Over the past couple of years, many investors have diversified globally by investing in international equities – mainly through mutual fund schemes offered by domestic houses. The number of investor accounts in global funds has increased manifold.

Franklin India Feeder - Franklin US Opportunities Fund (FUSOF) is one such fund.

What is Franklin US Opportunities Fund all about?

FUSOF is a fund of funds (FoF) and invests in the underlying scheme: Franklin US Opportunities. The Franklin US Opportunities fund is managed by the Luxembourg-domiciled Franklin Templeton Investments.

The basics of personal finance tell us that there is merit in diversification, including international diversification.

One, a developed market such as the US has the potential to withstand uncertainties and deliver significant returns over market cycles. For instance, during the tech bubble in 2000, the S&P BSE Sensex lost 21 per cent, but the US Dow Jones corrected only 6 percent. Similarly, in the subprime mortgage crisis of 2008, the Sensex lost 54 percent, but the US Dow Jones and NASDAQ 100 index fell 44 and 40 percent, respectively. In the current turmoil amid COVID-19, the US equity markets recovered relatively faster than other major global indices did. So, holding assets that do not move in the same direction tends to cushion the blow that a single equity market exposure can bring.

Second, you get an opportunity to invest in sectors that have limited presence in India. It enables you to participate in the growth story of emerging and niche segments such as semiconductors, artificial intelligence, online learning, aerospace technology and renewable energy. International funds, especially those that invest in the US, also give you opportunity to invest in globally-renowned brands such as Alphabet (Google’s parent company), Visa, Apple, Microsoft, Facebook, Netflix, Intel and GE.

Third, the general downward trend of the rupee vis-à-vis the US dollar boosts returns. If the rupee depreciates, the return from an international scheme will be higher and vice-versa. Over the last 35 years, the rupee has depreciated by an average of six percent annually. Diversifying to dollar-denominated assets can hedge against any future depreciation in the rupee vis-à-vis the US dollar. So, for parents looking at sending their kids abroad for education, investing in international assets makes sense to beat rupee depreciation.

Portfolio and Performance

The underlying fund, Franklin US Opportunities, follows a multi-cap approach of investing across stocks and sectors. However, its holdings are mostly in large-cap US stocks. Grant Bowers, who has over 20 years of investment experience, manages this fund, with a team of 40-plus analysts.

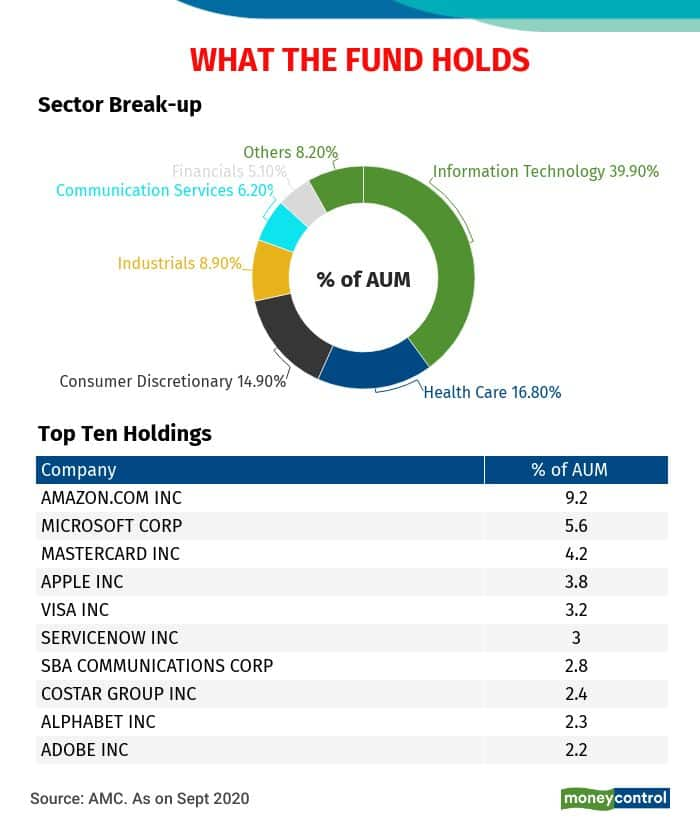

It is benchmarked against the Russell 3000 Growth Index. It holds 60-90 stocks in its portfolio. Its major holdings as of September 2020 were in technology stocks (40 percent), followed by healthcare (17 percent) and Consumer Discretionary (15 percent). The top five stocks were Amazon, Microsoft, Mastercard, Apple and Visa.

