The National Highways Authority of India (NHAI) is awaiting final approvals from the Ministry of Road Transport and Highways (MoRTH) and the Ministry of Finance (FinMin) to prepay loans worth Rs 18,000 crore to Rs 20,000 crore by the end of March 2025.

The NHAI’s debt was pegged around Rs 3.3 lakh crore at the start of April 2024. It is now estimated to be around Rs 2.8 lakh crore.

NHAI plans to use the gross budgetary support (GBS) in Budget 2024-25 for the purpose, multiple officials aware of the ongoing discussions told Moneycontrol.

"A proposal to prepay loans worth Rs 18,000 crore - Rs 20,000 crore has been sent to the central government for approval. Prepayment of these higher interest loans will help NHAI save interest cost of around Rs 450 crore," a senior NHAI official told Moneycontrol.

So far in 2024-25, a significant portion of MoRTH's capital expenditure has gone to help NHAI refinance its debt levels. The NHAI has utilised around Rs 40,000 crore of the highway ministry's budgetary allocation to repay loans.

"The NHAI was earlier expected to repay debt using funds raised from asset monetisation, but the process of asset monetisation has been on the downturn so far in the current financial year," a second official from the NHAI told Moneycontrol.

Emails sent to the MoRTH and NHAI remained unanswered till the time of publishing this report.

The central government had, in September 2024, started discussions with NHAI's long-term bond holders for the prepayment of three bonds, a letter sent by the NHAI on August 11 to one of the bondholder banks, seen by Moneycontrol, showed.

As part of the negotiations, the central government has reached out to the State Bank of India (SBI), Punjab National Bank (PNB), Aditya Birla MF, Axis MF, Morgan Stanley, and ICICI Bank, all of which have subscribed to the bonds.

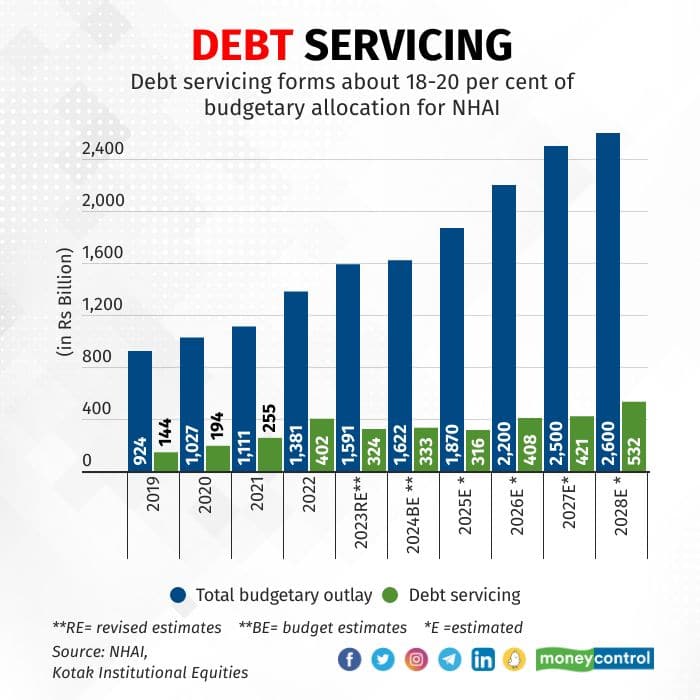

Budgetary allocation to MoRTH was raised by three percent to around Rs 2.78 lakh crore for 2024-25 from 2.7 lakh crore a year back. Out of the total Rs 2.78 lakh crore, the NHAI has been allocated around Rs 1.68 lakh crore as part of MoRTH’s capital expenditure plan for 2024-25, a 3.9 percent increase from 2023-24, when it was allocated Rs 1.62 lakh crore.

As per the revised estimates of the government, the NHAI spent around Rs 1.674 lakh crore in 2023-24.

NHAI debt restructuringThe central government is expected to shoulder the capital expenditure requirements of the NHAI for the next decade or until the NHAI can sustain its own debt repayment through toll revenues, officials mentioned above said.

"NHAI's market borrowing is expected to be capped till around 2035 in order to ensure that its debt levels fall but highway construction and awarding continue to grow at the same time," one of the officials said.

As part of the government's strategy to reduce NHAI's debt, the central government had made no provision for borrowings by the highway developer in 2024-25, according to the budget document for 2024-25. The current financial year marks the third in a row when the NHAI's internal and extra-budgetary resources (IEBR) has been set as negligible, in an attempt to stop its debt ballooning to unsustainable levels.

