Most of the passively-managed schemes track the Nifty 50 and closely mimic the index’s performance.

These funds make allocations to the Nifty 50 stocks, exactly as per their weights in the Nifty.

For example, if a stock has delivered significant gains, its weight in Nifty will surge. The index fund or an exchange traded fund tracking the Nifty will also increase its allocation to the stock to reflect the increased weightage.

Therefore such schemes have higher exposure to stocks that delivered strong returns in the recent past and lower allocation to shares that lagged behind.

Such a strategy is likely to work when markets are polarised (as seen in 2018 and 2019), when a handful of Nifty stocks stand out in the stock markets.

But, in a broader market rally, when a large set of stocks goes up, is there a better way to profit from stock markets? The DSP Equal Nifty 50 Fund has precisely this mandate. It is a passively-managed fund benchmarked against the Nifty 50 Equal Weight index: a replica of Nifty 50 index, but where all companies carry an equal weight. The aim is to capitalise on returns from as many stocks that go up, and not just the few whose weightages are greater than the rest within the Nifty.

What is the DSP Equal Nifty 50 Fund all about?

As the name suggests, all the stocks in this fund carry an equal weight; a 2 percent allocation. “These are leaders in their respective industries. And, it is not skewed towards fewer companies,” says Anil Ghelani, head-passive investments and products at DSP MF.

As domestic equity markets have started to see a broader rally in recent past, the Nifty 50 Equal Weight Index has started to outperform Nifty 50. In CY20, the Nifty 50 Equal Weight Index delivered returns of 19 percent, while Nifty 50 gave returns of 16 percent.

Another period when a broader set of stocks participated in the market rally was between 2007 and 2009, which also saw the 2008 global financial crash. During this period, the Nifty 50 Equal Weight index gained 57 percent, beating the Nifty 50 returns of 30 percent.

Protecting the downside

The fund does not take concentrated exposure to any particular stock.

“A market-cap weighted index such as the Nifty 50 sees a sharp rally when the favourites or the heavy-weight stocks go up; but, when these index favourites fall, the index also sees a sharp fall and it cannot be avoided in a market-cap weighted index,” says Vidya Bala, co-founder of Primeinvestor.in.

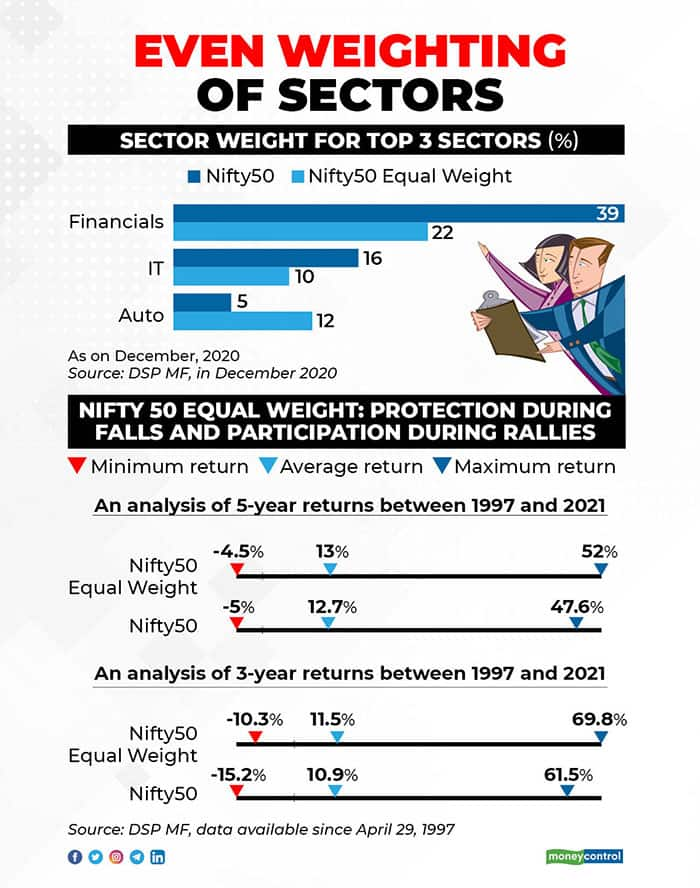

How much sectors weigh, differ between these two indices. For example, banking and financials constitute 22 percent in Nifty 50 Equal Weight as per in December, 2020 as opposed to 39 percent in Nifty 50. Information Technology sector constitutes 10 percent in Nifty 50 Equal Weight index and 16 percent in Nifty 50.

This divergence makes the index less dependent on the fortunes of one or two sectors. “Since you won’t know which stocks are likely to perform in future, through an equal weight strategy, you can diversify your weights equally and also spread out your risks,” Bala adds.

A rolling return-analysis done by DSP Mutual Fund for the period between 1997 and 2021 shows that the Nifty 50 Equal weight index has done better than the Nifty 50, during rallies as well as in containing downsides during corrections.

What doesn’t work

There can be periods of underperformance if the polarisation in the equity markets returns and a handful of Nifty stocks lead the performance charts.

“In an equal-weighted strategy, you don’t participate heavily in the stocks that have been showing high momentum, as weights are limited. To that extent, such a strategy can underperform significantly, if few Nifty stocks lead the markets,” Bala points out.

Also Read: Why large-cap funds may not be out of the woods despite their recent outperformance

In the last three-year period, the fund has delivered compounded annual growth rate (CAGR) of 5.53 percent, shows data from ACE MF, while UTI Nifty Index Fund has delivered CAGR of 11.77 percent. This underperformance can attributed to the polarisation seen in markets in 2018 and 2019. Such polarization can well happen in future as well.

Moneycontrol’s take

The DSP Equal Nifty 50 Fund is likely to do well in periods when a broader set of Nifty stocks participate in the markets, but could lag when the markets are polarised.

An equal-weight index is yet another attempt to maximise your returns by better understanding how markets move. Predicting the direction of the Nifty’s or Sensex’s constituents is hazardous. To that extent, an equal weight Nifty 50 is merely a strategy, not a fool-proof plan.

Invest only a small portion in the DSP Equal Nifty 50 Fund, after exhausting all other regular options (active and passive) in line with your goals and asset allocation pattern.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.