Credit card issuer SBI Card and e-commerce player Flipkart have partnered to launch the Flipkart SBI Credit Card, offering cashback rewards across popular platforms such as Myntra, Flipkart, Cleartrip, Zomato, Uber, and more during the festive shopping season.

“This card targets value-conscious customers, those who are likely to use credit cards for their daily purchases and seek offers, rewards, cashback, and other benefits that offer value for their money,” said SBI Card’s spokesperson.

Here’s a quick analysis of the rewards, fees and limitations of this card, to assess if it is a worthy addition to one’s wallet.

The Offer

The Flipkart SBI Credit Card offers rewards, including 5 percent cashback on Flipkart and Cleartrip transactions, and 7.5 percent on Myntra purchases, with a maximum quarterly cap of Rs 4,000 for each category.

Ankur Mittal, co-founder of Card Insider - a platform that tracks credit cards – said the card's cashback offer on Myntra purchases surpasses its offer on Flipkart spends.

The SBI Card spokesperson explained who this card aims to serve. “This tiered cashback structure is part of a broader strategy. Shoppers constantly look for rewarding offers, and this differentiation allows the credit card to cater to aspirational customers, expand the card’s offering across the entire Flipkart Group — by tailoring rewards and delivering value at each transaction.”

Additionally, the card also offers 4 percent cashback on transactions made with select partners, including Netmeds, Zomato, Uber, and PVR, with a quarterly cap of Rs 4,000. All other eligible expenses will receive one percent cashback with no cap.

This card is available on both the Mastercard as well as Visa networks.

Fees and Charges

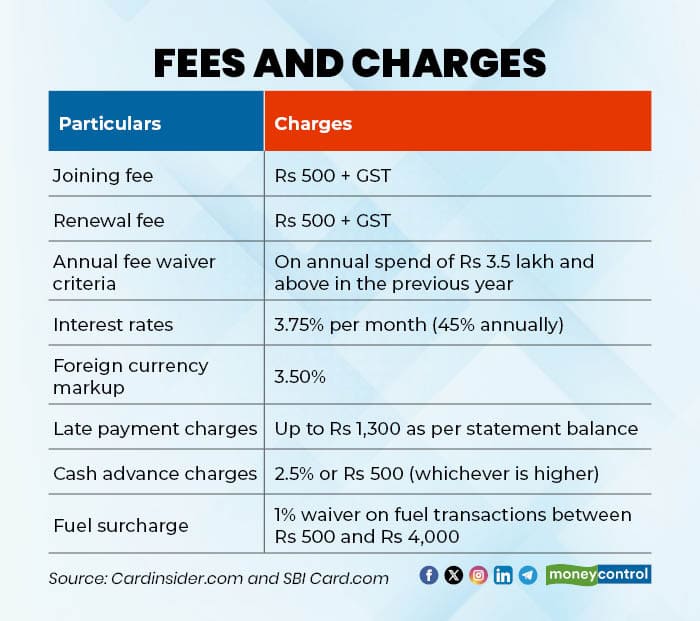

The Flipkart SBI Card has a joining fee of Rs 500 + GST with renewals for the same amount. However, the annual fee is waived if the cardholder spends Rs 3.5 lakh or more in the previous year. The credit card charges interest at 3.75 percent per month, which translates to 45 percent annually. Additionally, there is a foreign currency markup of 3.50 percent. Late payment charges range up to Rs 1,300, depending on the statement balance.

What Works?

According to Card Insider’s Ankur Mittal, the Flipkart SBI Credit Card is an all-rounder cashback card, offering decent value-back across multiple categories at a low annual fee.

The system will automatically credit the cashback to the cardholder's account within two business days after the statement cycle, a straightforward process.

Also read | GST 2.0: Why middle-class families should invest before splurging during festival season

What Doesn’t Work?

Ankur Mittal said one drawback of the card is the lack of complimentary airport lounge access benefits.

On this aspect, the SBI Card spokesperson said, “The Flipkart SBI Credit Card is tailored for online shoppers, with benefits focused on Flipkart, Myntra, and Cleartrip cashback, making it well-suited for digital retail rather than luxury travel.”

Sumanta Mandal, founder of TechnoFino, a platform that reviews debit and credit cards, said the card has quarterly caps on accelerated cashback and criticizes the high spending requirement for annual fee waiver, especially for an entry-level card.

Also read | ITR filing: Why you shouldn’t wait until September 15 to file your returns

Peer Comparison

According to Sumanta Mandal, the Flipkart SBI Credit Card closely resembles the existing Flipkart Axis Bank Credit Card, suggesting that Flipkart is diversifying its partnerships with multiple banks.

Card Insider’s Ankur Mittal said there are subtle differences between Flipkart’s SBI Card and Axis Bank Credit Card. The Flipkart SBI Card offers higher value in welcome benefits, and both cards have different partners under the 4 percent cashback category.

Should you Apply?

According to Mittal, the Flipkart SBI Credit Card is ideal for frequent shoppers on Flipkart and its partner platforms, such as Myntra and Cleartrip, due to its cashback offers and lower joining/annual fees.

However, Mandal points out, while the Flipkart SBI Credit Card offers decent benefits, it doesn't particularly stand out from existing strong cashback cards. For those who primarily spend on Flipkart, the SBI Cashback Credit Card and SBI PhonePe Select Black Credit Card are better alternatives, as they already offer 5 percent cashback on Flipkart, matching the new card's key feature with other benefits. But the joining and renewal fees of both these cards are higher compared to the Flipkart SBI Credit Card.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.