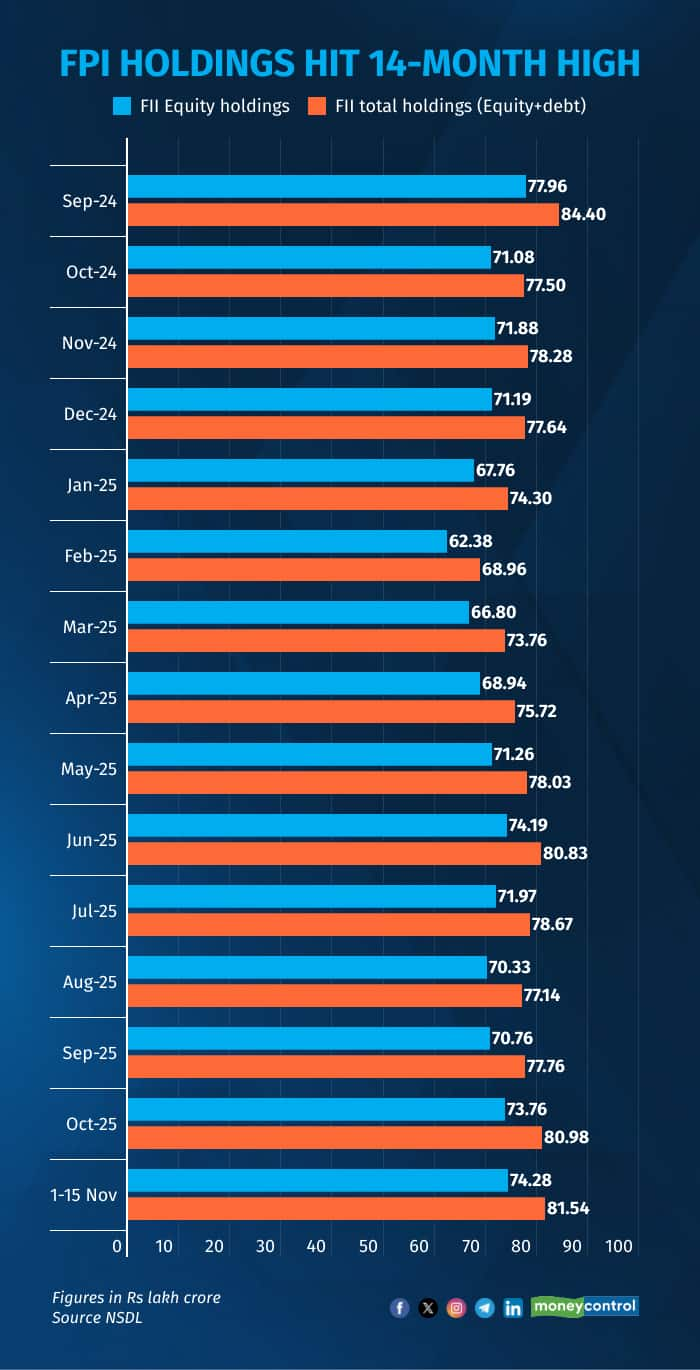

Foreign portfolio investors’ (FPIs) holdings in domestic securities climbed to a fourteen-month high in the first half of November. This surge came even as Foreign Institutional Investors (FIIs) remained net sellers during the period.

In the first fifteen days of November, FPIs’ assets under custody rose to Rs 81.53 trillion — the highest since September 2024 — with Rs 74.28 trillion parked in equities and the rest allocated to debt and hybrid instruments, according to data from the NSDL.

The rise in foreign exposure coincided with gains in the broader market, with both the Sensex and the Nifty advancing nearly 1.5 percent during the period. This followed a strong October, when the benchmark indices had rallied 4.5 percent each, while the broader BSE MidCap and SmallCap indices gained 4.7 percent and 3.2 percent respectively.

Despite the increase in overall holdings, FIIs remained cautious. They sold equities worth about Rs 3,166 crore in the first half of November while purchasing roughly Rs 2,693 crore in debt. This came after a strong buying streak in the previous month, when they had infused more than Rs 10,285 crore into equities and Rs 16,124 crore into debt.

Sector-wise flows reflected sharp divergence. IT stocks saw the steepest FII pullback at Rs 4,873 crore, followed by consumer services, which recorded outflows of nearly Rs 2,918 crore. Healthcare and power each witnessed outflows of about Rs 2,500 crore, while FMCG and financial services saw withdrawals close to Rs 2,000 crore apiece.

Consumer durables and services logged outflows of Rs 1,379 crore and Rs 673 crore respectively, while chemicals and automobiles recorded outflows of Rs 518 crore and Rs 385 crore.

A few pockets still attracted meaningful interest. Telecommunications stood out with inflows of Rs 9,400 crore. Oil and gas followed with Rs 2,990 crore, while capital goods drew Rs 788 crore in fresh FII investment.

Analysts say Indian equities are finding renewed support from expectations of easing India–US trade tensions, improving corporate earnings prospects, and stability in macroeconomic conditions.

They add that FII outflow pressures may moderate further as policy support strengthens. Recent pro-growth measures — including GST rate cuts, a steep repo rate reduction in June, and an upgrade to India’s sovereign rating by S&P — have reinforced optimism that foreign appetite for Indian assets could continue to firm up in the months ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.