The Moneycontrol-SecureNow Health Insurance Ratings process places health plans in the 'A' list only if they achieve an overall score exceeding 65 percent.

An A-grader

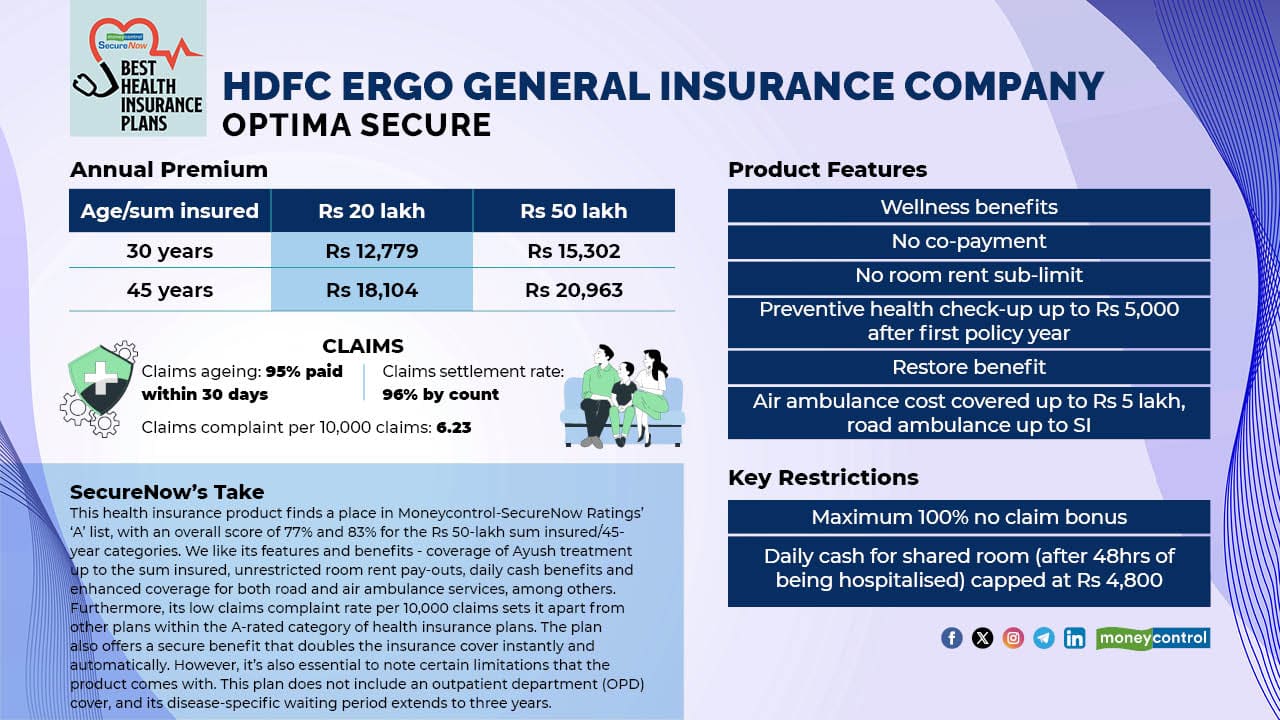

This week, we're reviewing HDFC ERGO General Insurance's Optima Secure plan given its overall score of 77 percent — 83 percent if you consider an age of 45 years and sum insured of Rs 50 lakh. An overall score of more than 65 percent indicates that the plan not only meets, but exceeds our stringent criteria for comprehensive coverage, benefits, and value for individual policyholders.

Claim settlement track record

This insurance product has impressive claims performance, with 95 percent of claims being settled within 30 days, and a high claims settlement rate of 96 percent. Moreover, its low claims complaint rate of 6.23 per 10,000 claims reflects positively on customer satisfaction and insurer responsiveness.

In terms of features, the plan offers a comprehensive wellness package, and does not impose co-pay or room rent sub-limits. Policyholders can also avail of preventive health check-ups of up to Rs 5,000 after one year of policy issuance, and coverage for Ayush treatment procedures up to the sum insured.

Additionally, air ambulance coverage of up to Rs 5 lakh, and road ambulance coverage up to the sum insured ensure comprehensive emergency medical assistance.

Also read: How to use Moneycontrol-SecureNow Health Insurance Ratings

The restore benefit, which reinstates the sum insured if exhausted during the policy term, enhances financial security.

Understand the limitations

However, certain restrictions exist. While the plan offers a maximum no-claim bonus of 100 percent, it lacks coverage for outpatient department (OPD) expenses. Further, the three-year waiting period for pre-existing diseases and two-year waiting period for pancreatitis, all forms of cirrhosis, cataract, skin tumours, etc., may pose challenges for potential policyholders with existing health conditions.

Also read: Future Generali Health Absolute Insurance Plan: Benefits, Eligibility, Claim and more

In sum, this A-rated insurance product offers comprehensive coverage with useful features. Moreover, it also ranks high on claim performance, which is a source of comfort. Prospective buyers should weigh considerations such as the absence of OPD coverage and the three-year waiting period for pre-existing diseases before making a decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.