The results of the polls were unexpected and indicate a weaker comeback for the BJP government, which will have to rely heavily on other parties as it falls short of a clear majority. It is also possible that the opposition may muster up a broader coalition and try to form a government. The permutations and combinations of the political parties will be known in the next few days. But how will the election results impact the economic climate in the country? We look at how government policies and elections have impacted economic growth and investments in India over the years through a series of graphs.

Since achieving Independence in 1947, India has neither enjoyed stupendous success nor failures like the countries in East Asia and Latin America. Through different environments, discussions and debates among the constituents, India has managed to grow at a steady pace clocking approximately 6 percent growth (Graph 1) in GDP (Gross Domestic Product) and is well poised to deliver that growth over the next few decades.

Elections have not mattered

Source: World Bank, RBI and www.parliamentofindia.nic.in as of December 2023.

Different governments have pursued economic policies differently and have focused on a specific issue or theme (See Table 2). While all of this has resulted in GDP growth, any continuity in the government or its policies bring some more comfort and predictability to all stakeholders of the country.

Table 2: Reforms under different regimes have helped the economy.

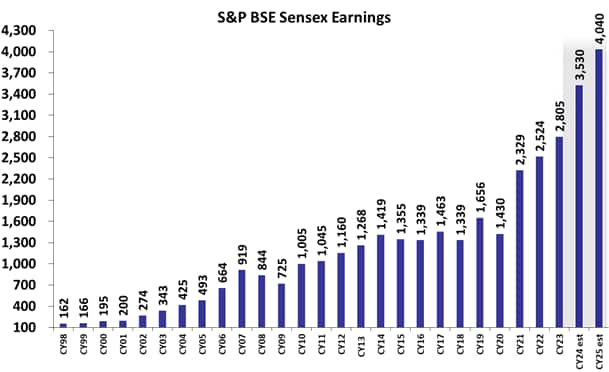

The policies and the resultant economic growth have led to earnings growth and the eventual performance of the stock markets. In the long run, the correlation may be strong between the stock prices and earnings. Hence, once the noise around elections settles down, the focus of investors will come back to evaluating the economy and the performance of companies (See Graphs 3 and 4).

Graph 3: Do not be distracted by global macro: Economic activity has led to a 20 times growth in earnings

Source: Bloomberg

Since 1998, if you one was to track the earnings and the Sensex movement, they track each other very closely emphasising the fact that earnings matter more and not necessarily the election outcomes (see Graph 4).

Graph 4: Sensex tracks earnings

Source: Bloomberg

Source: Bloomberg

In the near term, election outcomes may make the stock prices volatile but eventually, they will focus on the long-term trajectory. See Table 5 for the short- and long-term performance of previous elections.

Table 5: Reasonable long-term returns irrespective of election outcome

Source: Bloomberg; Sensex Total Return is considered

Data shows that after 2004, despite market scepticism, long-term returns have turned out well. While the election season may be over, the exciting journey for your investments is ongoing. You can navigate the market landscape with confidence.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!