If you are investing in the equity markets for the first time, a large-cap fund will suit you well. These are among the most conservative equity-oriented funds on mutual fund (MF) street. And MC30 has three large-cap funds on offer.

MC30, Moneycontrol 30, is a curated list of 30 investment-worthy mutual fund schemes from which investors can pick and choose . MC30 brings down the choice of funds from over a thousand, to a more manageable 30. All you need is just 7-12 schemes, across asset classes, to make a solid portfolio.

See here: The sparkling list of MC30

Why large-cap funds?

Large-cap oriented mutual funds are less risky than most equity funds.

As mandated by the capital market regulator, actively managed large-cap funds invest at least 80 percent of their assets in the top 100 companies listed in the stock market based on market capitalisation.

While the large-cap index and ETFs are likely to mimic the performance of large-cap indices, actively managed large-cap funds try to beat the large-cap benchmarks.

These funds offer stability as they invest primarily in well established companies with a proven track record and stable earnings. They are less volatile compared to mid and small-cap funds.

Also read: How to use MC30?

Ravi Kumar T V, Founder, Gaining Ground Investment Services, says, “this low volatility for new investors can be comforting who may not like to see their investment fluctuating significantly. Most of the large cap funds invest across various sectors thereby spreading the risk and benefit from diversification”. New investors who may not have the time or knowledge to research the top companies can easily take this route via large cap funds to participate in equities and build their investment portfolio, Kumar adds.

MC30 presents six such schemes that are following either the Nifty 50 or the Nifty 100 index as benchmark. Of these, three are actively managed large-cap schemes and the rest are passively managed Exchange traded funds (ETFs) and index funds.

Can large-cap schemes outperform the benchmark?

The period between 2018-2022 had been a rough ride for active large-cap funds as they found it difficult to beat their benchmarks due to the narrowing down of the category’s investable universe and the choppy market conditions. However, things changed post 2022 as many active large-cap funds managed to deliver better return than their benchmarks.

As per the ACEMF data, as much as 66 percent of active large-cap funds beat their respective benchmarks in 2023 thanks to the broad based market rally.

Also see: Best mutual funds: 86% of actively-managed schemes outperformed benchmarks in MC30’s 2023 run

Here are our actively managed large-cap fund picks.

HDFC Top 100 fund

Launched in September 1996, HDFC Top 100 fund (HT100) is one of the oldest funds in the industry. Earlier known as HDFC Top 200, HT100 had maintained its dominance in both asset size and returns. Now it is the fifth largest fund within the large-cap category.

Prashant Jain managed this fund through various ups and down of the equity market for nearly 18 years from 2004 to 2022. Rahul Baijal has taken over after Jain left the fund house in 2022.

Also see: The methodology behind the curated basket of mutual fund schemes

The fund is currently managed with a blend of growth and value styles, unlike its past focus on value. “In my personal value, a blend of growth at reasonable price and value could achieve consistency and performance in the large-cap mutual funds in India” says Baijal. Since taking over, he has increased exposure to sectors such as healthcare, private sector banks and telecom while decreasing exposure to the energy, consumer discretionary and IT sectors.

