Assets managed by women fund managers doubled to Rs 13.45 lakh crore at the end of January, while their number went up to 49 from 42 a year ago.

While the assets managed or co-managed by women are growing, their share of the overall industry remains miniscule. The bright spot, however, is that the number of women managers has gone up after remaining unchanged for the last two years.

Women managers or co-fund managers now handle around 20 percent, or Rs 13.45 lakh crore, of the total assets of the Indian Mutual Fund (MF) industry.

Total mutual fund assets jumped 27.52 percent to Rs 67.25 lakh crore at the end of January 2025 from the previous year.

Also read | Indian women now prioritise retirement and travel, planning for kids’ weddings takes a back seat

According to Morningstar Investment Research India’s 2024 report, the total open- and closed-end assets managed or co-managed by female fund managers were about Rs 6.66 lakh crore or 12.63 percent of the total mutual fund assets till January 31, 2024.

Latest data available with ACE MF shows that the count of overall fund managers inched up to 482 from 473 in the previous year. India had 433 male fund managers at the end of January 2025, two more than in the year-ago period.

With this, the percentage of women fund managers has also increased from 8.88 percent to 10.17 percent on a yearly basis.

Notably, the rise in assets managed by women has come despite two leading names — Anju Chhajer of Nippon India Mutual Fund and Sohini Andani of SBI Mutual Fund — leaving the industry in the past year.

Not all fund houses have women fund managers. There are 49 women managers in 25 fund houses. Six fund houses have three or more women overseeing MF schemes at the end of January, six had two and 13 fund houses had at least one woman fund manager.

Gender diversity

Numbers available with ACE MF show that a total of 339 schemes across 25 fund houses were managed or co-managed by women at the end of January.

Among these, ICICI Prudential Mutual Fund had the highest women representation at seven. Through 66 schemes, women fund managers handle Rs 2.27 lakh crore worth of assets at ICICI Prudential Mutual Fund.

Also read | Countering stereotypes is not easy, but India Inc has come a long way, says SBI MF’s Mansi Sajeja

At India's biggest asset management company – SBI Mutual Fund -- five women fund managers were handling assets worth Rs 1.88 lakh crore through 14 schemes.

Nippon India MF had two women fund managers handling Rs 1.53 lakh crore of assets through 26 schemes.

Top fund managers

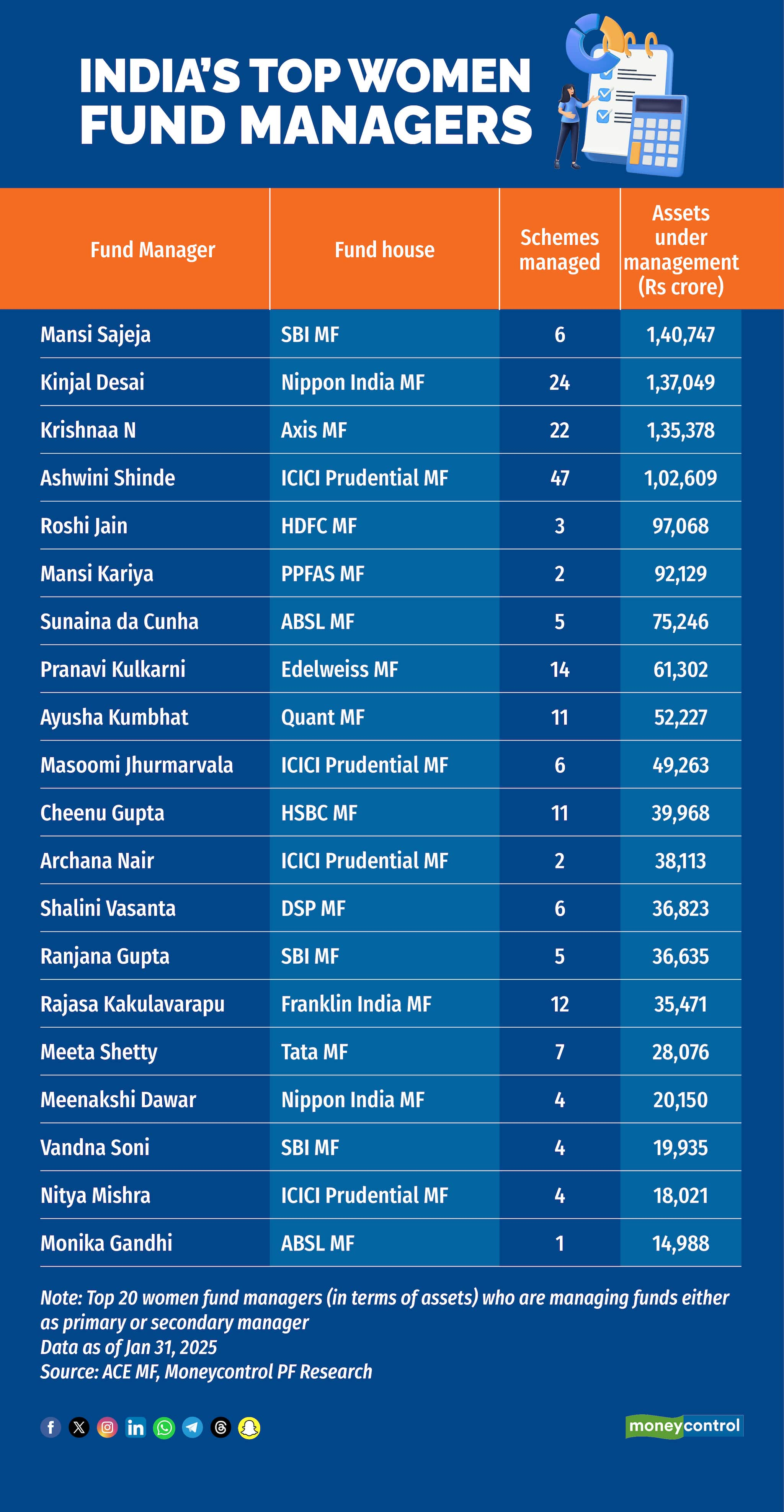

Data shows that the top five fund managers among the 49 women were handling around 45.55 percent or Rs 6.13 lakh crore of the assets managed by this group.

Mansi Sajeja of SBI MF was India's top women fund manager, with assets worth Rs 1.41 lakh crore. Next were Kinjal Desai of Nippon India Mutual Fund and Krishnaa N of Axis Mutual Fund, managing Rs 1.37 lakh crore and Rs 1.35 lakh crore, respectively.

To put things in perspective, India’s biggest overall asset manager, Manish Banthia, manages or co-manages Rs 3.49 lakh crore of assets at ICICI Prudential MF.

In terms of schemes among women fund managers, Ashwini Shinde of ICICI Prudential MF is managing or co-managing 47 funds, while Ekta Gala of Mirae Asset India MF is responsible for 30 funds. Kinjal Desai of Nippon India MF handles 24 schemes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.