Highlights:

- Decline in overall volume in Q1 FY20 driven by a significant drop in scooter segment

- Improved realisation led by price hikes and a rich product mix

- Business outlook for 2W segment is weak for the short term, positive for the long term

- 3W continues to show strong momentum

- Valuation at elevated levels

--------------------------------------------------

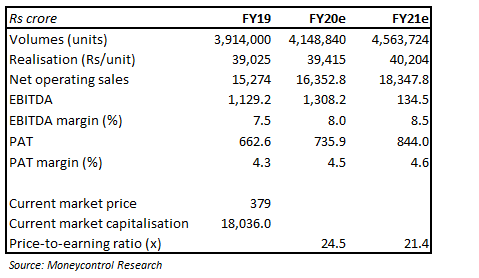

TVS Motors (TVS) (CMP: Rs 379.65, mcap: Rs 18,036.68 crore) posted a decent set of numbers in a challenging environment for the entire automobile industry. It posted growth in the net revenue driven by improved realisation. Operating margin also remained stable despite low volume and negative operating leverage.

We have a neutral stance on the company despite its strong presence in the domestic market. The reason being its lofty valuation (21.4 times FY21 projected earnings) compared to its peers (14-15 times).

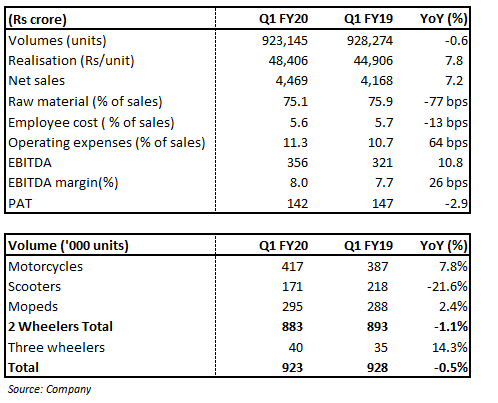

Quarter in numbers

Key highlights

Volume – motorcycle and three-wheeler witnesses growth

Amid the weakness in demand and subdued consumer sentiment, TVS posted a year-on-year (YoY) volume decline of 0.6 percent, hit by 21.6 percent YoY decline in scooters volume, which got partially offset by 7.8 percent and 14.3 percent growth in motorcycle and three-wheeler segments, respectively.

Improved realisation

Overall realisation improved 7.8 percent (YoY) led by a rich product mix and multiple price hikes effected by the company to pass on the rise in raw material (RM) prices. Improvement in realisation helped the company post 7.2 percent YoY growth in its net revenue.

In terms of operating profitability, earnings before interest, tax, depreciation and amortisation (EBITDA) margin witnessed a marginal uptick of 26 bps on a YoY basis. The EBITDA margin continues to be much lower than the double-digit margin guidance given by the management.

Outlook

2W industry outlook sluggish in near term

The growth in two-wheeler industry continues to be lacklustre with no signs of respite coming in. Lower than average monsoon is expected to aggravate the already ailing sector. According to the management, the short-term outlook for the overall two-wheeler industry continues to be muted because of subdued consumer demand led by non-availability of retail finance, and higher insurance cost and rising vehicle prices due to implementation of safety regulations.

The environment for two-wheeler segment in India would continue to be challenging and would witness flat volume growth in the first half of FY20. However, second half of FY20 should be strong. The management cited pre-buying ahead of BS VI implementation, good festive season and reduction in the interest rate as the key triggers for the industry.

In the long term, we, however, believe that there is a huge potential for two-wheelers in India and strong demand is expected to come from both rural and urban areas on the back of very low penetration and rising disposable income. It is expected to get boost from rural market led by the government’s focus on rural areas and increase in minimum support price (MSP).

Strong 3W market

The overall three-wheeler market continues to gain strength after the end of the Permit Raj. This has led the company to post strong volume growth in the 3W segment. We believe that TVS will continue to perform well in this space.

Stable export markets

The overall export markets seem to be stabilising and benefiting TVS, as is evident from its quarterly volume numbers, which witnessed a YoY growth of 10 percent.

Currently, TVS caters to demand from 62 countries and has been gaining significant market share there. In fact, it has been outperforming industry growth in those markets, primarily, on the back of its product range.

Operating margin – Far away from double-digit guidance

Despite cheaper input prices, EBITDA margin continues to be under pressure due to lower volume growth amid weakness in demand. The company is still far away from its target of achieving double-digit EBITDA margin. The management has highlighted that new launches, strong traction in the export market, commodity cost benefit and cost efficiencies would help the company achieve its target.

Valuation continues to be at elevated levelsDespite 37 percent fall in the stock price from its 52-week high level, the valuation for TVS continues to be at elevated levels compared to its peers. The company is trading at 21.4 times FY21 projected earnings, which leaves little comfort for investors.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.