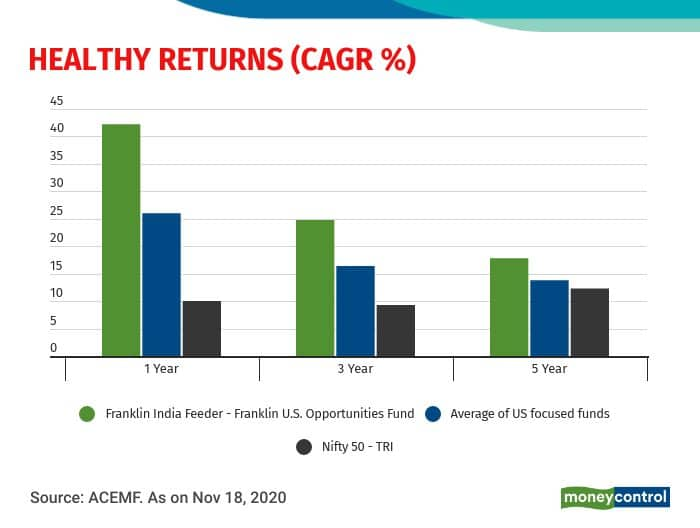

FUSOF is one of the top performing schemes among the funds investing in US stocks. It has also managed to outperform domestic equity funds across timeframes by huge margin.

The upswing in the US economy in recent years helped US-focussed funds beat domestic equity schemes in terms of returns. Over the last few years, US Equity markets have rallied due to low interest rates, higher liquidity and lack of growth visibility in other major economies. The biggest companies (especially technology majors) have outperformed and the current COVID-19 crisis has extended their dominance. Over the last three years, the rupee has depreciated more than 14 percent. This has also helped US based funds report higher returns.

The scheme has delivered a compounded annual growth rate (CAGR) of 42 percent, 25 percent and 18 percent returns during one, three and five-year periods. This is much better than schemes with similar investment mandates.

On a rolling return basis as well, the fund has done well. Rolling return tells us more about a scheme’s consistency as it analyses multiple point-to-point returns taken over a period of time. We looked at a series of five-year returns, taken on a daily basis over a seven-year period. Here, the fund gave 13 per cent returns, as opposed to 10.4 per cent category average return. Meanwhile, NIFTY 50-Total Returns Index (TRI) gave 9 percent returns.

What is the future of FUSOF?

Experts believe that US markets are over-valued, after years of good run. Shyam Sekhar, chief ideator and founder, iThought, says, “The best time to enter into global funds was when COVID-19 struck. People tracing an investment opportunity at this point of time are coming late to the party. The ideal time to buy US stocks is when they are reasonably valued and their economic prospects look set to improve. At the movement, the US stock market has already factored in the improved prospects.”

Srikanth Bhagavat, managing director, Hexagon Capital Advisors believes that ”The forward PE of the S&P 500 is clearly at the upper end of its 15-year range. But the US market is polarised with a handful of growth stocks influencing the index and its valuation. Valuation needs to be seen in the light of the enormous liquidity and low interest rates, too.”

However, in the latest Portfolio Manager Insight note, Grant Bowers states, “US equity markets will continue to wrestle with the COVID-19 impact on the economy for the remainder of 2020 as infection rates, treatment developments and business re-openings will dictate economic growth going forward regardless of which politicians hold power.”

It would be unwise to invest in this fund expecting past returns to be replicated. But an allocation of up to 10 percent in this fund can be considered as international schemes offer diversification.

International funds are taxed as debt funds. Long-term capital gains tax is applicable at 20 percent with indexation on the profit, if you sell them after 36 months. Capital gains are added to your income if the holding period is less than 36 months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.