For most of us, our salaries are credited in our savings accounts. Investments are made and loans are serviced from the same account. But savings bank accounts generally carry lower interest rates compared to those on fixed deposits. There are some small and new private banks that offer higher interest on savings accounts compared to leading private and public sector banks. You can use the savings account for parking your emergency corpus. It’s important to give some serious thought to know how much interest is paid by banks for leaving our funds in savings accounts.

New private banks offer higher interest rates

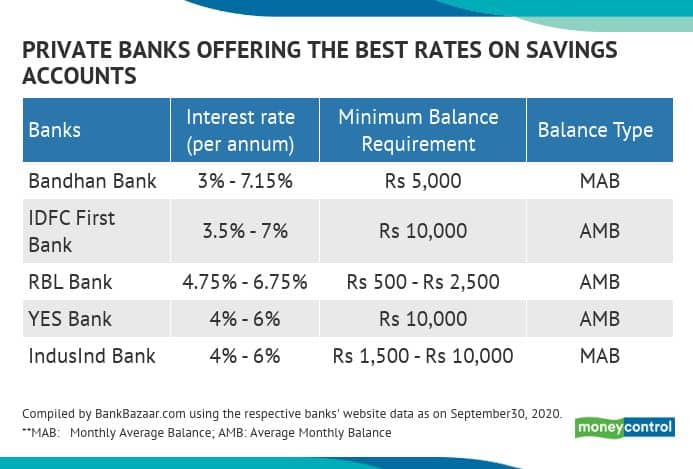

As per data compiled by BankBazaar, new private banks such as Bandhan Bank and IDFC First Bank offer interest rates of up to 7.15 per cent and 7 per cent, respectively on their savings account. Other private banks offer interest of up to 6.75 per cent. These interest rates are higher compared to leading private and large public sector banks. For instance, HDFC Bank and ICICI Bank offer 3 per cent to 3.5 per cent interest, the State Bank of India (SBI) and Bank of Baroda offer 2.70 per cent and 2.75 per cent interest respectively on their savings account.

Interest rate on savings account for all BSE listed public sector banks and private banks are considered for data compilation. Banks whose websites don't advertise the data are not considered. Minimum balance requirement for regular savings account and excluding basic savings bank deposit (BSBD) account are considered.

Minimum balance requirements are higher

The minimum balance requirement in savings accounts of private banks starts from Rs 500 and it goes up to Rs 10,000. This is kept higher by the banks compared to public sector banks because they are more interested in reaching out to the salaried middle class and self-employed professionals with their services. At IDFC First Bank and Bandhan Bank, the minimum balance requirement is Rs 10,000 and Rs 5,000 respectively. At leading private banks such as Axis Bank and HDFC Bank, the minimum balance requirement is Rs 2,500 to Rs 10,000. For ICICI Bank, the minimum balance requirement is Rs 1,000 to Rs 10,000.

Choose a bank with a long-term track record, good service standards, wide branch network and ATM services across cities; a higher interest on savings accounts would be a bonus.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.