Ankur Mittal, co-founder of credit card comparison website CardInsider, was taken aback by an unexpected text message. The message, from a credit information company (CIC), claimed that a fintech lender accessed his credit history and check his credit score.

The wrinkle is Mittal never sought a loan from this company. “When I contacted the lender, I was told that an intermediary of theirs had made the credit enquiry. This amounts to unauthorised access as I had not given my consent [by way of applying for any loan or credit card through the fintech player],” says Mittal.

The unsolicited credit check, presumably to evaluate Mittal’s creditworthiness for a loan, highlights growing cases of unauthorized access of consumers’ financial data.

Similarly, Bengaluru-based research analyst, Eshwar Vemala, stumbled upon a credit enquiry for a personal loan made by a private sector bank he had never reached out to. “I had neither contacted the bank for any loan or credit card, nor did I share my mobile number on any third-party app in pursuit of a loan,” he says. He had no relationship with the bank. Still, there was an enquiry.

He alerted the bank in the hope to find some justification, but there’s no resolution in sight yet.

Like Mittal and Vemala, Suraj Talreja, a data analyst from Indore, encountered a similar challenge in September. He received an enquiry alert from TransUnion CIBIL, in relation to a personal loan from a fintech lender. He contacted the lender, who sought basic information such as permanent account number (PAN) and mobile number to investigate the issue. “So far, there is no concrete explanation from them on the reasons for the unauthorised enquiry. They have promised to take corrective measures in the next few days,” he says.

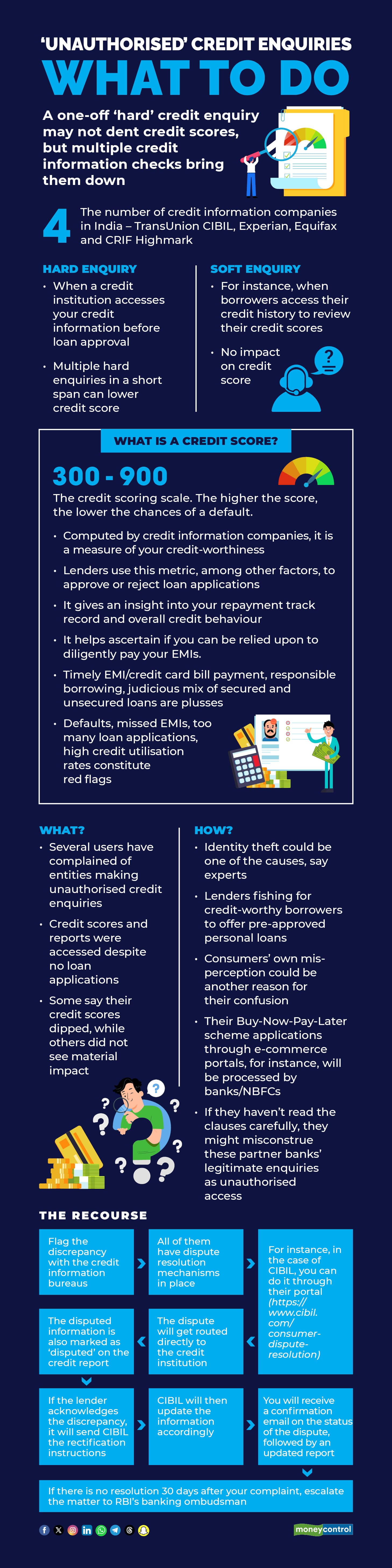

The reason why such enquiries raise eyebrows is their potential to adversely affect credit scores, though there is no consensus on the magnitude of the impact. According to Mittal, his credit score dipped by eight points post the enquiry by the fintech lending firm, which, he feels, is significant.

On their part, CICs point out that for lending institution to be able to check your credit history, it will need several details. Only your name or mobile number are not enough. “For checking an individual’s credit report, credit institutions must enter the details of the consumer like name, date of birth and identifier details like PAN/ voter’s ID/ passport/ driving licence on the CIC’s platform,” points out Bhushan Padkil, SVP and Head, Direct-to-Consumer Business, TransUnion CIBIL. Yet, if such an unauthorised enquiry has been made, you must immediately dial the credit information bureau.

