If you're planning to study abroad or send your children for overseas education, remember that tax collected at source (TCS) might apply if the remitted amount for studying abroad exceeds a certain threshold.

The TCS rate can vary based on the amount, payment source, and whether PAN details are provided. Additionally, if you work part-time while studying abroad the income earned could also be subject to tax, depending on your residential status.

Know the TCS rules

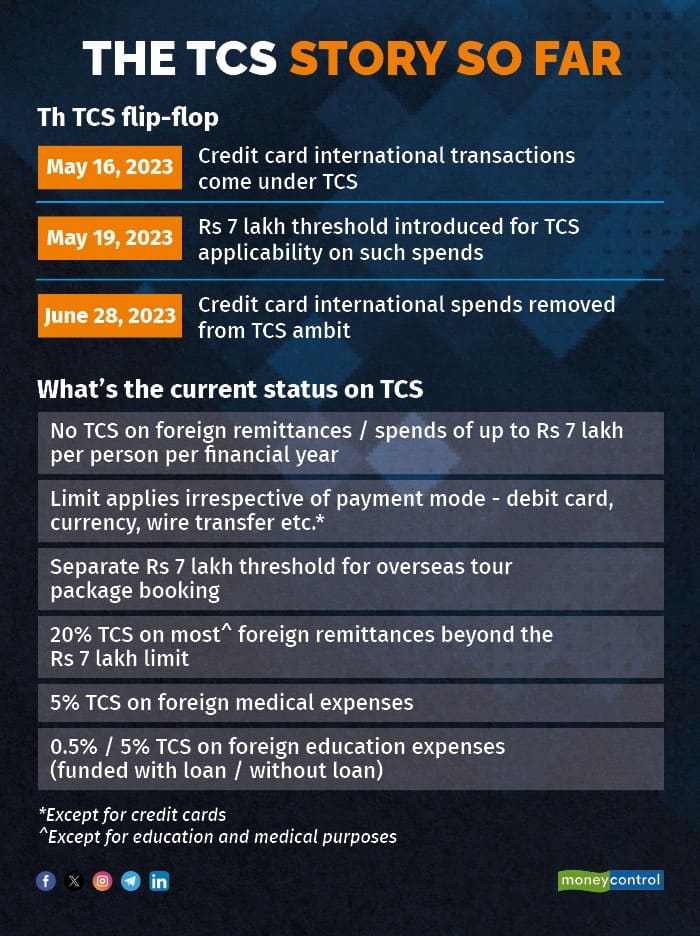

The Finance Act, 2020, amended Section 206C of the Income Tax Act, 1961, introducing TCS on foreign remittances under liberalised remittance scheme (LRS) for amounts exceeding Rs 7 lakh per financial year, with an initial rate of 5 percent. The Finance Act, 2023 later made an amendment in the section and increased the TCS rate to up to 20 percent, effective from October 1, 2023.

However, there are exemptions for educational remittances, and the TCS rate is lower if the amount is remitted through an education loan.

“Under LRS, parents can send up to Rs 7 lakh per year without being subject to TCS for education-related expenses. If the aggregate amount exceeds Rs 7 lakh, TCS rates apply, with different rates for various scenarios,” said Dirghayu Kaushik, Co-founder & CEO, Ambitio, an AI-based global admission platform.

Also read: TCS of 20% on credit cards put on hold, forex cards get Rs 7-lakh exemption

Lower TCS rate for fees paid via education loan

The TCS rate is lower if an education loan is used to fund foreign education. According to Mamta Shekhawat, Founder of Gradding, an overseas study platform, education loans taken for overseas studies are subject to a TCS of just 0.5 percent even for amounts of over Rs 7 lakh. However, in the case money is sent abroad through sources other than education loans, a TCS rate of 5 percent will be applicable if the remitted amount exceeds Rs 7 lakh.

Also, remember that if money is remitted for purposes other than education, even if the child is studying abroad, the remitted amount will attract TCS at a higher rate. As per the rule, “any remittances made for the student’s abroad purposes with expenses for basic living needs that are not directly related to their education would attract 20 percent TCS. It is only applicable if the parents are not able to prove that the amount sent abroad was for educational purposes,” said Shekhawat.

Besides that, if the remitter does not provide a Permanent Account Number (PAN), the prescribed TCS rate is higher. For foreign money transfers financed by educational loans surpassing the maximum threshold of Rs 7 lakh, the TCS rate will rise to 5 percent, whereas in the case of other income sources, the TCS rate will increase to 10 percent.

Also read: Foreign education loan: How to get the best deal

Tax on students’ part-time income overseas

Many students studying abroad choose to work part-time to earn extra income to support their education expenses. However, before taking up a job, it's crucial to understand the legal and tax implications. “As an international student, you may be eligible for a work permit if you are graduating from an accredited learning institute. Hence, you can stay and work temporarily or permanently in the country. There are certain restrictions or conditions to work in a foreign country. So, you must stick to your right to work and conditions in a particular country as mentioned under visa rules,” said Kaushik.

Also, the income earned may be subject to tax that needs to be paid - in India as also the study destination. “Income earned through such employment is eligible for taxation,” said Shekhawat. She explains that in the US, the most popular study-abroad destination among international students, those who receive internships or employment through Optional Practical Training (OPT) have to fill out a Form W-4, especially when they are getting paid.

Further, “at the year end, these income earners need to complete a Form 1040-NR when filing their tax returns,” added Shekhawat.

Tax return filing in India

Also, besides the country where you are studying, you might need to file Income Tax Return (ITR) in India, depending on your residential status, the source and place of receipt of income. If you receive your income directly in India (e.g., in your Indian bank account), you may have to file a return and pay tax in India.

However, if you are working in another country and receive the income directly in cash or a foreign bank account outside India, such income would not be liable to tax in India.

Also, you can claim exemptions and avoid double taxation when filing your ITR in India by filling out the necessary forms. “Indian students are eligible for tax reduction, credit, or exemption under tax treaty regulations. For that, you need to fill out a Form W8-BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) to your company employer,” said Shekhawat.

Although the rules and regulations may appear complex at first, knowing about them can simplify your journey and help you stay compliant with both Indian and foreign financial laws while studying abroad.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.