Over the years, the number of students seeking higher education opportunities outside India has grown steadily. In 2022, over 7,50,000 Indian students chose to move abroad for studies. The number of students going to the US, Canada and the UK has almost doubled from 2021.

Indian students have long preferred pursuing higher education opportunities overseas. Studying abroad introduces them to international competence, develops academic rigour, allows them to access courses that enjoy global recognition and are taught by world-class experts, thus making the students future-ready. A degree from a university in the US, Canada, Australia, Germany, or the UK also helps students build an international network.

But all this costs a lot of money, so students need to plan their finances well in advance.

Budget

Education inflation and fluctuating exchange rates often compel students to manage their funds efficiently. Understanding the expenses and creating a budget helps students master their finances while studying abroad.

Also read | Planning your child's education abroad? Residency via investment can help

Costs

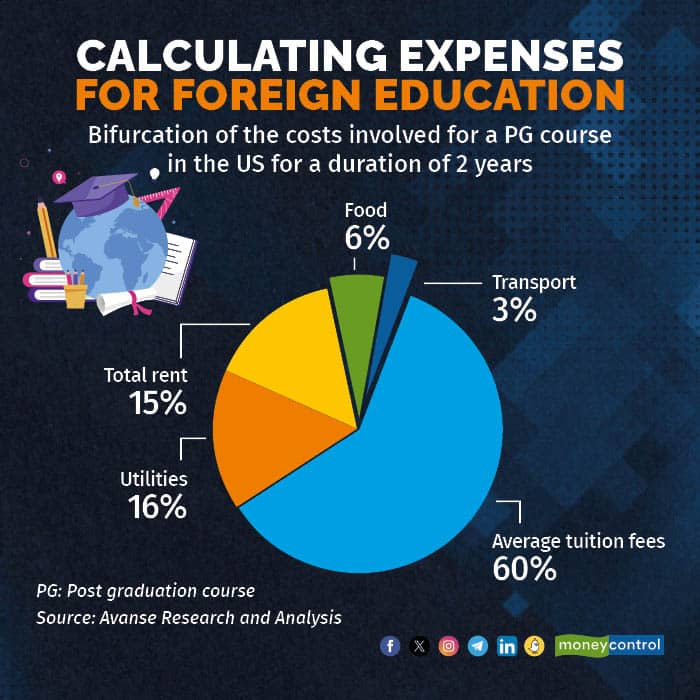

Before creating a budget, students must evaluate the various costs associated with studying abroad. Apart from the tuition fees and accommodation costs, they must also account for daily living expenses, such as the cost of meals and travel, health insurance, the cost of textbooks and other study materials, travel expenses to and from India, and miscellaneous costs for leisure.

Students can use an online College Course Expense Calculator to better estimate the total cost of studying abroad. Many financial institutions offer education loans that cover the overall cost of education.

Here’s a primer on preparing a budget for your foreign education.

Realistic estimates

Students must prepare a realistic estimate of their costs and needs. Overestimating their budget can lead to unnecessary expenditure and financial concerns. On the other hand, underestimating the finances required can also cause financial distress. Being aware of the costs and exchange rates helps students create a realistic budget that they can stick to.

Also read | Not just hospitalisation, travel insurance also compensates delayed flights, lost bags, laptops, passports

Education loan EMI calculator

Students who take education loans can use an online education loan calculator to estimate the EMI, allowing them to plan repayments in advance. Students can try various combinations of tenure and loan amount to find a suitable EMI, given their financial situation.

Track spends

Students can use budgeting apps to track their expenses. Making a note of how much they spend will help them stick to their budget and cut down unnecessary costs.

Emergency corpus

While living on a budget, students must also work on building an emergency fund. A contingency fund will help students manage their finances better. Students can set aside a portion of their monies for emergency use.

Earning while learning

Students can also find part-time employment opportunities as per the host country’s laws. Working for a few hours each week allows students to earn and manage their finances better, reducing their need to dip into their funds. It also safeguards them from fluctuating exchange rates, since they will earn and spend in the same currency.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.