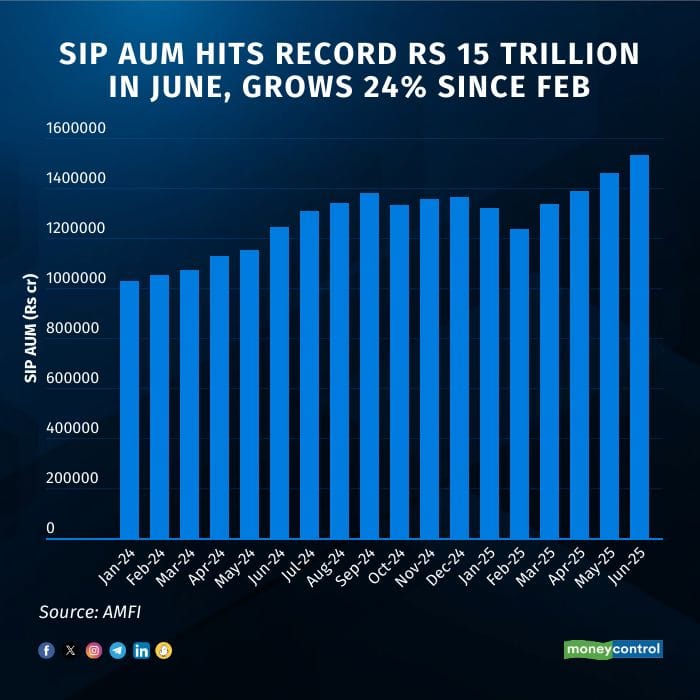

The SIP AUM surpassed the Rs 15 trillion milestone in June 2025, reflecting sustained investor interest despite heightened market volatility. Since February 2025, the SIP AUM has grown by over 24 percent to Rs 15.30 trillion from Rs 12.38 trillion.

The journey of SIP AUM began with its first trillion in early 2016. It took over five years to cross Rs 5 trillion in July 2021. The subsequent rise to Rs 10 trillion took nearly 31 months, achieved in January 2024. However, the next leap—from Rs 10 trillion to Rs 15 trillion—occurred in just 17 months, marking the fastest Rs 5 trillion increase to date.

This surge pushed the share of SIP AUM in the total mutual fund industry to an all-time high of 20.57 percent in June 2025. Over the past 12 months, this share has consistently hovered around 20 percent, according to data from the Association of Mutual Funds in India (AMFI).

The momentum in SIP inflows was further supported by the 2025 Union Budget, which introduced tax relief measures such as enhanced standard deductions and revised tax slabs. These reforms have increased disposable income, especially for salaried individuals and middle-class investors, enabling more retail participation in SIPs.

Net equity inflows climbed to Rs 23,568 crore in June, registering a 24 percent month-on-month rise from Rs 18,994.56 crore in May. In April, equity inflows were approximately Rs 24,253 crore. Concurrently, mutual fund SIP contributions reached a record high of Rs 27,269 crore in June, up 2 percent from Rs 26,688 crore in May, and slightly above April’s Rs 26,632 crore.

Ajay Garg, CEO of SMC Global Securities, noted that SIPs offer investors a disciplined approach by averaging costs over time. "SIPs allow investors to buy more units when prices are low and fewer when prices are high, effectively reducing the average cost per unit. This makes SIPs especially appealing during periods of market turbulence," he said.

Following a sharp decline since October 2024, Indian markets have rebounded strongly since mid-March. The Sensex and Nifty have each surged by 13%, while the broader BSE MidCap and SmallCap indices have risen by 18.5% and 23%, respectively.

Nikunj Saraf, Vice President at Choice Wealth, noted that sustained SIP inflows, reduced redemptions, strategic diversification, and robust market fundamentals have reinforced investor confidence. “This reflects the growing trust in mutual funds as a disciplined investment avenue and the enduring structural faith in equities, even amid market volatility,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.