Edelweiss Financial Services has opened its Rs 100 crore secured non-convertible debenture (NCD) public issue, with a green-shoe option of Rs 100 crore, making it a possibly Rs 200 crore issue. The diversified financial services company is raising funds to repay or pre-pay borrowings as well as for general corporate purposes.

About the issue

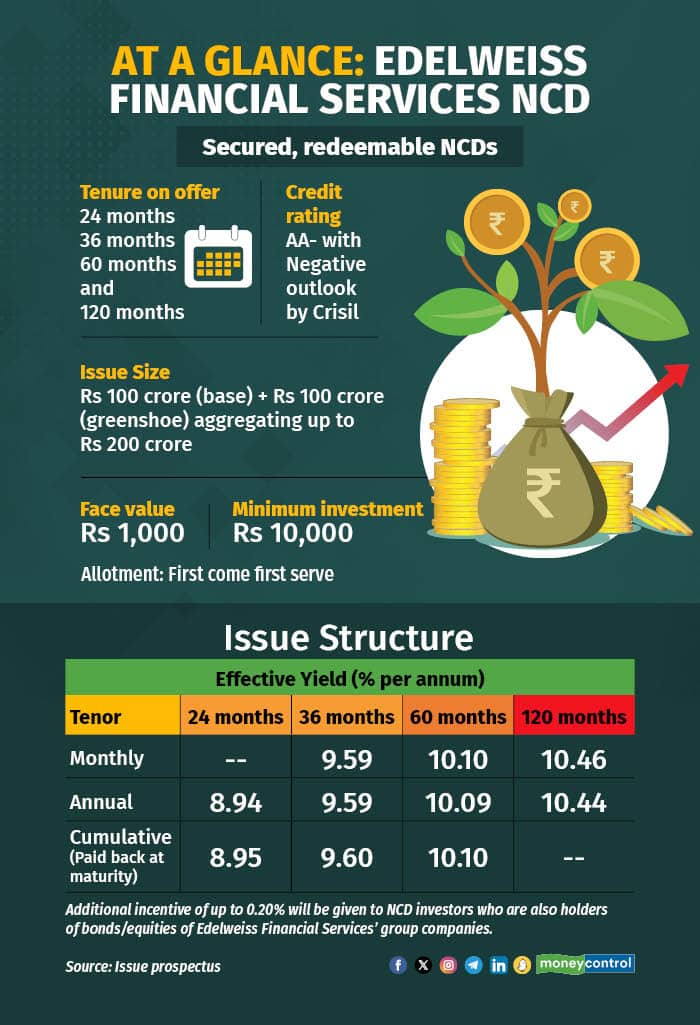

There are 10 series of NCDs carrying fixed coupons with tenures of 24 months, 36 months, 60 months and 120 months, offering annual, monthly and cumulative interest options. The effective annual yield ranges from 8.94 percent to 10.46 percent. The highest payout is offered in the 120-month tenor option.

While the monthly interest payout option isn't available in the 24-month tenor, cumulative (paid back at maturity) payout won't be available in the 120-month tenor option.

Also read | Tax-saving FDs: These banks offer interest rates of up to 7.5%

An additional incentive of up to 0.20 percent will be given to holders of earlier bonds of Edelweiss Financial Services as well as bonds/equities of Edelweiss Financial Services’ group companies.

Crisil has rated the NCD issue AA- with a negative outlook.

Trust Investment Advisors and Nuvama Wealth Management are the lead managers of the issue. The NCDs will be listed on the BSE.

What works?

Edelweiss Financial Services is a stable company with adequate capitalisation, supported by multiple capital raises.

“You need to look at the parentage of the company to whom you're giving money. If you think that the group has enough resources so that they will not default on your investment, that is a key aspect. If something goes wrong, we feel that Edelweiss group has enough resources to be able to come out of it,” said Anup Bhaiya, founder of Mumbai-based Money Honey Financial Services, which recommends the issue to clients.

According to Crisil, the Edelweiss group is a diversified services company and it has attained competitive positions, which should lend greater stability to earnings over time.

What doesn’t work?

Crisil’s AA- rating indicates the NCDs carry a fair level of risk regarding timely servicing of financial obligations. In terms of credit quality, the issue isn’t rated AAA, which is considered to have the highest degree of safety. In the past, even some issues with the highest rating have defaulted, leaving investors in a fix.

Also read | Time to rebalance your portfolio? Check out these aggressive hybrid funds

Further, there may not be an active market for the NCDs on the stock exchange. As a result, liquidity and market prices of the NCDs may fail to develop and may be adversely affected.

According to Crisil, the company’s asset quality remains weak.

“Any sharp weakening of asset quality, specifically in the wholesale lending book, will impact profitability as well as capitalisation and remains a key rating monitorable,” Crisil said.

The rating company also flagged low profitability compared with peers as one of the key risks.

What should you do?

It is important to understand the risks associated with NCD investments. Returns are not guaranteed and in the extreme event of cash flow stress for the company, there is the possibility of a default, with even your capital at risk.

Keep in mind that any kind of capital, especially in debt allocation, is best deployed in multiple instruments.

Also read | Tempted by the market rally? Know the risks well before investing in smallcap funds

Further, NCD issues pale when compared with debt funds on liquidity grounds. Redeeming NCDs before maturity might be a challenge as the Indian debt market is not that deep.

A fixed-income expert, who suggests that investors give this issue a miss, said existing papers of Edelweiss Financial Services are available with better interest payout in the secondary markets.

The Edelweiss Financial Services NCD issue opened for subscription on October 6 and will close on October 19. The allotment of NCDs will be on a first come, first served basis.

To know more about the investment ascent in India with the nation’s leading financial pioneers, tune in to the Moneycontrol Mutual Fund Summit, 11th October 2023 in Mumbai, 3.50 pm onwards. Log on here for further details.

Powered by Axis Mutual Fund, Strategic Partner Reliance Industries Limited, Associate Partners HSBC Mutual Fund, Motilal Oswal MF, 360 ONE Mutual Fund, IBM and Baroda BNP Paribas.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.