As part of Budget 2022-23, the government projected NHAI’s IEBR to fall to around Rs 1 lakh from Rs 65,000 crore in 2021-22. IEBR constitutes funds raised by NHAI by way of profits, loans, and equity.

The officials also said that, as per government estimates, India is expected to build a robust world class highway network by 2035, following which maintenance work will form the bulk of MoRTH's and NHAI's capital expenditure.

"Both MoRTH's and NHAI's capital expenditure and need for market borrowing is expected to fall significantly after 10 years," the second official said.

The government also expects the private road sector in the country to increase capital expenditure over the next decade. This will help reduce the burden of highway development in the country on the central government.

In order to promote private capex into the road sector, the Centre has already sidelined the Bharatmala project and has asked MoRTH and NHAI to push for more public-private partnership (PPP) projects to develop highways in India

MoRTH is planning to award road projects under the PPP mode, with NHAI expected to soon come up with tenders for 15 road projects worth Rs 44,000 crore, covering 900 km, for bids under the Build-Operate-Transfer (BOT) mode. If successful, this could mark the comeback of PPP projects in highways.

NHAI’s debt saw a 14-fold rise in less than seven years between 2014-15 to 2022-23, the highway authority's debt stood at Rs 3.44 lakh crore at the end of January 2022, against Rs 24,188 crore in 2014-15.History of NHAI debt

NHAI’s debt saw a 14-fold rise in less than seven years between 2014-15 to 2022-23, the highway authority's debt stood at Rs 3.44 lakh crore at the end of January 2022, against Rs 24,188 crore in 2014-15.History of NHAI debtNHAI’s debt saw a 14-fold rise in less than seven years between 2014-15 and 2022-23. The highway authority's debt stood at Rs 3.44 lakh crore at the end of January 2022, against Rs 24,188 crore in 2014-15. The government is now looking to reduce it to Rs 1 lakh crore.

The Finance Ministry had asked MoRTH in 2023 to reallocate the capital expenditure in the budget for other purposes.

“The finance ministry had asked MoRTH to reallocate capital expenditure into other avenues like reducing the debt of NHAI, reducing import dependence of road construction equipment, especially tunnelling equipment from China, and setting up institutions to boost skill development,” another official said.

Following the finance ministry’s suggestion, MoRTH is now looking to utilise the Rs 2.78 lakh crore allocated to the ministry in Budget for 2024-25 to reduce the debt of NHAI.

NHAI had raised funds through fixed coupon rate bonds, with tenures of five, 10, 15, 20, 25 and 30 years, respectively. A number of these bond issues, the last of which came in 2021-22, are maturing between 2025 and 2030. The move would allow NHAI to deploy more capital for strengthening the highway network, and bring down interest payments, which are taking up a big chunk of the government’s annual budget allocations.

Slower highway construction and awarding; lower fund utilisation by MoRTHProject execution has also been on the fall in 2024-25 as fewer projects were awarded in 2023-24 after the cabinet did not clear the proposal sent by MoRTH in October 2023 to develop 30,600 km of national highways by 2031-32 at an estimated cost of Rs 22 lakh crore under the Bharatmala Pariyojana.

"Around 5,100 km of national highways have been constructed in FY25 till December 2024, as against 6,200 km of national highways that were constructed in FY24 till December 2023," another senior MoRTH official said, adding that due to lower awarding and project execution, MoRTH's capital expenditure in FY25 has been significantly lower in the first 9 months, compared to the same period in FY24.

In FY25, MoRTH awarded road projects for the construction of around 2,500 km and one BoT project till December 2024. In the same period in FY24, road projects for the construction of around 3,100 km were awarded till December 2023. In FY23, road projects for the construction of around 7,100 km were awarded till December 2022.

MoRTH has spent Rs 1.75 lakh crore to Rs 1.8 lakh crore as capital expenditure till December 2024 in FY25, compared to Rs 2.15 lakh crore till December 2023 in FY24.

ICRA forecasts a 30 percent on-year decline in road awarding to 8,500-9,000 km in FY25, compared with the government’s target of 10,500 km. The Centre awarded 8,581 km of road projects in FY24, against a target of 13,290 km.

The highway ministry had constructed around 12,349 km of national highways in FY24 but missed the target of 14,000 km.

The ministry has been missing its highway construction target for the past three years. The building of national highways peaked during the pandemic-hit FY21 when lockdowns helped accelerate construction, touching an all-time high of 37 km a day, leading to a record 13,327 km of highways being built.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.