The Reserve Bank of India (RBI), recently warned borrowers to be aware of digital lending entities that promise personal loans within minutes and charge exorbitant rates of interest. The Central Bank’s warning came after several complaints about retail borrowers falling prey to a growing number of unauthorised digital lending platforms and mobile apps that promise quick loans in a hassle-free manner. The suicide cases of borrowers being unable to pay loans associated with digital lending apps are also rising.

Following the caution note from the central bank, the Digital Lenders Association of India (DLAI) has now tightened the code of conduct and issued guidelines for borrowers to identify unreliable digital lending apps.

An executive committee member of DLAI says, “We are working with our members and the regulatory bodies to control practices that are illegal or in any way harmful to customers. However, we have noticed many such digital lending apps have found loopholes in the system and reached vulnerable customers, often in urgent need of money.” He adds that these unorganised and unreliable digital lending firms typically only have a mobile app as a consumer interface. The reports about collection malpractices, such as blackmail or misuse of personal information are linked to such firms.

Also read: How app-based loan sharks lay death-traps for borrowers

Taking corrective steps

DLAI claims it has taken stringent steps to ensure ethical practices are followed in the digital lending industry. An updation of the DLAI code of conduct, making it stringent in controlling loopholes has been done. Existing members that did not adhere to the code of conduct were asked to leave the association and it is working closely with the payment partners to identify unethical practices of digital lenders and unorganised lending firms in the industry.

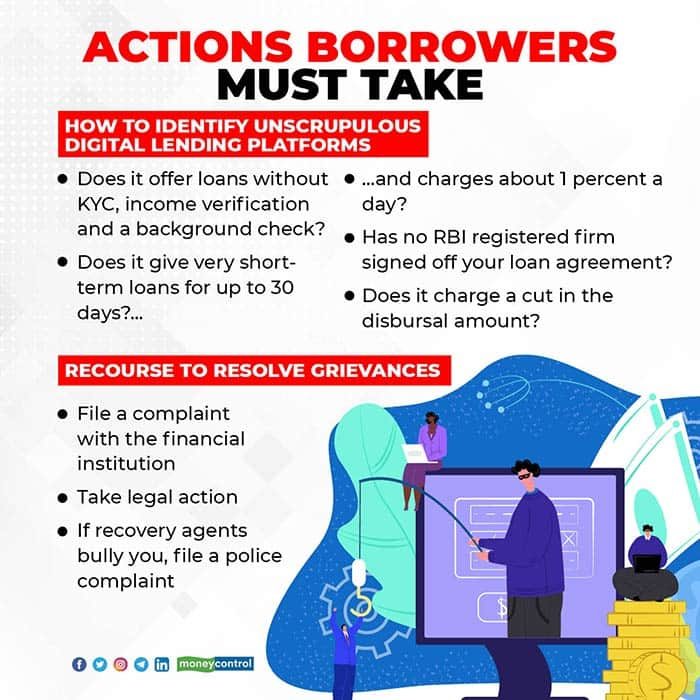

DLAI urges borrowers to be aware of dubious digital lending firms. Some of the key pointers you can use to identify unscrupulous lenders are that such digital lending apps will offer loans without KYC (know your customer) and income verification so they cannot be trusted; also, they are likely to charge very high interest rates and other hidden charges will be levied on loan amount. While applying for a loan, you must verify the background of the lending company. Look for the partner bank or NBFC’s details. The loan agreement must mention these details.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.