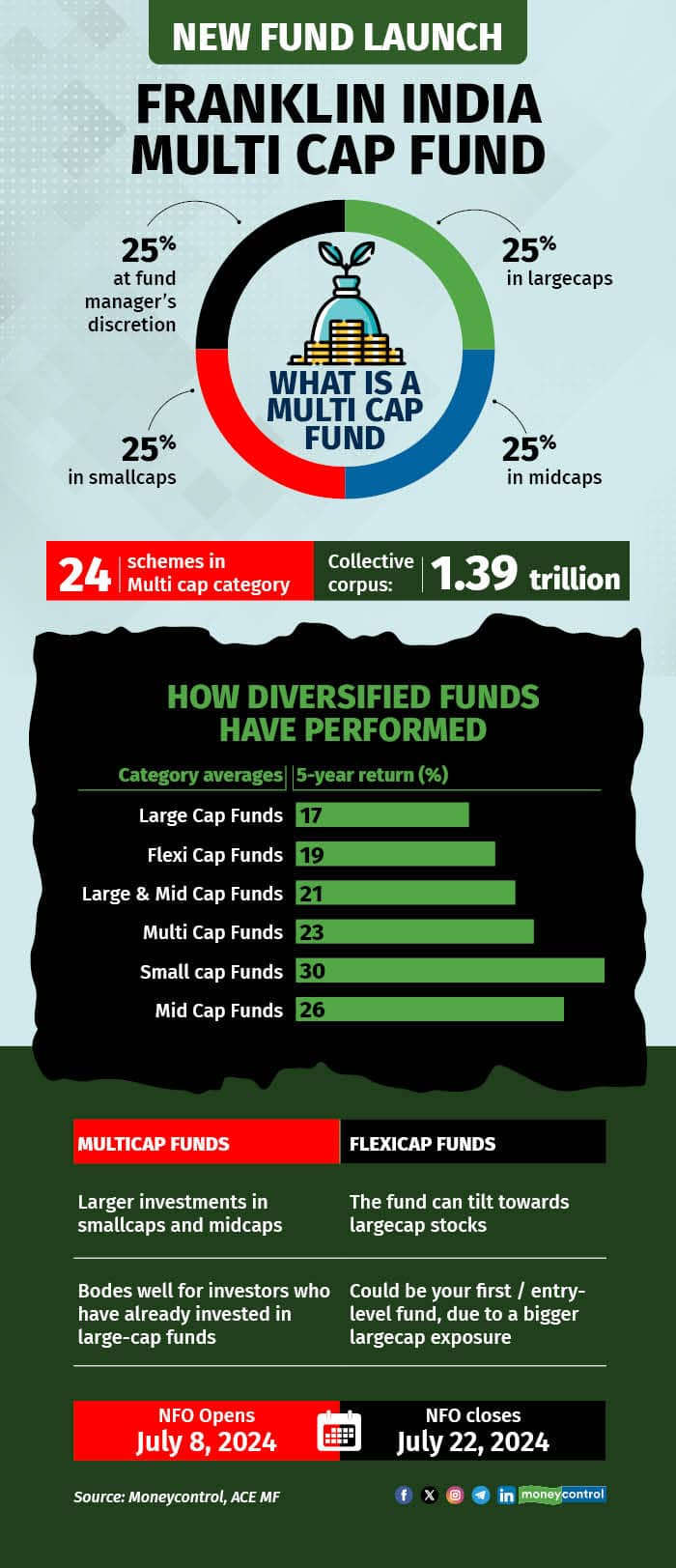

Market highs are not scaring away mutual funds from launching new schemes. On a day when the S&P BSE Sensex touched 80,000 levels for the first time in its history, Franklin Templeton India Mutual Fund launched a new equity scheme. Called Franklin India Multi Cap Fund (FMCF), this is a diversified fund that invests in stocks across large-caps, mid-cap and small-caps. The multi-cap segment, although young, is a crowded segment. There are 24 schemes with a collective corpus of Rs 1.39 lakh crore, as per ACE MF data.

Here are 4 things you need to know about this fund.

Diversified, but multi-capBeing a multi-cap fund, this fund must have a meaningful presence in all three segments — large-caps, mid-cap and small-caps, with a minimum of 25 percent investments in all three. It is free to invest the remaining 25 percent in any segment it wishes to. In November 2020, the capital market regulator, Securities and Exchange Board of India (SEBI), introduced a new category of funds called the flexi-cap category. Schemes in this category could invest across large-caps, mid-cap and small-caps in any proportion they like as against a multi-cap fund that has a minimum threshold for each of these categories. Since Franklin Templeton India’s existing scheme, Franklin India Flexi Cap Fund, got categorised as a flexi-cap fund, it didn’t have a multi-cap fund. The fund house has now filled that gap by launching FMCF.

Most flexi-cap funds tilt towards large-cap stocks. An analysis of the latest portfolios of flexi-cap funds shows that they hold 58 percent in large-cap stocks, 19 percent in mid-cap stocks and just about 17 percent in small-cap stocks, on an average.

New fund launch - Franklin India Multi Cap FundSmall caps can give you a taste of new sectors

New fund launch - Franklin India Multi Cap FundSmall caps can give you a taste of new sectorsR. Janakiraman, Chief Investment Officer, Franklin Templeton India Asset Management says that the small-cap segment offers good investment opportunities that mustn’t be missed. Between 2018 and 2013, he showcases the rise in listed digital companies across seven sectors; Retail, Food Technology, Software, Insurance, Fintech, Social / Media, and Logistics, which were almost totally absent in 2018. Between 2020 and 2023, he says there were over 100 Initial Public Offerings (IPOs), of which just 3 percent of issuances have been in the large-cap space. The rest have been in the small- and mid-cap space.

Nifty 500 versus Nifty 500 MulticapThe benchmark index of FMCF is the Nifty 500 Multicap 50:25:25 index, which invests 50 percent in large-caps and then 25 percent each in mid-cap and small-cap stocks. This is mostly in line with how multi-cap funds invest.

On the other hand, the Nifty 500 index has around 70 percent allocation to large-caps. Most flexi-cap schemes tend to move around that kind of large-cap allocation. A flexi-cap scheme has more flexibility to invest in - and switch between - different market segments. Which one should you go for?

Both multi-cap and flexi-cap funds offer you diversification across large-caps, mid-cap and small-caps. But if you already have significant exposure to large-cap stocks, it’s better to opt for multi-cap funds as all multi-cap funds would invest at least 25 percent each in small-cap and mid-cap stocks and another 25 percent, at least, in large-caps. For the remaining 25 percent, the fund manager has her discretion.

Although mid-cap and small-cap stocks are more volatile than large-cap stocks, there is no clear winner on a year-to-year basis, as per a Franklin Templeton analysis. Looking at calendar year returns from 2006 and 2023, the fund house observed that large-cap stocks (represented by the Nifty Large-Cap 100 index) outperformed in seven calendar years. Mid-cap stocks (represented by the Nifty Midcap 150 index) outperformed in three years. Small-cap stocks (represented by Nifty Smallcap 250 index) outperformed in seven years. This, experts say, points to a reason that a multi-cap fund bodes well if you wish to have fewer funds in your portfolio.

(Dhuraivel Gunasekaran contributed to this story)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.