Quality mid-cap stocks with long-term prospects are finding favour among the fund managers. Many such stocks are included not only in the portfolio of equity-orientated mutual fund schemes, but also part of the portfolio of conservative schemes such as hybrid and retirement-focused schemes.

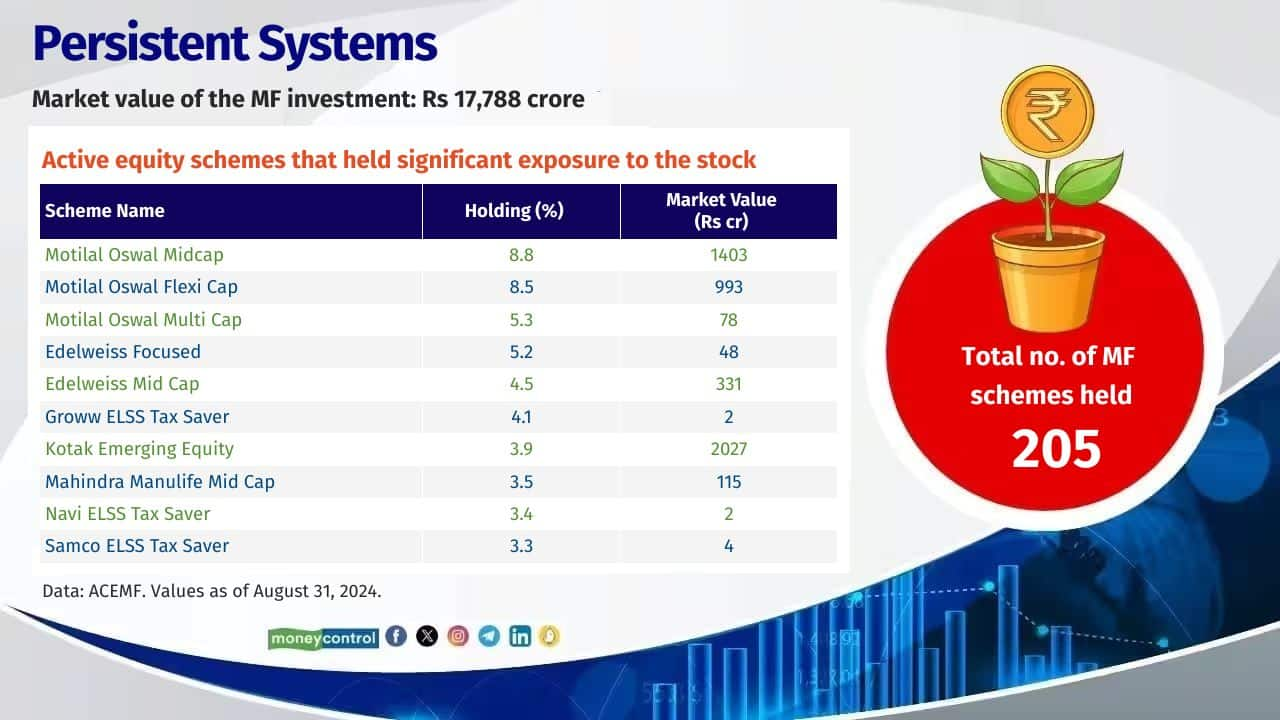

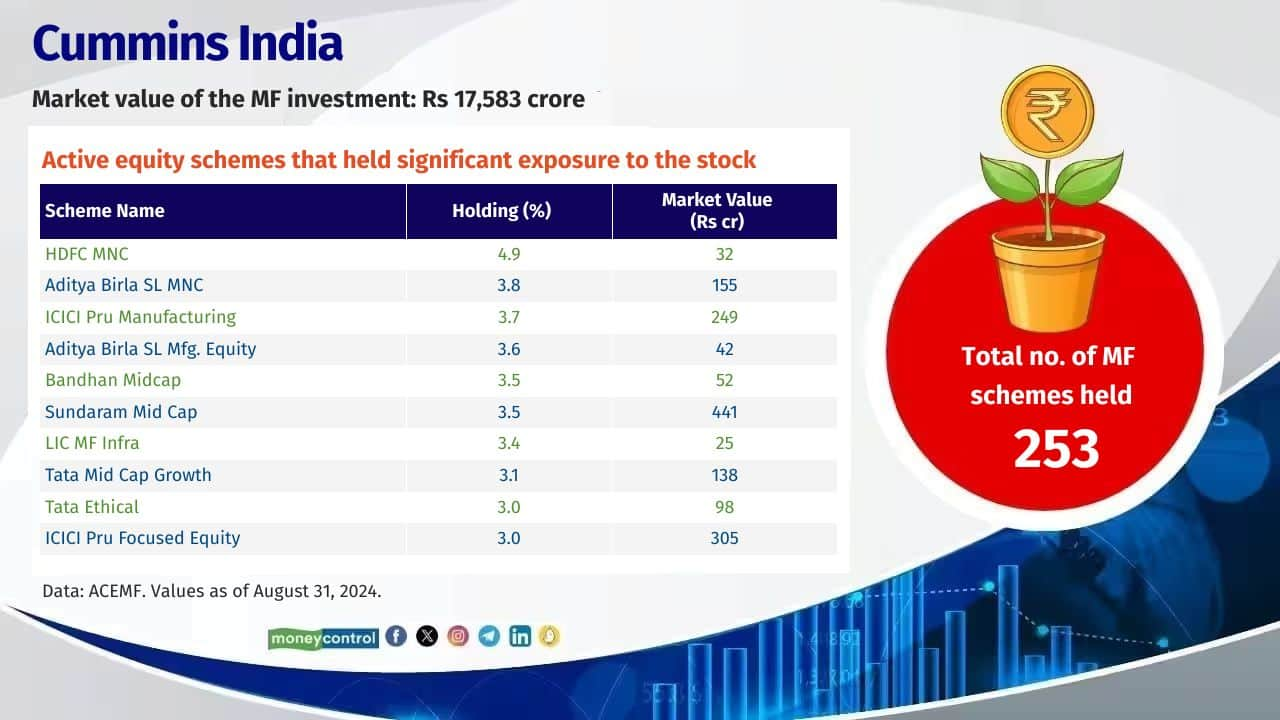

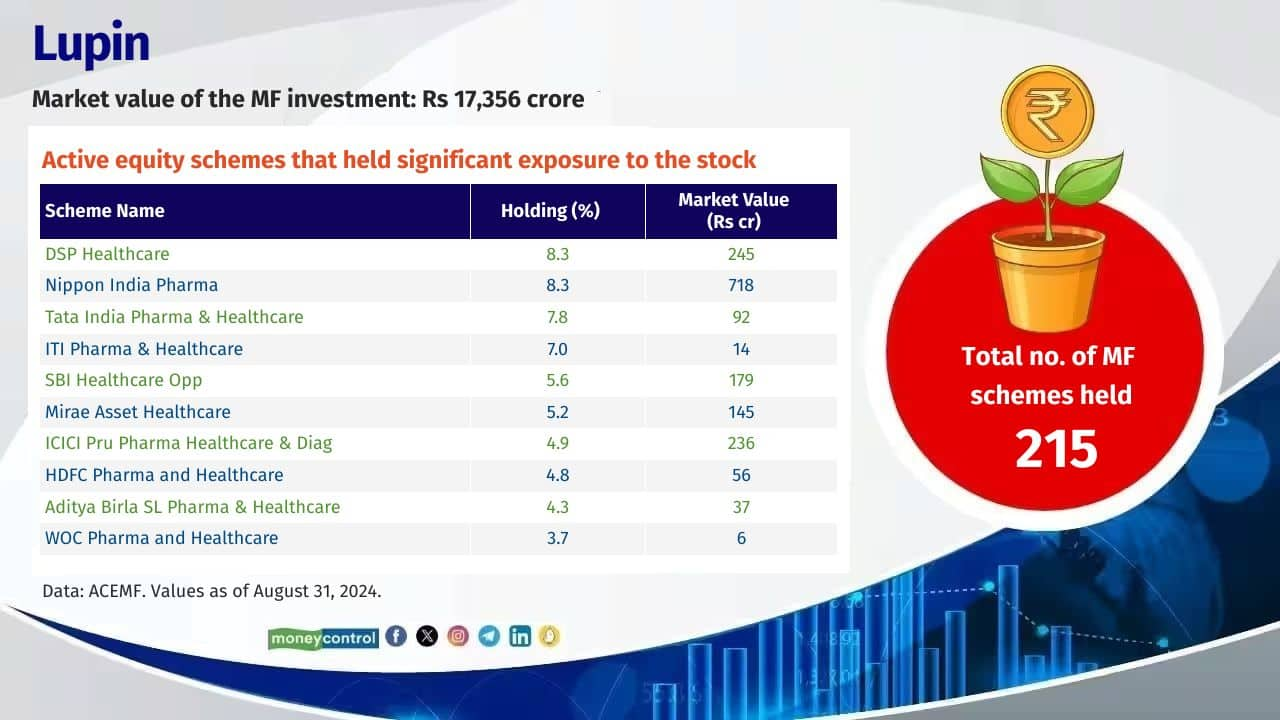

Persistent Systems, Cummins India and Lupin were the top three mid-cap stocks figured prominently among mutual fund portfolios in terms of the market value of the holdings. As per the ACEMF data, as of August, they were held by 205, 253 and 215 mutual fund schemes, respectively. All the equity-related mutual fund schemes, including active and passive funds, are considered for the study.

Also see: This mid-cap index shines as active funds struggle to outperform

Persistent Systems, a software company, topped the list. As of August, the market value of the mutual fund investment in the stock was Rs 17,788 crore. Actively managed equity schemes such as Motilal Oswal Midcap, Motilal Oswal Flexi Cap and Edelweiss Focused held allocated more than five per cent of their assets into the stock. Of the 205 schemes that held the stock, 131 were actively managed. The stock delivered 88 per cent over the last one year.

Cummins India, the diesel engine manufacturer, has been a preferred stock, figuring among top 10 holdings of many actively managed mid-cap schemes. The stock was held by nine mid-cap schemes in their top 10 holdings. The market value of the mutual fund investment as of August was Rs Rs 17,583 crore.

See here: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

Active equity schemes that held significant exposure to the stock include HDFC MNC, ICICI Pru Manufacturing and Bandhan Midcap Fund. The stock has delivered 124 per cent over the last one year.

Lupin, the pharmaceutical player was once ranked as large-cap stock by the industry body association of mutual funds in India (AMFI). Mutual funds had investment worth Rs 17,356 crore in this stock as of August. It was one of the few mid-cap stocks that has been added to their portfolio by active mutual fund schemes over the last six months. There were 26 schemes added this stock afresh over the last six months.

Also see: These small-cap stocks that MFs love generate significant revenue from exports

Active schemes that held significant exposure to the stocks include SBI Innovative Opportunities, Axis Quant and Tata Mid Cap Growth Fund. The stock has delivered returns of 87 per cent over the last one year.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.