Another year gone by. But what a year! The stock market fall blindsided investors just as much as the very rapid recovery. More, the rising market wave lifted most stocks – which means that the market rally was not as narrow as in earlier years.

If there’s one factor that has plagued the large-cap and multi-cap spaces in the past three years, it is that their outperformance over the index has taken a hit. The large-cap category, especially, had very few funds that were able to beat the Nifty 100 index and keep up that performance.

The narrow market rally in 2018 and 2019 saw only a small group of stocks rising – and consequently the Nifty 50, Nifty 100 and other market indices – and was partly to blame. Since funds will necessarily hold a basket of stocks based on valuations and potential, and because schemes cannot go accord very heavy weights to a few stocks, the narrow market uptick left them behind the index.

But with the Nifty 100 now sporting more gainers than earlier, has the tide turned for funds? Well, 2020 has been something of a roller-coaster ride. Here’s more.

Containing falls

The early part of 2020 saw markets crashing over 30 percent in a matter of weeks. In March 2020, the month of the steepest fall, the Nifty 100 index was down about 33 percent at its worst. Between February and May 2020, the period before markets stabilized and then took off, the Nifty 100 lost about 20 percent.

Through this phase, large-cap funds did well in keeping their losses at a better level than the index. At the worst of the fall, the average returns for the category were about 1.2-2 percentage points better than the index. While this may not seem high, note that the category on an average was lagging the Nifty 100 TRI until then. A good many funds contained losses better than how the category did, too – those such as Axis Bluechip, BNP Paribas Large Cap, and Canara Robeco Bluechip Equity contained losses by even wider margins of above 4 percentage points. Still others such as JM Large Cap moved a significant portion of their portfolio to cash to keep losses in check.

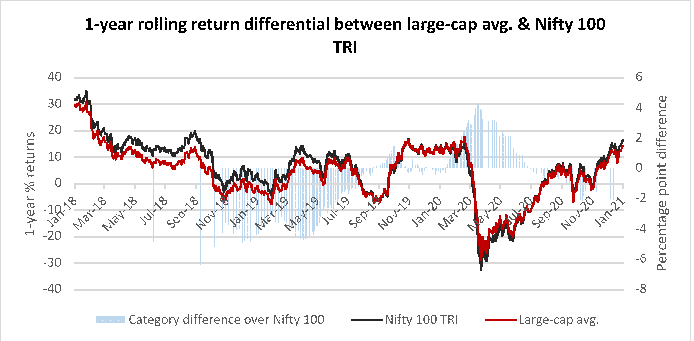

On the basis of one-year returns, the large-cap category had already begun slowly improving the performance against the Nifty 100 TRI towards the end of 2019, post the September upswing. The category average, which had been significantly below the Nifty 100 TRI, managed to marginally move above the index. The 2020 market fall cemented their performance against the Nifty 100 TRI. From March through to May, the large-cap average return beat the Nifty 100 TRI by a good 2.9 percentage points.

Eight out of every 10 large-cap funds beat the Nifty 100 TRI. This was an improvement from earlier months, when barely half the large-cap universe was able to deliver higher than the Nifty 100 TRI. Therefore, large-cap funds did tick off the role they need to play in containing downsides in correcting markets.

Momentum not sustained

But in the market’s return to buoyancy, large-cap funds appear to have lost grip on their performance again. The category average return dropped below that of the Nifty 100 TRI. Funds such as HDFC Top 100, DSP Top 100, Nippon India Large Cap are trailing the Nifty 100 TRI by a wide margin of 5-10 percentage points. Those such as Invesco India Large Cap and ICICI Pru Bluechip, which had pushed above the Nifty 100 TRI have dipped slightly below it again. The number of funds doing better than the index also slipped to earlier levels.

The graph below shows the one-year rolling return – compiled by PrimeInvestor – for the large-cap average and the Nifty 100 over the past three years, as well as the margin by which the category average has trailed – or beaten – the index. Notice how the underperformance has reduced only to move back up, of late.

This time around, narrowness of a rally is not a big factor. Of the Nifty 100 universe, half have delivered higher returns than the index for the 2020 calendar year. Further, using the Nifty 100 Equal Weight index as an indicator shows that the gap between the one-year return of this index and the Nifty 100 has narrowed. Not just that, the Nifty 100 Equal Weight one-year return has even moved above the Nifty 100. This suggests that the index constituents outside the top weights have been far better performers.

Therefore, the performance boils down to the stocks or sectors that saw strong price gains in the rally and how far funds could participate in such opportunities. For example, big stock gainers such as Aurobindo Pharma, Tata Consumer, Info Edge, Cadila Healthcare, Mahindra & Mahindra, Tata Steel and so on were not held by many funds or were held in smaller proportions. On the other hand, funds tended towards higher allocations to stocks such as ICICI Bank, HDFC Bank, HDFC, ITC, Bajaj Finance and others – which were not outperformers or were volatile through the year.

Another factor at play was how far funds were able to deviate from the benchmark. Most funds do not swing wildly away from sector allocations of their benchmark. While they may go overweight or underweight on sectors, the extent to which they do so is not large. Nor do funds go heavily overweight on the smaller sectors.

For example, the banking and finance space is an index heavyweight. Though funds were not overweight on the sector, the individual stock allocations to those such as ICICI Bank, SBI, or Axis Bank, HDFC and so on still served to pull down fund returns. Similarly, sharply rallying sectors such as chemicals, pharmaceuticals or auto did form part of allocations, but weights were not very large for most funds.

Therefore, the large-cap space still bears watching in terms of how well it is able to come out of the performance slump. The effect of the narrow rally appears to be dissipating for now; though most funds continue to lag the Nifty 100 TRI, they have at least narrowed the gap by which they trail the index. But how far funds are able to build on this improvement, and the strategy they follow to ride the broader market rally needs watching. Only continued improvement makes the case for retaining investments in this fund category for the long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.