Manoj Nagpal

2017 was a momentous year for mutual funds. It was a record year, both in terms of new investors and the amount of net inflows into MFs. Equity and equity-oriented balanced mutual funds saw a net inflow of Rs.2,68,000 crore (USD 42 bn) in 2017.

To put this in perspective, this is 3 times of mutual funds net inflows in 2016 and is almost 10x of the MF inflows in 2007 (the peak year of the previous bull run). These unprecedented inflows in mutual funds have shown a marked investor preference for some mutual funds and investors have ignored some other mutual funds completely. Investors have fuelled investments in certain mutual funds by investing a large part of their new inflows in them. In this article, we bring to you the top mutual funds chosen by investors for 2017 based on how they invested in 2017.

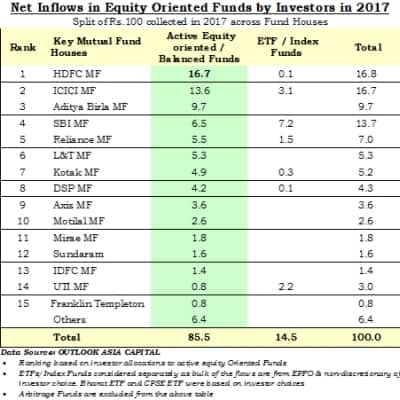

On an overall fund house basis, HDFC Mutual Fund was the most preferred fund house by investors for fresh allocations by investors in 2017 with a 16.7% market share for active equity oriented funds followed by ICICI Prudential MF (13.6%) and Aditya Birla MF (9.7%).

The top 5 mutual fund schemes by investor preference in terms of investments in each of the categories of equity and balanced funds were as below.

Though there are over 2000 mutual fund schemes, the top 5 funds in each category of above garnered between 45-75 percent of the net inflows in each of the category thus showing the almost dominance of the top 5 funds in each of the category. The largest dominance was seen in the Dynamic asset allocation category which saw almost 41 percent of the net inflows going to ICICI Pru Balanced Advantage Fund – which is the original pioneer of this category. The Balanced Fund category had a dominance by HDFC Mutual Fund with two of it’s fund viz. HDFC Prudence Fund and HDFC Balanced Fund cornering almost 31% of the net inflows. Incidentally, HDFC Prudence Fund is also now the largest mutual fund scheme in India with assets of over Rs 38,000 cr (USD 6 bn)

(The author is a consulting editor for Moneycontrol)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.