The automobile sector’s engine has started revving up again, with retail demand contributing to an uptick in sales in August 2020. Half of India’s 14 car and SUV manufacturers who dominate the market, with a 90 per cent share, recorded a 20 per cent growth over August 2019.

This buoyancy coincides with the benign interest rate scenario in the country after the Reserve Bank of India’s cumulative 115 basis points (one basis point is equal to 0.01 percentage point) rate cuts.

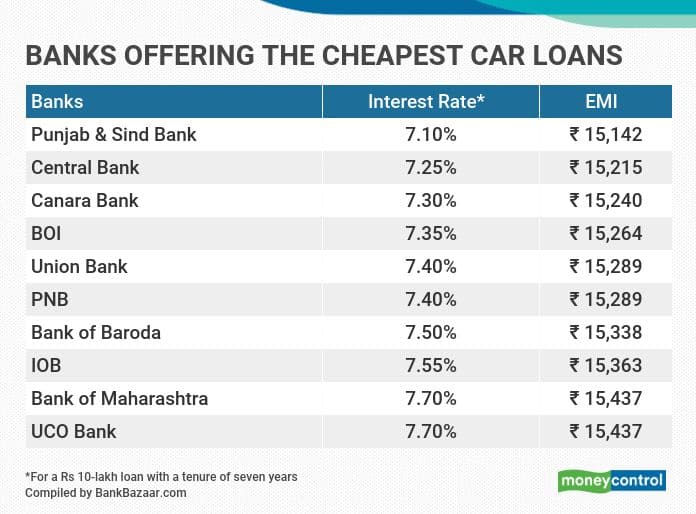

Public sector banks offer lower rates

So, if you are planning to join the bandwagon, several banks are willing to offer rates between 7.10-7.7 per cent for a Rs 10-lakh loan with a seven-year tenure, BankBazaar data shows. Like most retail loan categories currently, it’s the public sector banks that have taken the lead in offering the lowest rates.

All ten banks on the list of lenders charging lowest interest rates on car loans happen to be PSBs (public sector banks). Punjab and Sind Bank tops this list with interest rate of 7.1 per cent. Bank of Maharashtra and UCO Bank bring up the rear of this top ten list with interest rate of 7.7 per cent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.