caps in fund portfolios doubled, to 16 percent from 8 percent (see chart). On the other hand, the presence of large-caps declined to 64 percent from 73 percent.

Large-cap stocks are the top 100 companies in terms of market capitalisation while 101st to 250th-ranked stocks are mid-caps and from 251st-ranked stock onwards constitute small-caps.

Also see: This mid-cap index shines as active funds struggle to outperform

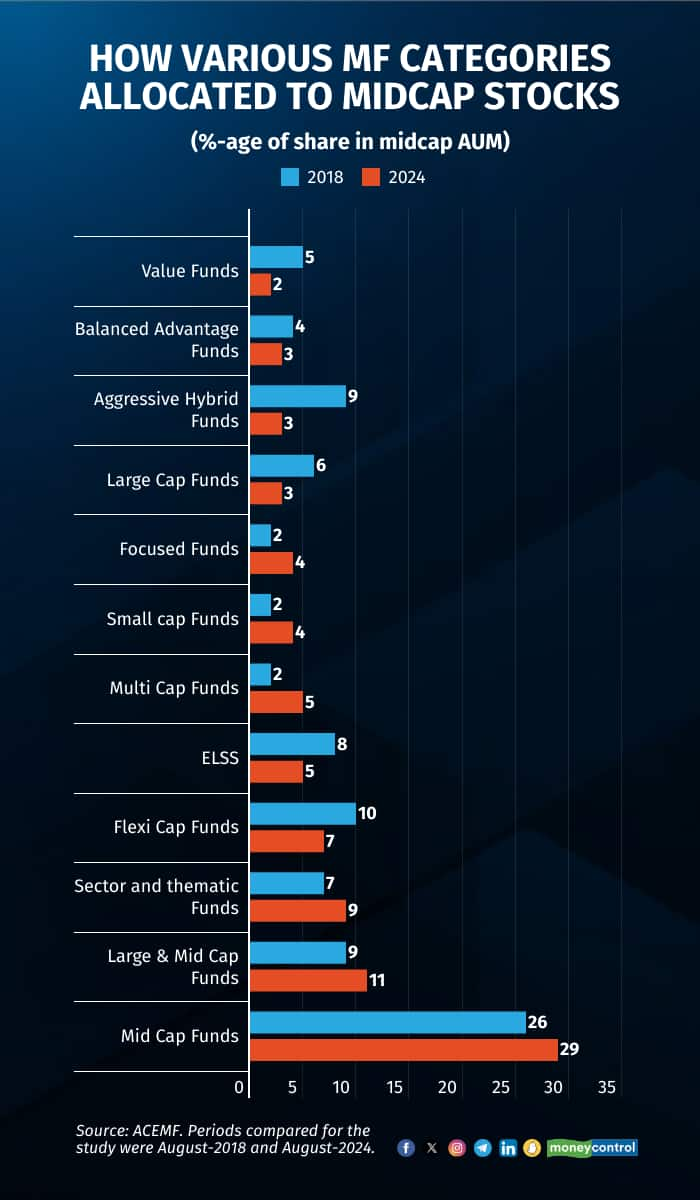

How funds in other equity categories allocated to mid-caps

It’s not just those mutual funds with the stated intention of buying mid-cap stocks that invest in them. Other fund types do, too. These funds, typically, are large-and-mid-cap funds, flexi-cap funds, ELSS or equity-linked savings schemes, multi-cap funds and thematic funds.

Over the last few years, share of mid-cap allocation declined in categories such as Flexi Cap Funds, ELSS and Large-cap funds.

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

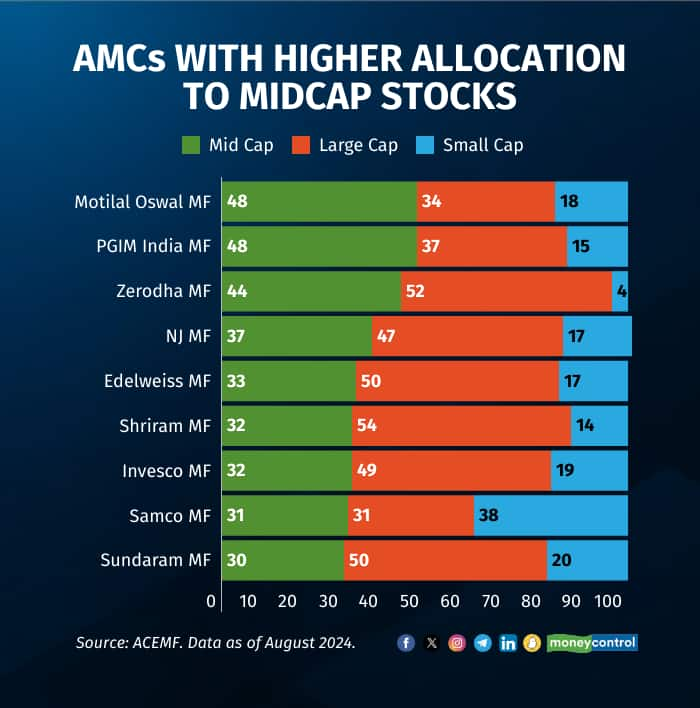

Top AMCs with higher allocation to midcap stocks

Many fund houses prefer to bet on mid-cap stocks. They have an in-house research team that specialises on mid-cap and small-cap segments. AMCs or asset management companies that held relatively higher allocation to the mid-cap segment include Motilal Oswal MF, PGIM India MF, Zerodha MF, NJ MF and Edelweiss MF. Both active and passive funds were included while compiling the data.

To be sure, older and larger fund houses have multiple schemes with a meatier allocation towards large-cap stocks. Therefore, even though their mid-cap schemes are among the largest, the overall share of mid-caps would still dwarf—purely in percentage terms of the allocation of their overall equity allocation—the mid-cap holdings of newer fund houses that have few (Zerodha AMC) or no large-cap schemes (NJ AMC) as yet.

Multibagger mid-cap stocks that paid off big

Many mid-cap stocks held by mutual funds rewarded unit holders handsomely.

Some of the mid-cap stocks that multiplied investors wealth include Rail Vikas Nigam, Mazagon Dock Shipbuilders, Apar Industries and Suzlon Energy.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

See here: 3 quality mid-cap stocks that more than 200 MF schemes are keen to hold. Do you own any?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.