If you have been having a large holding of mid-cap and small cap stocks or mid-cap and small-cap funds in your portfolio during the past six months, you would have seen a major erosion in your holding value. This is because both BSE Mid-cap and Small-cap indices has fallen around 11% YTD. This is against a marginal rise in BSE Sensex of around 2.25 per cent during the period.

“A lot has changed since the start of 2018. The mid- and small-cap space seems to be losing momentum. The sharp fall in the mid- and small-cap sectors is a result of many factors such as persistent selling by foreign investors and institutional investors, unsustainable high valuations, decreasing rupee value against dollar, a sharp increase the crude prices, uncertain and negative global cues including geopolitical concerns and repositioning of holdings by mutual funds to align with new classification by Securities and Exchange Board of India (Sebi),” Rahul Agarwal, Director Wealth Discovery/EZ Wealth said.

The correction in the mid- and small-cap stocks and its consequent impact on mutual funds, mainly on mid- and small-cap funds, after a stellar performance over the past two years, must have set you thinking on what you should be doing with your holding and what future position you should take on the mid- and small-cap space. Should you exit your mutual fund holdings or is the correction a good time to buy some more?

Agarwal says the correction can be used as an opportunity to exit non-performing funds and buy ones with a good track record. “If you are a long-term investor, it’s time to capitalise on the downturn. Wise investors always find opportunities when everyone is selling. In the near term, the market may move sideways but in long term market it regain momentum and investors who dared to take the risk in mid- and small-cap stocks and funds will find their portfolio in a much better state than those investing in large-cap stocks. At this point in time, investors should exit non-performing funds and move into ones with better performance track record and quality fund management style,” he said.

S Sridharan, Head, Financial Planning, Wealthladder Investment Advisors advises capping mid- and small-cap exposure to 30 per cent of the portfolio. “At any point in time, mid- and small-cap exposure shouldn’t be more than 30% of the portfolio. Those who have more than 30% exposure should trim their holding. Fresh investment through SIP mode is advisable, that too if the investors have a time horizon of not less than 5+ years. Lump-sum investment in small- and mid-cap funds at this juncture is not advisable,” he said.

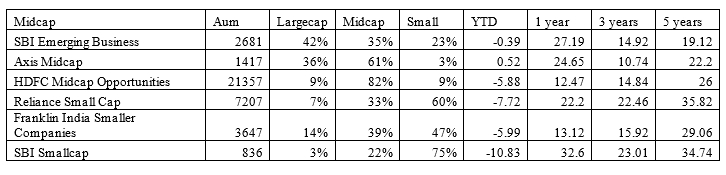

Below are Sridharan’s top mid- and small-cap picks:

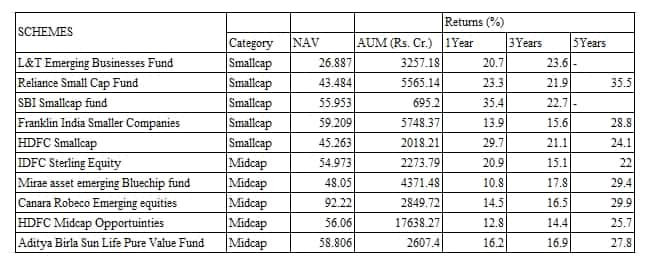

Rahul Agarwal suggests the following 10 options:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.