Funding children’s education abroad is a costly affair for most parents. With the recent depreciation of the Indian rupee against the US dollar over the past six months, parents now need to save significantly more for their child's foreign education.

Assuming an inflation rate of 4 percent and a rupee depreciation of 3 percent annually, the cost of a four-year course could rise substantially. As per calculations by Athena Education, an education consulting firm for undergraduate studies abroad, if a course currently costs Rs 3.18 crore, in eight years it could increase to Rs 5.29 crore. To fund such expenses, parents might need to set aside around Rs 18,200 monthly in an equity mutual fund (assuming a 12 percent annual return) over 18 years. This strategy helps counter both education inflation and rupee depreciation.

However, besides your own savings, there are two other ways to fund children’s overseas education— loans and scholarships. Let's explore the education loan option and see if your child is eligible for one.

Education loans from banks

Most banks offer specialised education loan schemes for students pursuing overseas studies. These banks provide foreign education loans with interest rates ranging from 8.60 percent to 13.70 percent per annum as of March 11, 2025, as per data compiled by BankBazaar.com.

“The recent Budget 2025-26 offers significant relief to students by exempting education loan remittances from Tax Collected at Source (TCS), making loans from banks and Non-Banking Financial Companies (NBFCs) a more attractive option for funding overseas education,” says Rahul Subramaniam, Co-founder, Athena Education.

What it covers and what it doesn’t

An overseas education loan from a bank covers a comprehensive range of expenses associated with studying abroad. This includes tuition fees payable to the university, as well as accommodation costs, insurance premiums, and study-related expenses such as books and necessary equipment like laboratory apparatus or laptops. Additionally, the loan covers other essential expenses directly related to education, including resident permit charges, student union fees, library fees, and laboratory fees. Furthermore, the loan can also be used to cover expenses related to study tours, project work, thesis, and other course-related requirements, ensuring that students have an uninterrupted educational experience abroad.

Not everything gets covered though. “For instance, there are certain expenses that are not covered under their education loan scheme, which includes travel costs, to-and-fro air tickets, and fees for external coaching or private tuition abroad,” says a Bank of Baroda (BoB) spokesperson.

“Then banks won't pay for your study visa, any fees for entrance exams like the IELTS or GRE, or application fees for the colleges you want to attend,” says Ankit Mehra, Co-founder and CEO of GyanDhan, a firm that offers education loans and study abroad counselling to students.

It's essential for students to note that education loans typically do not cover personal or discretionary expenses, such as participating in extracurricular activities, purchasing a vehicle, taking vacations, or other personal expenses.

Also read | Rupee depreciation: How Indian students can minimise impact on overseas education budget