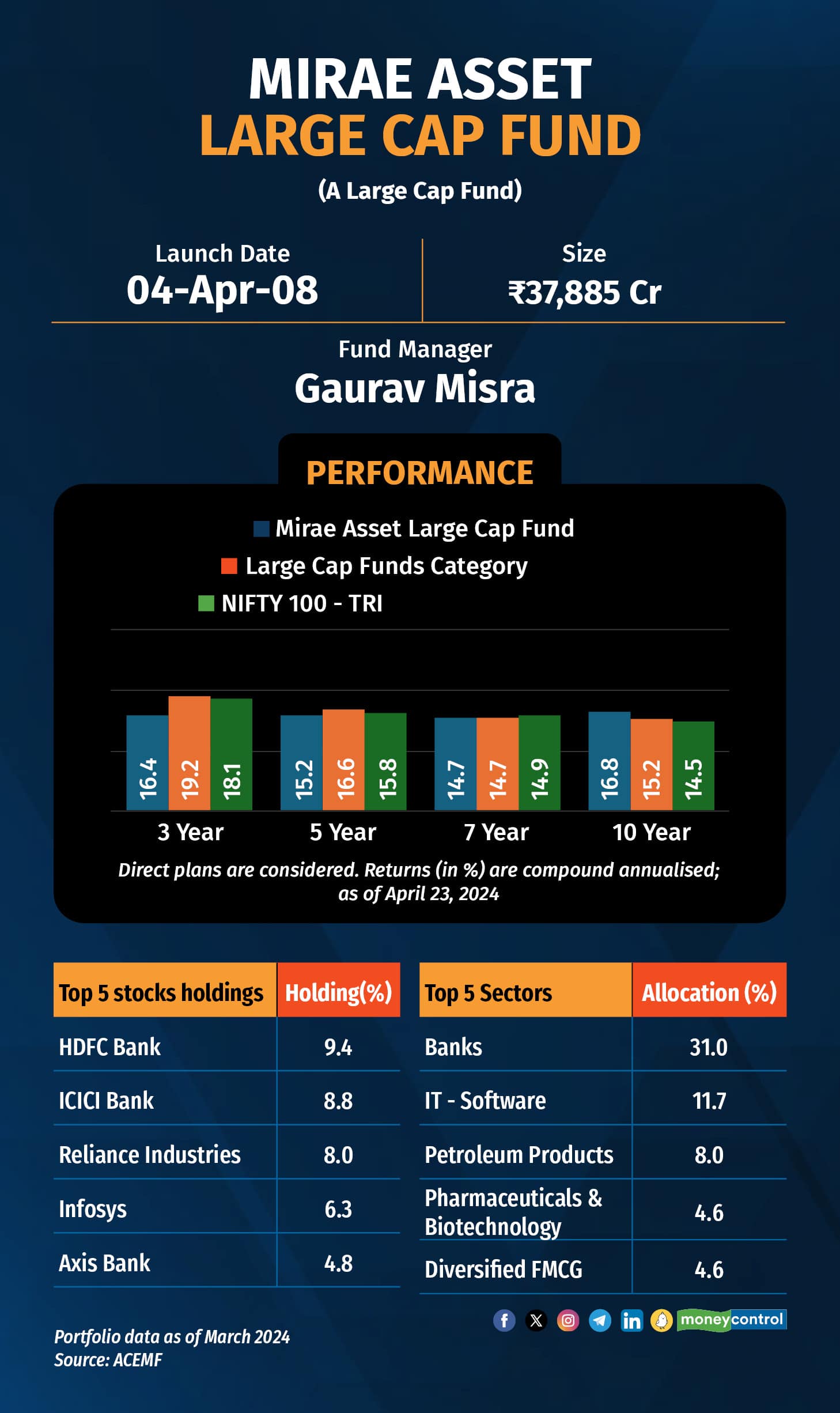

Mirae Asset Large Cap Fund

Mirae Asset Large Cap Fund (MALCF) has completed 15 years in 2023. It managed to deliver a compounded annualised return of 15 percent since its launch. Gaurav Misra and Gaurav Khandelwal jointly manage the fund.

Though the fund managed to deliver better returns over the long run, its short-term performance over the last 15-18 months has not been appealing. One of the main reasons is that its growth-oriented investment approach hindered its performance within the category as the value-style outshone over the last two years.

Also read: Top mutual funds: 3 new schemes that enter MC30

Its diversified allocation (about 66 stocks in the portfolio as of February 2024) and investment of about 15-16 percent of its corpus in mid and small-cap stocks has helped bolster the fund’s performance. With a corpus of nearly Rs 37,676 crore, MALCF is one of the top three largest schemes in the category.

Canara Robeco Bluechip Equity Fund

Canara Robeco Bluechip Equity Fund (CRB) has been one of the funds in the largecap category on delivering above average returns. Shridatta Bhandwaldar has managed this fund since 2016 and has an impressive track record.

Like any other fund, CRB has been going through a short term of underperformance over the past 15 months. Bhandwaldar explains, “We have a tilt towards growth and quality versus value, and that style has worked today, and we have a relatively lower allocation on that side. Also, some stocks under public sector undertakings (PSUs), non-banking financial companies (NBFCs), and small caps have done disproportionately well in the near term, and we are under-allocated, so those are predominantly the two reasons”.

However, its long-term performance has been noteworthy. CRB is at the top among its peers, delivering an average five-year rolling return of 13 percent (calculated from the last 10 years’ history).

Also read: The schemes that moved out of MC30 2024 and why

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.