Sachin Pal

Moneycontrol Research

Highlights:

- Delivered a strong performance in Q3FY19

- Strong market positioning in the North East

- Generates best-in-class EBITDA per tonne

- Operating at 60-65 percent capacity- Valuations look attractive after recent stock correction

-------------------------------------------------

Star Cement is the largest cement manufacturer in North East India and enjoys a strong positioning in the market. The outlook for the company looks positive as the demand in the region continues to be fairly robust and cement realisations are stable. Operational performance in Q3 was also strong as the company regained its mojo after a couple of lacklustre quarters and reported margins in excess of 29 percent. The stock offers an attractive investment proposition at this point, considering its capacity expansion, earnings outlook, moderation in commodity prices and current valuations.

Market leader in North East

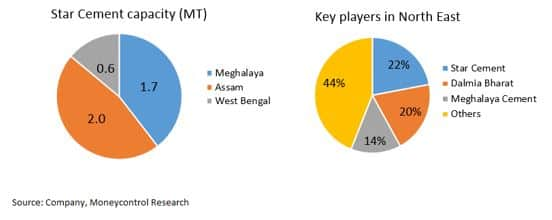

Star Cement is the largest cement manufacturer in the North East with a grinding capacity of 4.3 million metric tonne (MT), which translates to an estimated market share of 22-23 percent in the region. The company is one of the lowest cost cement producers in the country owing to integrated operations, which includes captive limestone mine and an in-house power plant. Given the unique market positioning in the region with fairly low competitive intensity, its unitary realisations and EBITDA stand in excess of Rs 6,000 and Rs 1,800, respectively.

Promoted by the Century plywood group

The company is controlled by the Bhajanka family, the promoters of Century Plywood—the largest producer of plywood, laminates and block-boards in India. The promoter group owns around 70 percent stake in the company and has experience of more than 40 years in the building material industry with business interests spanning across Plywood, Ferro Silicon and Granite. Sajjan Bhajanka is the Chairman of the Star Cement, while Sanjay Agarwal is the Managing Director (MD), who is also the MD of Century Plyboards.

Sufficient capacity headroom to capture growth

The company is operating at a capacity utilisation of about 60-65 percent and remains well positioned to benefit from a demand uptick in the northeast. The demand outlook is positive. With no new capacities in the pipeline, the price trend is anticipated to move in favour of the cement players in the near to medium term.

The company has also debottlenecked its clinker unit by 0.2 MT to 2.8 MT in the current financial year. It is planning to further debottleneck the clinker unit by the same amount over the next few months. Also, the railway sliding at its Guwahati plant is expected to commence operations in Q4FY19.

The company is in the process of setting up 2 MT grinding capacity in Siliguri, West Bengal, with a capital expenditure of around Rs 200-250 crore. This facility is expected to start by FY20-end.

Cost pressures to ease going forward

Operating profit margins have been on a decline amid rising cost pressures. Expenses have increased due to multiple factors. For example, freight expenses jumped as the related subsidies expired in January 2018. Also, the anticipated axle load benefits (the increase in the carrying capacity of a vehicle by 20-25 percent) has not had a positive impact on the transportation costs and continue to be higher owing to diesel prices. Further, a rise in coal prices resulted in increased power and fuel expenses. Going forward, we expect the cost pressures to ease as commodity prices have started coming off and this should aid margin improvement in the coming quarters.

Q3 performance came in strong

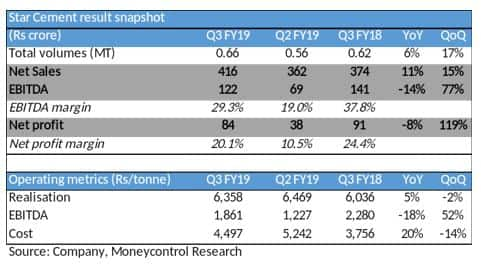

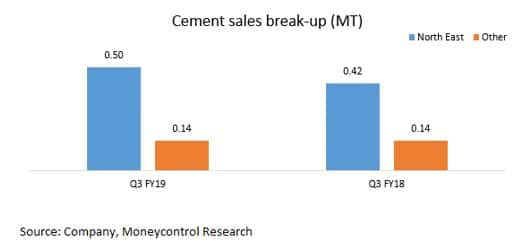

Star Cement reported sales growth of 11 percent on the back of higher volumes and realisations. The company recorded a volume growth of 6 percent year-on-year (YoY) owing to strong demand in the northeast region. Cement sale in the northeast was 0.5 MT (metric tonnes) compared to 0.42 MT in the same quarter last year. Though clinker sale volumes fell nearly 74 percent YoY to 0.015 MT, it increased by 85 percent sequentially.

Operating margins recovered on a sequential basis to 29.3 percent, compared with 19 percent in Q2 FY19. The margins were, however, lower than last year as the company incurred higher freight expenses on account of expiry of related subsidy (around Rs 300 per ton) in Jan 2018.

The top line also benefitted from a 5 percent improvement in realisations. EBITDA per tonne stood in excess of Rs 1,800 despite the rise in costs. This is majorly in-line with the guidance shared by the management at the start of this fiscal year.

Trading at attractive valuations

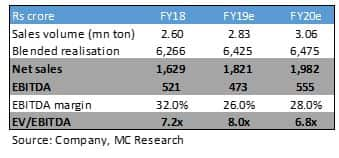

With a pick-up in infrastructure development activities, the demand is expected to remain firm overall. Government’s focus on infrastructure development should propel the regional industry growth to 7-8 percent in the near to medium term.

Star Cement (CMP: Rs 86; market cap: Rs 3,595 crores) with its unique geographical positioning is well placed to capture the demand in the northeast region. The company is trading at an FY20 Enterprise Value/EBITDA multiple of nearly 7 times and offers an attractive investment proposition from a medium to long term perspective.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.