Identity theft could be one of the key causes of such incidents. “It is possible that the customer has genuinely not applied for any loan or credit product, still the enquiry shows up on the credit report. This can be either a case of stolen identity [fraud] or a genuine mistake in punching of information by the other customer or the lender,” says Parijat Garg, a digital lending consultant.

The genesis could lie in personal information that you might have shared with third-parties. “For instance, we tend to share our details when we visit restaurants, hotels or malls to shop. It is possible that the data gets sold and lenders end up gaining access to it. If you have shared your information at a five-star hotel, for example, lenders might be keen on exploring whether they can offer you a pre-approved personal loan, given your higher spending and repayment capacity,” says Satish Mehta, Founder, Athena CredXpert, a credit counselling firm.

However, there could be cases, where the consumer might have erred in interpreting the credit enquiry. “There is another scenario where the customer perceives the enquiry to be unauthorised. Let’s say, I have applied for a ‘pay later’ option through an e-commerce website. Now, the credit enquiry will be conducted by the partner bank or the non-banking financial company [NBFC]. [Since the consumer had not dealt with these lenders], she might see the alert about the bank or NBFC’s enquiry as construe it to be unauthorised, whereas it is not,” says Garg.

Likewise, the brand name on the app that the customer may have installed and the company name might be different, resulting in confusion in customers’ minds. “The brand name [what the customer sees on the app] and the legal name of the credit institution [what appears on the credit report] are not the same. For example, Flexiloans is the business or brand name of the lender, whose legal name is Epimoney,” adds Garg.

Also read | How credit score is calculated and what affects it: ExplainedImmaterial impact or cause for concern?Mittal considers a drop of eight points in his credit score to be significant.

However, Mehta feels that while such enquiries can affect credit scores, they will not have a material impact. A case in point: Vemala’s credit score remained unchanged, despite the uninvited enquiry. Garg, too, believes that the impact could be in single digits – four to five points – which is not substantial.

However, the picture could be different in the case of multiple enquiries, as then, the individual could be seen as credit hungry. “Hard enquiry happens when a credit institution has accessed a consumer’s CIBIL report, usually in connection with a new credit card or loan application. While one-off enquiry may not have significant impact on an individual’s Credit Information Bureau (India) Limited [CIBIL] score, several such enquires in a short period of time may lower the score,” says Padkil.

Also explore: Free credit report and regular credit score updates on the Moneycontrol app and website. Approach credit bureaus, RBI banking ombudsman for resolutionBefore taking any step, ascertain whether your grievance is tenable. “You need to establish whether the enquiry was truly unauthorised or not. Check the business name of the lender whose name appears against the enquiry. Check if you happened to sign up with their partners around the time the enquiry was made,” says Garg.

If you are convinced that it is a case of identity theft and unauthorised access, you can escalate the matter. All credit information bureaus have put dispute resolution mechanisms in place. Mittal has approached the CIC concerned to rectify the error. “We have an online dispute resolution platform, where consumers can raise disputes on our website. Once a dispute has been submitted to TransUnion CIBIL, it gets routed directly to the credit institution [like a bank or NBFC] concerned. The information is also marked as ‘disputed’ on the consumer’s credit information report. If the credit institution accepts the dispute, it sends us correction instructions and we update the information accordingly. A confirmation email is sent to the consumer to communicate the status of the dispute, and an updated copy of the report is also sent once all the disputes are closed,” says Padkil.

Before knocking on the Reserve Bank of India's (RBI) ombudsman’s doors, wait for 30 days. “Such cases usually get resolved within seven-10 working days, particularly if the enquiry is not from too far back in time. The credit information bureaus as well as the lenders are now required to resolve customer’s requests and disputes within 30 days to avoid financial penalties,” says Garg.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.