April 17, 2017 / 19:45 IST

Kshitij Anand

Moneycontrol News

The S&P BSE Sensex rose by about 3 percent for the month of March supported by strong global and domestic liquidity. The domestic mutual funds (MFs) turned out to be net buyers in equity for the month of March 2017.

Mutual Funds were net buyers of equities in 21 trading session worth Rs 2,368 crore, as against net buying of Rs 1,850 crore in February 2017; however, the asset under management (AUM) dipped slightly.

The total AUM of the mutual fund industry decreased by 1.9 percent (Rs 34,428 crore) to Rs17.54 lakh crore for the month of March 2017, IDBI Capital said in a report.

On a month-on-month (MoM) basis, five categories namely Balanced, ELSS, Other ETF’s, Equity Funds and Infrastructure Debt saw growth in AUM while categories like Income, GILT, Liquid, Gold ETF’s & FOF Overseas saw a decline, it said.

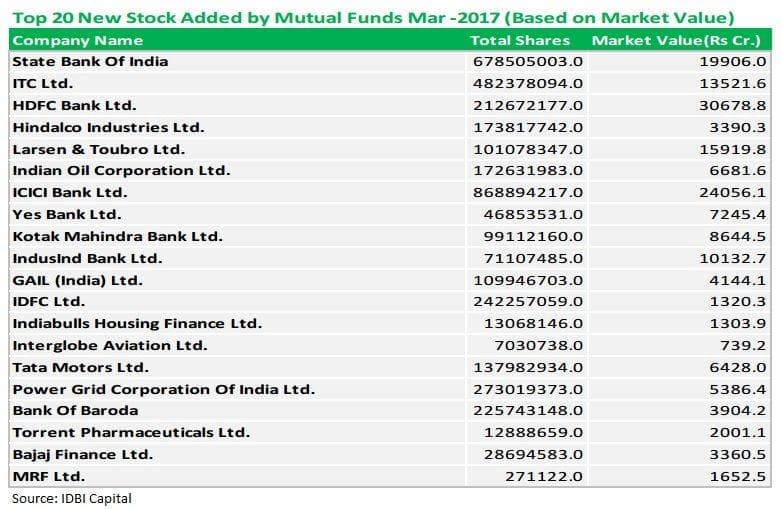

Top twenty stocks which mutual funds bought in the month of March based on market value include names like SBI, ITC, HDFC Bank, Hindalco Industries, L&T, IOC, ICICI Bank, Yes Bank, Kotak Mahindra Bank, IndusInd Bank, GAIL, IDFC, Indiabulls Housing Finance, Tata Motors, MRF etc. among others.

The AUM of Equity Fund increased by 4.1 percent or by Rs 18,842 crore to Rs 4.82 lakh crore in March 2017 over February 2017. The assets of ELSS increased by 8.2 percent or by Rs 4,679 crore to Rs 61,403 crore.

Equity Funds registered net inflow of Rs 5,307 crore and ELSS Fund saw a net inflow of Rs 2,906 crore. Thus, total equity funds witnessed net inflow of Rs 8,213 crore.

SIP Revolution is coming

The bulls run witnessed in the Indian market has taken everyone by surprise but retail investors will not let this opportunity go this time around. The systematic investment plan (SIP) has made the job easier for investors who are willing to jump into equity markets.

Investors pumped in a record Rs 3.43 lakh crore in mutual funds (MFs) in 2016-17, mainly into income and liquid schemes, more than double of Rs 1,34,180 crore seen in 2015-16, according to the Association of Mutual Funds in India (Amfi) data.

Some experts say that the trend has just started as we are in the middle of SIP revolution. As the attractiveness of other asset classes such as gold, real estate, fixed deposits fade more and more money will be pumped into equity markets via MFs.

"We are in the middle of a SIP revolution, Equity is the most attractive asset class and there will be big inflow from retail investors," Porinju Veliyath, MD & Portfolio Manager, at Equity Intelligence India told Moneycontrol.com.

"USD 100 bn is not a big amount it's just 5% of our GDP, less than a third of the planned spending in infrastructure by the government. We have been accustomed to thinking small, but now is the time to think big and make it large," he said.