Impressed with low National Pension System (NPS) expense ratio of just one basis point, but do not want increase allocation due to the long lock-in period? You have the option of opening NPS Tier-II, or investment, account in addition to the regular Tier-I retirement account. The latter is mandatory – you can open Tier-II only if you are contributing to Tier-I.

Unlike Tier-I, which allows withdrawal once you turn 60, Tier-II does not come with any lock-in period for non-government employees. So, you can invest through Tier-I for your retirement goals and direct your additional savings every month towards Tier-II account. This will help you create a corpus for other goals or boost your retirement kitty. Do note that unlike Tier-II contribution, Tier-II investment will not net you any tax benefits under section 80C, unless you are government employee. So, private sector employees do not get any 80C or other deductions for investing in tier 2 NPS.

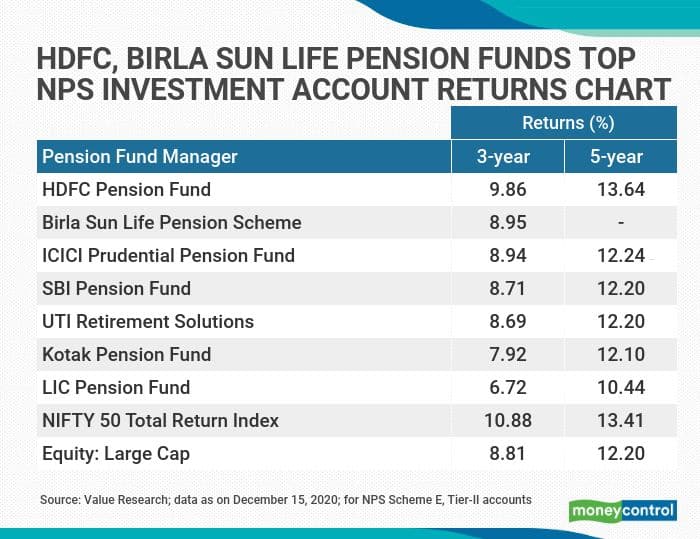

HDFC Pension Fund, the best performer

NPS Tier-I and Tier-II account performances can be tracked separately. As of December 15, 2020, HDFC Pension Fund was the top performer in the scheme E – equity funds – category across three and five-year horizons. It delivered 9.86 percent and 13.64 percent returns respectively across these two time periods. This fund, along with Birla Sun Life Pension Scheme (8.95 percent) and ICICI Prudential Pension Fund (8.94 per cent), outperformed equity large-cap funds (8.81 percent) over three years. None of NPS Tier-II equity funds, however, managed to beat the benchmark – Nifty 50 TRI (10.88 percent) during the period, according to data from Value Research.

In the five-year time period, HDFC Pension Fund surged ahead of the benchmark (13.41 percent), too, registering 13.64 percent annual returns. Other funds did not repeat HDFC Pension’s feat during the period, but ICICI Prudential Pension Fund outperformed equity large-cap mutual funds (12.20 percent), while SBI Pension Fund and UTI Retirement Solutions matched their performance over five years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.