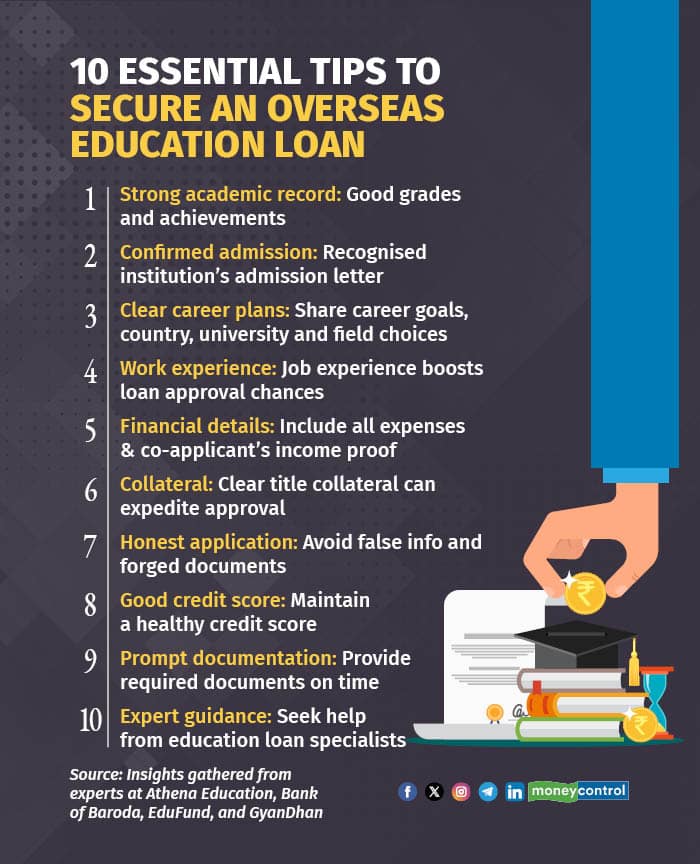

How lenders evaluate education loan applications

The loan amount approved by financial lenders varies depending on the destination country and the university. To determine this, lenders carefully assess the proof of admission letters and other documentation to verify the borrower's study plans.

A key factor in the loan approval process is the applicant's academic performance, which encompasses their past academic achievements and scores from standardised tests like GRE, GMAT, SAT, TOEFL, or IELTS.

“Then, lenders carefully assess the reputation of the selected institution and employment prospects of the course, as these directly impact future repayment capacity,” says Shridhar Hebbar, Chief Operating Officer, Kuhoo Finance, an NBFC.

To assess repayment capacity, lenders carefully review the financial history of both the student and co-borrowers. For substantial loans, collateral may be required, notes Hebbar.

According to the BoB spokesperson, acceptable collaterals for education loans include a mortgage of a property (such as land, house, or flat), bank deposits, government securities, public sector bonds, or life insurance policies held in the name of the student, parent, guardian, or guarantor.

Other critical factors considered during the assessment process include the proposed loan tenure and repayment structure.

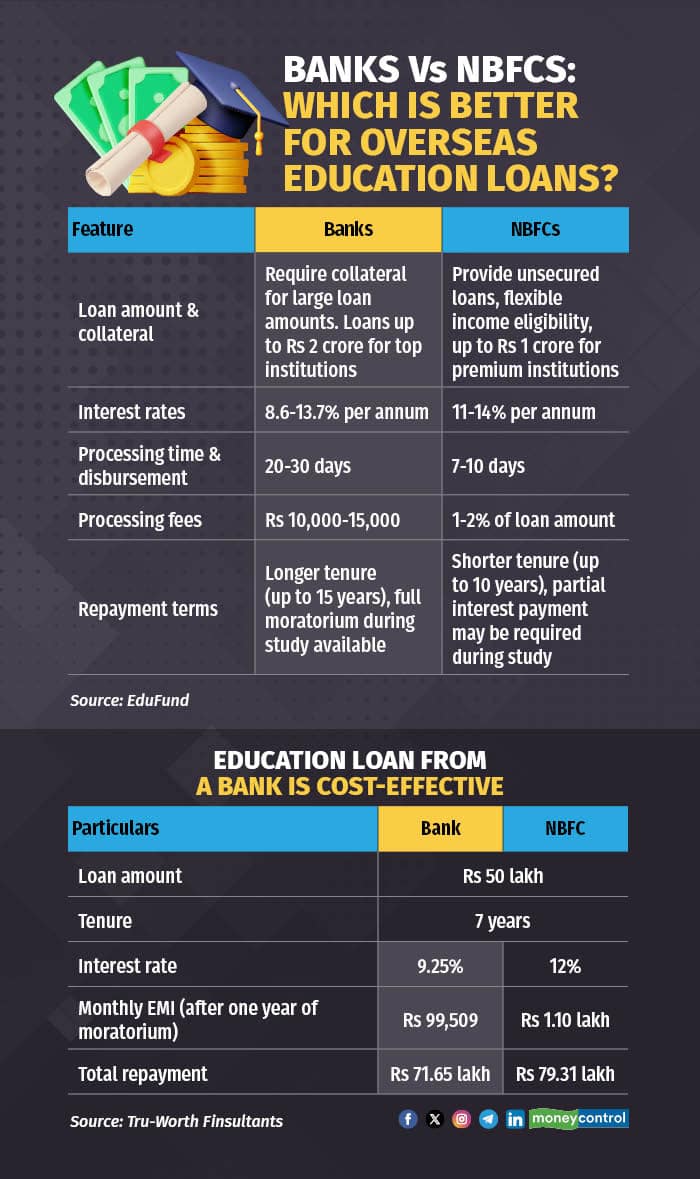

Banks or NBFCs: who offers better terms?

The decision between banks and NBFCs for education loans depends on individual student needs. According to Hebbar, while public sector banks typically offer lower interest rates and higher loan amounts, the process can be cumbersome and time-consuming due to extensive paperwork. In contrast, NBFCs provide more flexibility, and quicker processing times, making them an attractive alternative.

According to Eela Dubey, Co-Founder of EduFund, a SEBI-registered investment advisory firm that provides education counselling, an NBFC may be a more suitable choice for students lacking collateral and requiring immediate funding, despite potentially higher interest rates.

When selecting a lender, Dubey advises comparing interest rates, being aware of hidden fees, and checking for prepayment penalties, among other key considerations, to make an informed decision.

Also read | Education loan vs savings fund: What's the best way to fund your child’s education?

Education loans from international lenders

Students without collateral or a co-applicant may consider education loans from international lenders, which offer loans for select courses and universities. However, borrowing from an international lender requires careful evaluation of various factors before deciding.

When considering education loans from international lenders, take everything with a grain of salt. This holds true especially in the current economic climate when fluctuations in the valuation of the Indian rupee against the US dollar heighten exchange rate risk.

Hebbar explains that when students borrow in foreign currency (USD) from an overseas firm but return to India to work and earn in rupees, they incur substantial currency conversion costs. For example, a $50,000 loan taken when the exchange rate was Rs 75 per dollar but repaid at Rs 87 effectively increases the loan amount by nearly Rs 6 lakh without additional borrowing, he says.

USD-denominated education loans can offer distinct advantages, particularly for students planning to work abroad after graduation, notes Dubey. One major benefit is that some lenders do not require collateral or a co-signer, making it easier to secure funding. Additionally, repaying a USD-denominated loan helps build a US credit score, which can lead to better financial opportunities for those planning to work in the US. Furthermore, borrowers can avoid the risk of Indian rupee depreciation if they repay the loan in USD while earning abroad. In some cases, USD interest rates may also be lower than those for INR loans, making a foreign loan a more attractive option.

“When choosing international lenders, students must also verify the lender's credibility and track record," warns Mehra. He notes that some overseas non-bank lenders have previously faced liquidity issues, leading to delayed or suspended lending services, which can cause inconvenience to students in need of funds. In contrast, overseas banks are generally more stable, but their education loan offerings have been limited.

“Further, repayment terms could be more challenging due to differences in legal and financial systems,” adds Subramaniam.

Also read | Studying abroad: How to plan financially for your child’s foreign education

How soon should you repay?

Education loan repayment usually starts after a moratorium period, which typically spans the course duration plus a grace period of six months to one year.

BoB offers a maximum repayment tenure of 15 years, following a moratorium period that includes the course duration plus one year, regardless of the loan amount. Additionally, the bank suggests that students can benefit from a one percent interest rate concession by paying interest during the moratorium period from any available income source.

“Partial interest payments during studies, if feasible, significantly decrease compounded interest accumulation,” says Hebbar.

Hebbar recommends aiming to repay education loans within 5 to 7 years of graduation, rather than opting for the maximum 10 to 15 years of tenure. Although longer repayment periods result in lower monthly EMIs, they significantly increase the total interest paid.

However, it’s important to know that education loans in India are eligible for tax benefits under Section 80E, which can help lower the overall cost of borrowing.

According to Dubey, students should focus on completing their education and securing employment before prioritising accelerated loan repayment. Once in the workforce, increasing EMI payments as soon as possible can be an effective strategy to repay the loan quickly and minimise total interest paid over the loan term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!